Breach of Contract Remedies: Your Essential Legal Guide for Ontario

When someone breaks a business agreement in Ontario, the law doesn’t just leave you high and dry. There are several breach of contract remedies available, with the main goal of putting your business back in the financial spot it would have been if the deal had gone through as planned.

What Happens When a Business Contract Is Broken

A broken contract can feel like the ground has disappeared from under your project. It’s more than just a letdown; it’s a legal event that gives you the right to seek a remedy.

In Canada, when one side fails to live up to their end of a bargain, the other party—the one who was wronged—can turn to the courts for a solution. The whole point of this process is to right the wrong and get things back on an even keel.

Let’s say you hired a Burlington-based developer for a crucial software launch, but they miss the deadline completely. Suddenly, your business loses momentum and potential sales. In a situation like this, Ontario law gives you a clear path to recover those losses and hold the developer accountable.

The Main Legal Tools Available

The legal system has a few different tools in its kit to handle a breach. For businesses in the GTA and across Ontario, the most common remedies are:

- Monetary Damages: This is the go-to solution. It involves a cash payment to cover the direct financial losses caused by the broken promise.

- Specific Performance: This is a much rarer remedy where a court actually orders the other party to do exactly what they promised in the contract. It’s usually reserved for unique cases where money just won’t cut it.

- Injunctions: Think of this as a court order that acts like a stop sign or a green light. It either stops a party from doing something harmful or forces them to take a specific action to prevent more damage.

Each of these remedies has a different job, from straightforward financial compensation to forcing a specific action. Figuring out which one fits your unique situation is the first, most important step toward getting things sorted.

Breaches aren’t limited to supplier or client agreements; they can happen in employment contracts too. For more on that, you can learn about what constitutes wrongful dismissal in Ontario in our detailed guide. This background knowledge gives you a solid foundation for understanding how Ontario law tackles a breach and what your next steps should be.

Understanding Monetary Damages as the Primary Remedy

When a business deal in Ontario goes sour, the courts usually don’t step in to force someone’s hand. Instead, the most common legal remedy is about making things right financially. This is where monetary damages come into play.

The core idea is simple: the court wants to put the wronged party back in the same financial spot they would have been in if the contract had been followed through. It’s a practical approach that cuts right to the economic heart of the problem, translating the harm into a clear dollar figure.

Expectation Damages: The Core of Compensation

At the centre of most breach of contract claims in Canada are expectation damages. Think of these as the direct profits or benefits you lost because the other side failed to deliver on their promise. Essentially, the court calculates what you should have earned and awards that amount to make you whole again.

Let’s imagine a Burlington retailer orders $10,000 worth of exclusive seasonal products for the holidays. The supplier never delivers. The retailer had reasonably expected to make $25,000 in sales from that stock. In this case, the expectation damages would aim to cover the $15,000 in lost profit.

This principle is just as crucial in employment law. When an employee is terminated without proper notice, the damages awarded often mirror the salary and benefits they would have received during that required notice period. For a closer look at this, you can explore our comprehensive guide on notice and severance rights in Ontario.

Beyond the obvious lost profits, a few other types of damages might come into play:

- Consequential Damages: These are the ripple effects—the indirect losses that were a predictable result of the breach. If our retailer’s failure to get holiday stock tarnished their reputation and led to a drop in future sales, those further losses could potentially be claimed as consequential damages.

- Reliance Damages: This is about recouping money you spent because you were counting on the contract being fulfilled. If the retailer invested in a marketing campaign specifically for the products that never arrived, reliance damages could help them get that money back.

The Duty to Mitigate Your Losses

Here’s a critical twist in Canadian contract law: mitigation. Even if you’re the innocent party, you can’t just sit back and watch your losses pile up. The law in Ontario expects you to take reasonable steps to minimize the financial fallout from the breach.

Imagine our Burlington retailer finds out the supplier won’t be delivering the goods. They would be expected to make a reasonable effort to find an alternative supplier to salvage their holiday sales. If they don’t try, a court could reduce the amount of damages they can recover.

Finally, while compensatory damages are the norm, don’t expect a windfall from punitive damages. These are incredibly rare in Canadian contract law. The Supreme Court of Canada has established a very high bar, reserving them only for cases where a breach is coupled with malicious, oppressive, or truly outrageous conduct. Their goal isn’t to compensate but to punish and deter.

Exploring Equitable Remedies When Money Is Not Enough

When a contract is breached in Ontario, the court’s go-to solution is usually to award monetary damages. But what happens when a simple cheque can’t truly fix the problem? Sometimes, the fallout from a broken promise isn’t just about lost profits; it’s about losing something unique, something irreplaceable.

In these specific situations, Canadian courts might step in with what are known as equitable remedies. These aren’t cash payments. Instead, they are powerful court orders that compel a party to either follow through on their promise or stop doing something harmful. They’re not handed out easily and are reserved for those rare cases where money just won’t cut it.

Forcing the Deal with Specific Performance

Imagine your Mississauga-based manufacturing company signs a deal to buy a custom-built, one-of-a-kind machine—the linchpin of your entire production line. If the seller suddenly backs out, no amount of money can instantly replace that unique asset. This is precisely where specific performance comes into play.

Simply put, specific performance is a court order that forces the breaching party to do exactly what they promised in the contract. It’s a remedy designed to deliver the actual subject of the agreement, not just its cash equivalent.

Ontario courts will generally only consider this remedy when the subject of the contract is truly unique, such as:

- Real Estate: Every piece of land is considered unique. A court might force the sale of a specific commercial property in downtown Toronto that was central to a buyer’s expansion plans.

- Rare Goods: This could be anything from custom machinery to a rare piece of art or a valuable antique.

The court’s guiding principle here is whether damages would be an adequate fix. If a similar item is readily available on the open market, the court will almost always award monetary damages. The uniqueness of the asset is the make-or-break factor.

Stopping Harmful Actions with an Injunction

While specific performance compels action, an injunction does the exact opposite: it stops it. An injunction is a court order that forbids a party from doing something specific. This powerful tool is crucial for preventing irreparable harm that money could never undo.

Let’s say a senior executive leaves your tech firm in the Greater Toronto Area. Despite signing a non-competition agreement, they immediately start their own rival business using your confidential client lists. Your company is now facing an immediate and serious threat.

In this situation, you could seek an injunction to:

- Prevent the former executive from poaching your clients.

- Stop them from operating the competing business for a set period.

- Prohibit them from using any of your company’s proprietary information.

The whole point of an injunction is to press pause—to preserve the status quo and prevent any more damage while the larger legal dispute gets sorted out. It’s a proactive and potent remedy for when the harm is happening now and can’t be fixed later with a damage award.

Building a Strong Breach of Contract Claim

When a business deal goes sour, simply feeling wronged isn’t enough to win in court. To successfully claim a remedy for a breach of contract in Ontario, you need to build a rock-solid case backed by clear evidence. It’s less about abstract legal theory and more about the strength of your paper trail.

Think of emails, invoices, meeting notes, and of course, the written agreement itself. These are the building blocks of a powerful claim, transforming your complaint into a compelling legal argument.

The Four Pillars of a Successful Claim

To have a fighting chance in court, you need to prove four key elements. Picture them as the four legs of a table—if even one is weak or missing, your whole case can come crashing down.

- 1. Prove a Valid Contract Existed: First things first, you have to show that a legally binding agreement was actually in place. This means demonstrating there was a clear offer, a definite acceptance, and “consideration” (the legal term for an exchange of value between both parties).

- 2. Show You Fulfilled Your Obligations: Next, you must prove you held up your end of the bargain. Courts are much more inclined to help those who have acted in good faith and met their own contractual duties.

- 3. Provide Clear Evidence of the Breach: This is the heart of your claim. You must be able to point to exactly what the other party did—or failed to do—and back it up with concrete proof.

- 4. Demonstrate Measurable Losses: Finally, you have to draw a direct line from their failure to a quantifiable financial loss you suffered. The court needs to see a clear cause-and-effect relationship between the breach and your damages.

The Critical Role of Documentation

In Canada, the person bringing the claim (the plaintiff) has to prove these elements on a balance of probabilities—meaning your version of events is more likely than not to be true. A huge part of this is understanding the type of breach that occurred.

Was it a major, fundamental failure that undermined the whole point of the contract (a breach of a ‘condition’)? Or was it a more minor slip-up (a breach of a ‘warranty’)? This distinction is a cornerstone of Canadian contract law because it dictates the available remedies. A major breach might let you walk away from the deal entirely, while a minor one might only entitle you to financial compensation.

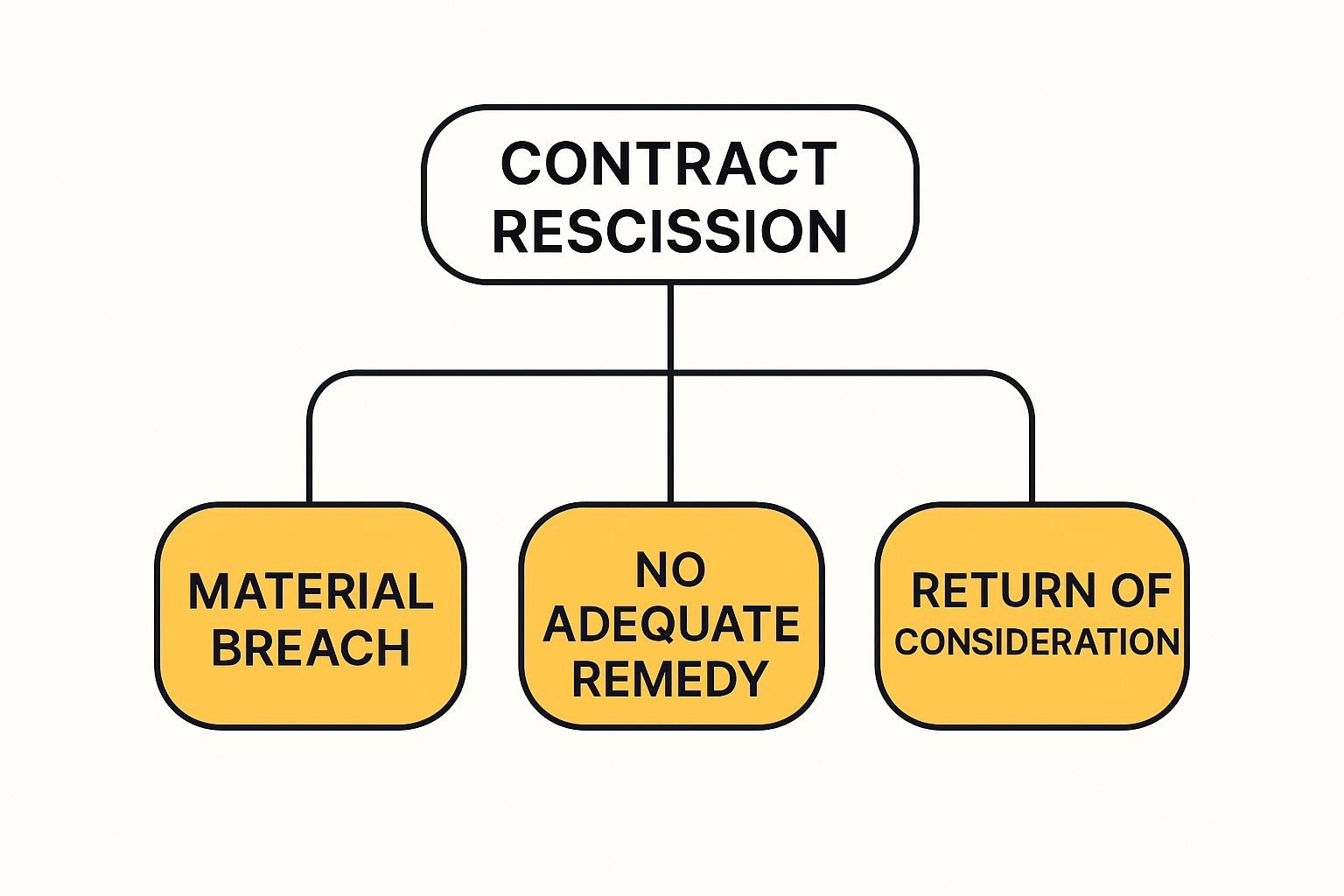

The infographic below touches on contract rescission, a powerful remedy often reserved for very serious breaches.

As you can see, completely cancelling a contract (rescission) is a high bar. It typically requires a material breach where money alone won’t fix the problem, and it’s possible to put both parties back in the position they were in before the contract was signed.

Ultimately, the strength of your evidence is what persuades a court to grant these powerful breach of contract remedies. This is especially true in employment law, where a major change to an employee’s role could be considered a breach. You can find out more by reading our guide on what is constructive dismissal in Ontario.

Navigating the Ontario Legal Process for Your Claim

Knowing your rights after a contract breach is one thing, but actually enforcing them is another journey altogether. For business owners across the GTA, understanding the practical steps involved in pursuing breach of contract remedies in Ontario can save a tremendous amount of time, stress, and money.

The path to resolution doesn’t always have to start in a courtroom. In fact, one of the most powerful first moves is often a formal demand letter. This isn’t just a simple email; it’s a carefully drafted document from a lawyer that clearly outlines the breach, the damages you’ve suffered, and what you want to make things right. It shows the other party you’re serious and can often pave the way for a settlement before things escalate.

Exploring Alternatives to Court

Before you even think about filing a lawsuit, it’s smart to look at negotiation or mediation. These methods, often called alternative dispute resolution (ADR), are almost always faster and cheaper than a full-blown court battle.

- Negotiation: This is a direct conversation between both sides, usually with lawyers involved, aimed at finding a settlement everyone can live with.

- Mediation: Here, a neutral third-party mediator steps in to guide the conversation, helping both parties find common ground and craft a solution themselves.

These approaches often lead to more creative and flexible solutions than a judge might impose, which can be crucial for preserving important business relationships. This is especially true in employment disputes, where finding a collaborative solution is often best. If you’re dealing with a workplace issue, it’s wise to understand all your avenues; you can learn more by looking for employment law lawyers near me who are experts in the Ontario system.

Choosing the Right Legal Venue in Ontario

If you can’t reach an agreement through ADR, your next step is filing a claim in the right court. In Ontario, this decision comes down to how much money you’re seeking. Getting this right is critical, as it directly affects the cost, complexity, and timeline of your case.

Choosing the correct court is a crucial first step in litigation. Filing in the wrong venue can lead to unnecessary delays and added costs, highlighting the importance of getting clear legal advice from the outset to ensure your claim is on the most efficient path.

There are two main courts for contract disputes in our province:

- Small Claims Court: If your claim is for $35,000 or less, this is your venue. The process is designed to be simpler, less formal, and more affordable, making it a great option for many small businesses.

- Superior Court of Justice: For any claim over the $35,000 limit, you have to file in the Superior Court. Be prepared for a much more complex and lengthy process with significantly higher costs, driven by detailed procedural rules and extensive discovery.

Figuring out which path to take means weighing the value of your claim against the potential costs of getting it back. This is where getting solid legal advice early on really pays off, helping you build a strategy that gives you the best shot at a successful outcome.

Answering Your Top Questions About Contract Breaches

When you’re dealing with a broken contract, the legal jargon can feel like a maze. Let’s cut through the noise and tackle some of the most common, real-world questions we hear from business owners across Burlington, Toronto, and the rest of Ontario.

How Long Do I Have to Sue for Breach of Contract in Ontario?

This is a big one, because the clock is always ticking. In Ontario, the law that governs this is the Limitations Act, 2002. It sets a firm deadline for starting a lawsuit.

For most breach of contract cases, you have a two-year window to file your claim. That two-year countdown usually starts on the day you first discovered the breach—or the day you reasonably should have discovered it.

Missing this deadline is a critical, and often fatal, mistake for your case. If you’re even a day late, the court will almost certainly throw out your claim, no matter how solid it is. That’s why it’s so important to get legal advice as soon as you think a contract has been broken.

Can I Recover My Legal Fees If I Win the Case?

It’s a fair question—after all, you shouldn’t have to be out-of-pocket for someone else’s mistake. In Ontario’s court system, the winning side can typically get a portion of their legal fees paid by the losing side.

But here’s what you need to know: you almost never get 100% of your legal bills covered. The standard award is what’s called “partial indemnity” costs. This usually amounts to about 50-60% of what you actually spent on your lawyer.

There are exceptions. If the other party acted in bad faith or was particularly unreasonable during the lawsuit, a judge might award “substantial indemnity” or even “full indemnity” costs. But that’s rare. Your contract might also have specific clauses about who pays for legal costs, which can change the outcome.

What Is the Difference Between a Material and a Minor Breach?

Getting this right is key, because it dictates what you can actually do about the breach. The severity of the broken promise determines the power you have in response.

A material breach is a serious failure that strikes at the core of the agreement. It’s a breach so significant that it deprives you of the fundamental benefit you were supposed to get from the contract. If this happens, you have a couple of powerful options:

- You can sue for damages to compensate for your financial loss.

- You can also choose to treat the contract as officially over, freeing you from any further obligations.

On the other hand, a minor breach (sometimes called a breach of “warranty”) is a less critical misstep. It’s a problem, and it might cause you damages, but it doesn’t undermine the entire purpose of the contract. When there’s a minor breach, you can sue for the losses you suffered, but you still have to hold up your end of the bargain.

For more answers to common legal questions, you can also explore our firm’s comprehensive FAQ page.

At UL Lawyers, we provide the clear guidance you need to navigate complex business disputes. If you are dealing with a broken contract in Ontario, contact us for a consultation to understand your rights and options. Visit our website at https://ullaw.ca to learn more.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies