A Guide to Accident Benefits in Ontario

A car accident can turn your world upside down in an instant. Beyond the immediate shock and potential injuries, you’re suddenly faced with a confusing insurance system. Thankfully, in Ontario, we have a ‘no-fault’ insurance system designed to get you immediate support from your own insurer, no matter who was at fault. This is your safety net, and it’s there to help you focus on what really matters: your recovery.

Your Roadmap to Accident Benefits in Ontario

Navigating the aftermath of a collision can feel overwhelming, but understanding the system is the first step toward getting back on your feet. Ontario’s laws provide this crucial, immediate support through the Statutory Accident Benefits Schedule, or SABS as it’s commonly known.

Think of SABS as a mandatory component built into every single auto insurance policy in the province. It provides a standard package of benefits to anyone injured in an accident, ensuring you can access funds for medical care and lost income without having to wait for the legal system to decide who was to blame. The steps you take right after a crash are critical, not just for your health, but for securing these benefits. Knowing what to do after a car accident is essential for laying the groundwork for a successful claim.

The No-Fault Framework Explained

The term ‘no-fault’ is one of the most misunderstood parts of Ontario’s insurance system. It doesn’t mean that no one is considered responsible for the accident. It simply means that for your initial benefits, you deal directly with your own insurance company.

This design is brilliant in its simplicity—it gets money into your hands for treatment and recovery much faster. Behind the scenes, the insurance companies will still determine fault to figure out who pays for vehicle repairs and how premiums might be affected later on. But for your immediate needs, that part of the process doesn’t get in your way.

This structure allows you to claim for essential support, including:

- Medical and Rehabilitation Costs: This covers vital treatments not paid for by OHIP, like physiotherapy, chiropractic care, massage therapy, and psychological counselling.

- Income Replacement: If your injuries keep you from working, these benefits provide a financial cushion, covering a portion of your lost earnings.

- Attendant Care: For more serious injuries, this benefit helps pay for a personal support worker to assist with your daily activities while you heal.

The real purpose of the no-fault system is to separate your immediate need for medical and financial help from the much longer process of assigning blame. Your well-being comes first, right from day one.

Acting Quickly Is Key

When it comes to your accident benefits claim, the clock starts ticking the moment the accident happens. The deadlines are strict, and missing them can unfortunately put your entire claim at risk. You must move quickly to protect your rights.

Here’s a quick rundown of the most important timelines you absolutely must meet.

Critical Deadlines for Your Accident Benefits Claim

This table summarizes the essential timelines you must follow after a motor vehicle accident in Ontario to successfully claim your benefits.

| Action Required | Deadline | Why It Matters |

|---|---|---|

| Notify Your Insurer | Within 7 days of the accident | This is your first official notice to the insurance company. Failing to do this on time can lead to delays or even a denial of your claim. |

| Submit Your Application | Within 30 days of receiving the forms | After you notify them, your insurer sends you an application package. You must complete and return it within 30 days to formally start your claim. |

| Notify the At-Fault Driver | Within 120 days of the accident | If you plan to sue the at-fault driver for damages beyond your SABS benefits, you must provide them with written notice. |

| File a Lawsuit | Within 2 years of the accident date | This is the ultimate deadline. The legal time limit (statute of limitations) for filing a lawsuit related to the accident is two years. |

Meeting these deadlines is non-negotiable. If you’re feeling overwhelmed by the process or are concerned about the timelines, it’s always a good idea to seek professional advice to ensure you don’t miss a critical step.

Making Sense of Ontario’s No-Fault System

The term ‘no-fault insurance’ is one of the most misunderstood concepts in Ontario law. It trips a lot of people up, and for good reason. Many assume it means that no one is ever found responsible for a car accident. That couldn’t be further from the truth.

At its core, the no-fault system is simply about getting you help, fast. It means that after a collision, you turn to your own insurance company for accident benefits in Ontario, like medical care and income support. This happens immediately, regardless of who caused the crash.

The whole point is to separate your urgent need for recovery from the often lengthy process of figuring out who was legally to blame.

Your Insurer Pays First, Fault Is Determined Later

Here’s a good way to think about it. If you need a prescription filled, you use your own drug plan. You don’t have to prove who or what made you sick to get coverage; you just use the benefits you’ve paid for. Ontario’s system for accident benefits is built on that same idea. You get the help you need without having to wait for insurance companies to argue over liability.

But make no mistake, fault is still a huge factor behind the scenes. Your insurer and the other driver’s insurer will investigate and apply Ontario’s Fault Determination Rules to figure out who was responsible. That decision determines which insurance company ultimately pays the price and how your premiums might be affected down the road.

The real benefit of Ontario’s no-fault model is this: you are claiming benefits from your own policy. This allows you to focus on getting better, not on fighting to prove the other driver was wrong just to get your physiotherapy approved.

This is a critical distinction. It ensures your access to income replacement, rehabilitation, and other vital supports isn’t held hostage by a complicated investigation.

Why Fault Still Matters—A Lot

So, while your own policy provides that immediate safety net, the question of fault becomes central if your injuries are serious. When your needs go far beyond what the standard benefits can cover, you may need to file a lawsuit (often called a tort claim) against the at-fault driver.

In that lawsuit, proving the other driver’s fault is everything. A successful claim can provide compensation for damages that SABS simply doesn’t cover, including:

- Pain and Suffering: For the physical and emotional toll the injuries have taken on your life.

- Future Economic Losses: For income you’ll lose in the long term, far beyond what SABS provides.

- Additional Healthcare Costs: For medical and rehabilitation needs that exceed your policy limits, potentially for the rest of your life.

This is where the two parts of Ontario’s system come together. The no-fault benefits are your first line of defence, providing the foundation for your recovery. The right to sue the at-fault driver is the path to securing full and fair compensation when you’ve suffered a life-altering injury. To see how these pieces fit into the bigger picture, you can explore our detailed overview of Ontario’s car accident law.

Ultimately, the no-fault system is designed to catch you when you fall, guaranteeing everyone has immediate access to benefits. Once you grasp that core principle, you’re in a much stronger position to navigate the entire claims process.

The Core Benefits You’re Entitled to Claim

After a car accident, the last thing you should be worrying about is how you’ll pay your bills or afford treatment. That’s where Ontario’s Statutory Accident Benefits Schedule (SABS) comes in. It’s a built-in part of every auto insurance policy, designed to provide a crucial safety net for your immediate and long-term needs.

Think of SABS as a toolkit for your recovery. Each benefit is a different tool, meant to handle a specific challenge you might face, from lost income to the cost of physiotherapy.

Getting a handle on these core categories is the first step. Let’s walk through the main types of support available under a standard policy so you know what you can access.

Covering Your Bills When You Can’t Work

One of the first questions people ask after an accident is, “How am I going to pay my rent if I can’t work?” SABS directly addresses this with benefits designed to keep you financially stable.

The most common is the Income Replacement Benefit (IRB). If you were employed before the collision and your injuries are keeping you from your job, the IRB is there to help. It covers 70% of your gross weekly income, up to a standard maximum of $400 per week. You may be entitled to more if you purchased optional coverage when you got your policy.

But what if you weren’t working? SABS has provisions for other situations, too.

- Non-Earner Benefit: Maybe you were a student, retired, or between jobs. If your injuries now prevent you from carrying on a “normal life,” you could be eligible for $185 per week after a short waiting period.

- Caregiver Benefit: This is for individuals who were the main caregiver for someone who depends on them (like a child or an aging parent) and, due to a catastrophic injury, can no longer provide that care. This benefit helps pay for someone to take over those duties.

It’s incredibly important to know that you often have to choose one of these benefits early on in your claim. Once you’ve made a choice, you generally can’t switch. Getting advice on which path best suits your pre-accident life is a critical step.

Funding Your Physical and Mental Recovery

Your health is everything. SABS is set up to ensure you get the care you need to heal, both physically and mentally. The Medical and Rehabilitation Benefit is the cornerstone of this support, covering reasonable and necessary expenses that aren’t paid for by OHIP or your extended health plan.

This is a broad and powerful benefit that can include a huge range of treatments:

- Physiotherapy, chiropractic care, and registered massage therapy

- Counselling with a psychologist or social worker

- Prescription medications

- Medical devices like crutches, wheelchairs, or specialized braces

- Accessibility modifications to your home or vehicle

This benefit is what gives you access to the specialized care that can truly change the course of your recovery. For a more detailed look at the types of compensation available, our guide on motor vehicle accident compensation offers further insights.

Support for Daily Life and Tragic Losses

When injuries are severe, even simple daily tasks can feel impossible. The Attendant Care Benefit is designed specifically for this reality. It provides funding to hire an aide or attendant to help with personal care—things like bathing, dressing, and meal preparation—if you can no longer manage on your own.

Finally, in the absolute worst-case scenarios, SABS provides support for families grieving the loss of a loved one. The Death and Funeral Benefits offer a lump-sum payment to a surviving spouse and dependants. A separate amount is also provided to help cover funeral expenses.

While no amount of money can replace a family member, these benefits are there to relieve some of the immediate financial pressures during an unimaginably difficult time.

Let’s organize these core benefits into a clear table so you can see the standard maximums at a glance.

Standard SABS Benefit Categories and Maximums

This table breaks down the main accident benefits available under a standard Ontario auto insurance policy, outlining what they’re for and the typical maximum amounts you can claim. Keep in mind these limits can often be increased by purchasing optional benefits.

| Benefit Type | Purpose | Standard Maximum Amount |

|---|---|---|

| Income Replacement | Replaces a portion of lost income if you’re unable to work. | 70% of gross weekly income, up to $400/week. |

| Non-Earner | Provides a weekly benefit if you weren’t working and can’t carry on a “normal life.” | $185/week. |

| Caregiver | Covers costs to hire a caregiver if you’re catastrophically injured and can’t care for a dependant. | Up to $250/week for the first dependant, plus $50/week for each additional dependant. |

| Medical/Rehabilitation | Pays for medical and rehab expenses not covered by OHIP (e.g., physio, psychology). | $65,000 for non-catastrophic injuries. |

| Attendant Care | Covers the cost of an aide for personal care if you can’t care for yourself. | Up to $3,000/month for non-catastrophic injuries. |

| Death Benefit | A lump-sum payment to a surviving spouse and/or dependants. | $25,000 to spouse, $10,000 to each dependant. |

| Funeral Benefit | Helps cover the costs associated with a funeral. | Up to $6,000. |

Each of these benefits has its own specific rules and eligibility criteria. Understanding which ones apply to your unique situation is the key to building a strong and comprehensive claim that fully supports your recovery journey.

How Injury Severity Impacts Your Benefits

In the world of Ontario’s accident benefits, how badly you were hurt is the single most important factor. It’s what dictates the level of support you can access for your recovery. The system, known as the Statutory Accident Benefits Schedule (SABS), isn’t a one-size-fits-all model; it sorts injuries into three distinct tiers, each with its own funding limits and rules.

Getting a handle on these categories—the Minor Injury Guideline, non-catastrophic injuries, and catastrophic impairment—is critical. It helps you understand what to realistically expect as you move forward. Your doctor’s assessment is the key that unlocks which category your injuries belong to.

The Minor Injury Guideline (MIG)

Let’s start with the most basic tier: the Minor Injury Guideline, or MIG. Think of it as the express lane for less severe injuries. This category is designed specifically for things like minor sprains, strains, whiplash, bruises, and cuts that aren’t expected to cause any lasting problems.

If your injuries place you in the MIG, the financial support for your medical and rehabilitation needs is capped at a strict $3,500. That amount has to cover everything from physiotherapy and chiropractic appointments to any assessments you might need.

The whole point of the MIG is to simplify and speed up claims for straightforward injuries. But what if your recovery isn’t so simple? If a pre-existing condition complicates things or you just aren’t healing as expected, it’s possible to be moved out of the MIG, but you’ll need strong medical evidence to make it happen.

Non-Catastrophic Injuries

One step up from the MIG, we find the “non-catastrophic” category. This is a broad bucket that catches a whole range of more significant injuries—things like broken bones, serious joint damage, chronic pain, or psychological trauma like PTSD that genuinely disrupts your daily life.

For these non-catastrophic injuries, the available benefits get a serious boost. A standard, basic auto insurance policy provides a combined total of $65,000 for medical, rehabilitation, and attendant care benefits. This larger pool of funds is there to support a more complicated and longer-term recovery journey.

Keep in mind, that $65,000 is just the starting point. If you chose to buy optional benefits when you set up your insurance policy, your coverage limits could be substantially higher.

Catastrophic (CAT) Impairment

At the very top of the scale is catastrophic impairment, often shortened to “CAT.” This designation is reserved for the most severe, life-altering injuries that permanently and drastically change a person’s ability to live independently.

The criteria for a CAT designation are incredibly specific and strictly medical. We’re talking about conditions such as:

- Paraplegia or quadriplegia

- The amputation of a limb

- Complete loss of sight in both eyes

- A severe traumatic brain injury that meets specific thresholds on medical scales like the Glasgow Coma Scale

- A “whole person impairment” rating of 55% or more that is directly caused by the accident

Being deemed catastrophically impaired completely changes the game. The standard limit for medical, rehabilitation, and attendant care jumps to $1,000,000. This funding is intended to provide for a lifetime of care, support, and medical treatments. Because a CAT diagnosis has such profound financial implications, it’s wise to explore every avenue of support. For instance, our guide on how to apply for CPP disability can provide helpful information on federal programs that may also be available.

The financial pressure on the insurance system is real, as the costs of medical care continue to climb. According to 2022 data, Ontario saw 1,913 fatalities from motor vehicle collisions, a 6% increase from the year before. At the same time, the average cost per claim in Ontario swelled from $8,926 in 2021 to $10,955 in 2023, showing just how much the expenses for claims and rehabilitation are growing. You can discover more about these traffic collision statistics on statcan.gc.ca.

Your Step-by-Step Guide to the Claim Process

At first glance, filing a claim for accident benefits in Ontario can feel like wading through a sea of paperwork and deadlines. But if you break it down step-by-step, it’s a much more manageable process. The secret is to stay organized, be proactive, and never lose sight of the critical timelines.

It all starts with one simple, urgent action: you have to tell your insurance company about the accident. This first step isn’t just a good idea; it’s a non-negotiable requirement.

You have a strict deadline of seven (7) days from the date of the accident to notify your insurer. The only time this is excused is if your injuries were so severe that you were physically unable to make contact.

Initiating Your Claim The Right Way

After you’ve given notice, your insurer will assign an adjuster to your file and mail you a package of forms. This package is the core of your application, and your next major task is to fill it out completely and accurately.

The most important document in this package is the Application for Accident Benefits (OCF-1). This is what officially kicks off your claim. If it’s not filled out properly and in full, your insurer has no obligation to start paying benefits, which can cause frustrating and costly delays.

The OCF-1 form will ask you for details about:

- Your personal information and policy number.

- The specifics of the accident—when and where it happened.

- Your employment and income details, especially if you’re unable to work.

- Any other insurance you might have, like an extended health plan through your job.

Think of the OCF-1 as the foundation of your entire claim. Every detail helps the insurer piece together what happened and figure out which benefits you’re eligible to receive.

The Role of Your Healthcare Team

While you’re busy with the initial application, your doctors and therapists are also playing a crucial part in documenting your injuries. Their medical evidence is submitted on specific forms that link your treatment directly to your claim.

One of the most critical forms is the Disability Certificate (OCF-3). This is completed by a healthcare professional—like your family doctor, physiotherapist, or psychologist. It’s their official report outlining your injuries, the limitations they’re causing, and how long they expect your disability to last.

Another key document is the Treatment and Assessment Plan (OCF-18). Your therapist or doctor fills this out to request funding for specific treatments, such as a block of physiotherapy sessions or counselling. The insurer has to approve this plan before they will cover the cost of those treatments.

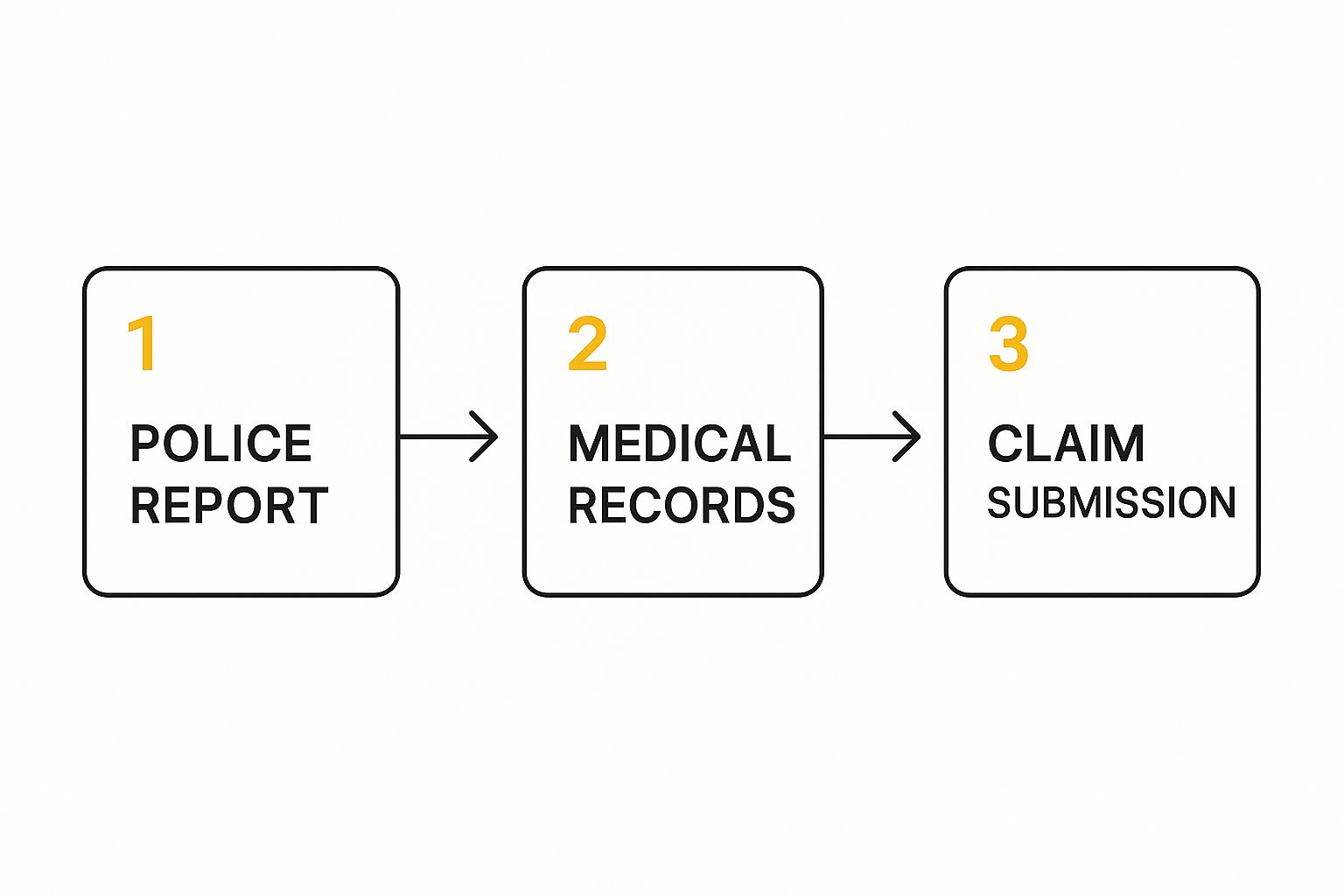

This visual shows how the official accident report, your medical records, and the application package all come together to form a strong, well-supported claim.

What to Expect from Your Insurer

Once you’ve submitted your completed application, the ball is in the insurer’s court. They have a specific amount of time to review everything and make a decision on your benefits. Don’t be surprised if they come back with more questions or requests for information.

In some situations, your insurer might require you to attend an Insurer Examination (IE). This is an appointment with a doctor or specialist who is chosen and paid for by the insurance company. The goal here is for them to get an independent opinion on your injuries and your treatment needs.

An Insurer Examination is a standard part of the process, but it’s vital to understand its purpose. The report from this assessment will heavily influence the insurer’s decisions about your benefits going forward.

Navigating this process on your own, especially if you’re dealing with a denial or a complex injury, can be incredibly tough. An experienced injury lawyer in Burlington can offer guidance and make sure your rights are protected every step of the way, helping you secure the benefits you rightfully deserve.

Lawsuits, Pain and Suffering, and the Statutory Deductible

While your own insurer’s accident benefits are your first line of financial support, sometimes they just aren’t enough. When a serious accident leaves you with losses far beyond what SABS can cover, you may have the right to sue the at-fault driver. This is often called a tort claim.

A lawsuit lets you seek compensation for damages that SABS doesn’t—or can’t—fully cover. The most significant of these is compensation for your pain and suffering. However, there’s a major catch you need to know about: the statutory deductible.

It’s a common point of confusion, so let’s be clear: this deductible has nothing to do with your SABS benefits. It only ever applies to the money awarded for pain and suffering in a lawsuit against the person who caused the accident.

What is the Deductible and How Does It Work?

Think of the statutory deductible as a threshold set by the government. Its purpose is to discourage smaller lawsuits from clogging up the court system. For anyone whose injuries result in a smaller or mid-sized award for pain and suffering, this deductible can take a huge bite out of their final settlement.

The math is simple but its impact is profound. Whatever amount a judge or jury decides your pain and suffering is worth, the insurance company for the at-fault driver gets to subtract the deductible amount right off the top. You only get what’s left.

Let’s say you’re awarded $60,000 for your pain and suffering. You don’t walk away with that full amount. The insurer subtracts the deductible from it first, meaning the cheque you receive will be for a much smaller sum. This can be a tough pill to swallow if you weren’t expecting it.

The 2025 Deductible Amounts in Ontario

These numbers aren’t fixed forever; they’re adjusted each year for inflation. As of January 1, 2025, the government updated the figures again.

Here’s the breakdown:

- For awards for pain and suffering (called non-economic loss), there is a $46,790.05 deductible.

- This deductible applies to any award under $155,965.54.

- For claims by family members under the Family Law Act (for loss of care, guidance, and companionship), the deductible is $23,395.04.

You can read a more detailed analysis of the 2025 deductible increases to see the full picture.

So, how do you avoid this? The deductible vanishes—it’s “waived”—only if your pain and suffering damages are assessed as being more valuable than the $155,965.54 threshold. This is exactly why getting a realistic, expert valuation of your claim is one of the most critical steps before deciding to file a lawsuit. It helps set realistic expectations and shapes the entire legal strategy.

Common Questions About Accident Benefits

When you’re trying to navigate accident benefits, it’s natural for questions to pop up, especially if you weren’t in a straightforward car-on-car collision. It’s a confusing system, and many people are unsure how the rules apply to their specific situation. Let’s clear up some of the most common uncertainties.

A question I hear all the time comes from pedestrians and cyclists: “What happens if I was hit by a car? Am I even covered?” The answer is a definite yes. Ontario’s no-fault system is designed to make sure that anyone injured in an accident involving a motor vehicle can get the help they need.

If you have your own car insurance, you’ll start your claim there. If not, your claim would go through the insurance company of the driver who hit you. The bottom line is that there’s always a path to getting benefits, regardless of whether you were behind the wheel, on a bike, or just crossing the street.

Can an Insurer Just Stop My Benefits?

This is a huge source of anxiety for many people. You’re relying on these payments for your recovery, and the thought of them suddenly stopping is terrifying. So, can your insurance company just cut you off?

No, they can’t. An insurer needs a legitimate medical or legal reason to stop your benefits, and they must follow a strict, formal process to do so. They can’t just decide on a whim.

They are required to give you a clear, written explanation of their decision and provide official notice before the payments end. If you believe their reasoning is wrong—and it often is—you have every right to fight it. The dispute goes to the Licence Appeal Tribunal (LAT), where an impartial adjudicator reviews the evidence from both sides and makes a final ruling.

Do I Really Need a Lawyer to Apply?

This is another classic question. Technically, no, you don’t need a lawyer to fill out the initial forms. You can absolutely start the process on your own. But thinking a few steps ahead, getting legal advice early on is one of the smartest things you can do, particularly if your injuries are serious or the claim gets complicated.

An experienced lawyer is more than just a form-filler; they’re your advocate. They make sure your application is solid from day one and can anticipate the insurance company’s next move. This becomes critical if a benefit is denied or your insurer tries to cut you off, as they’ll be ready to defend your right to the full compensation you’re entitled to.

Bringing a professional in from the start simply levels the playing field. It ensures you don’t make small mistakes that could cost you thousands down the road and helps you secure the accident benefits in Ontario you need to focus on what really matters—getting better.

Navigating a denied or complex claim requires professional expertise. The team at UL Lawyers is dedicated to ensuring you receive the full benefits and compensation you deserve. We are a Burlington, Ontario-based firm serving all of the GTA and Ontario, offering a free consultation to discuss your case with no upfront fees. Contact us today to get the support you need by visiting https://ullaw.ca.

Related Resources

Find a Car Accident Lawyer in Mississauga Fast

Continue reading Find a Car Accident Lawyer in Mississauga FastNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies