Is Depression a Disability in Ontario? Your Rights Explained

It’s a question many people grapple with: is depression legally considered a disability in Canada? The short answer is yes, absolutely. But it’s not quite as simple as just having a doctor’s diagnosis.

Think of your diagnosis as the starting point. The real key, in the eyes of the law, is how the condition affects your day-to-day life.

Yes, Depression Can Qualify as a Disability in Canada

In Ontario, and across Canada, depression is recognized as a disability, but there’s a crucial condition. Both provincial and federal laws define a disability based on whether a condition significantly interferes with your ability to manage normal life activities, especially your job.

So, while getting a formal diagnosis from your doctor is the essential first step, it’s not the finish line. The legal test really zeroes in on the functional limitations your symptoms create. For example, does severe fatigue make it impossible to get to work on time? Does a persistent cognitive fog prevent you from concentrating on your tasks? That’s what a claim will focus on.

The Legal Foundation for Your Rights

Several key laws in Canada and Ontario form the legal bedrock for recognizing mental health conditions like depression as a disability. These are the laws that protect your rights and open the door to getting the support you need.

To make this clearer, let’s look at the primary laws that protect your rights and establish eligibility for benefits when dealing with depression.

Key Legal Frameworks for Depression as a Disability

| Legal Framework | Jurisdiction | Core Protection Provided |

|---|---|---|

| Ontario Human Rights Code | Provincial | Prohibits discrimination based on disability (including mental health) and requires employers to provide reasonable accommodations. |

| Canadian Human Rights Act | Federal | Offers similar protections against discrimination for those in federally regulated industries like banking and telecommunications. |

| Canada Pension Plan (CPP) | Federal | Defines disability as a “severe and prolonged” condition preventing you from maintaining any substantially gainful work. |

These legal frameworks are designed to ensure that a mental health condition is treated with the same seriousness as a physical one.

A diagnosis is the what; the functional limitations are the how. How does your depression stop you from performing the essential duties of your job or managing your daily life? That is the question at the heart of any disability claim in Canada.

This distinction is so important. Plenty of people manage their daily lives with mild depression. But for someone experiencing major depressive disorder, the impact can be completely debilitating.

When symptoms become persistent and make work impossible, you may be entitled to supports like sick leave, short-term disability, or eventually long-term disability payments. If you’re just starting this process, our guide on short-term disability in Ontario explained can provide a detailed breakdown of how those initial benefits work.

When you’re dealing with mental health, legal definitions can feel cold and confusing. But the way Ontario law looks at disability is actually more flexible and human-centred than many people realize. The key piece of the puzzle is the Ontario Human Rights Code, and it casts a very wide net.

The Code doesn’t get hung up on a specific diagnosis. Instead, it’s all about the effect the condition has on your life. This is a crucial point to grasp when you’re asking, “Is my depression considered a disability?” in Ontario.

Looking Past the Label to Real-Life Limits

The law cares less about the word ‘depression’ and far more about what it does to you. The core question is whether your condition creates a “substantial interference” with your ability to go about your daily life. A formal diagnosis is your starting point, but it’s just that—the start.

To make your case, you have to show how the symptoms of your depression create real, functional roadblocks. Think of it this way: the diagnosis is the “what,” but your limitations are the “so what.”

The Ontario Human Rights Commission is clear that “disability” should be interpreted broadly. It covers past and present conditions and even includes subjective experiences like pain and fatigue. This approach is fundamental to protecting people with mental health challenges.

What This Looks Like in the GTA

To get a better handle on what “substantial interference” actually means, let’s ground it in some real-world examples for someone navigating life in the Greater Toronto Area.

- The Commute: The anxiety that often comes with depression can make a crowded GO train or TTC ride feel completely overwhelming. This isn’t just an inconvenience; it can lead to missing work altogether.

- Cognitive Fog: That “brain fog” that makes thinking feel like wading through mud? It can make it nearly impossible to concentrate in a busy downtown office, hit deadlines, or make sense of complex tasks.

- Social Isolation: A major symptom of depression is pulling away from others. This can make it incredibly difficult to join team meetings or work with colleagues—basic requirements for most jobs.

- Debilitating Fatigue: Sometimes, the sheer exhaustion makes getting out of bed feel like a monumental achievement. A full workday, plus a long commute from a place like Burlington, can seem out of the question.

In the end, it’s all about connecting the dots. Your medical records need to draw a clear line from your diagnosis to these kinds of functional impairments. That connection is what elevates a medical condition to a legally recognized disability in Ontario. Proving these limitations is also vital for federal programs, and our guide on how to apply for CPP disability benefits dives deeper into the evidence you’ll need.

Qualifying for Disability Benefits for Depression

Knowing your rights is the first step. The real challenge, however, is actually securing the financial support you need. For people in Ontario struggling with depression, there are a few different programs that offer disability benefits, but each one plays by its own set of rules.

Think of it like trying to open three separate doors, each with a completely different key. Your main sources of support are private Long-Term Disability (LTD) insurance, the federal Canada Pension Plan Disability (CPP-D) program, and the provincial Ontario Disability Support Program (ODSP).

Here’s the critical part: getting approved for one program does not mean you’ll automatically get the others. You have to build a separate case and meet the specific eligibility criteria for each and every program you apply to.

The Three Main Doors to Disability Support

It’s easy to get overwhelmed trying to figure out these options, especially because their definitions of “disability” are so different. What one private insurance company considers a disability might not be enough to meet the government’s much tougher standards. You really have to understand the specific test you’re up against for each application.

Let’s break down the three key programs:

-

Long-Term Disability (LTD) Insurance: This is a private benefit, most often provided through a workplace benefits package. The definition of “disability” comes directly from the fine print in your insurance policy. Typically, for the first two years, you need to prove that your depression prevents you from doing the main duties of your own job. After that, the goalposts often shift, and you may need to show you can’t perform any job.

-

Canada Pension Plan Disability (CPP-D): This federal program is for people who’ve paid enough into the Canada Pension Plan over the years. The bar here is set much higher. To qualify, you must show that your depression is both “severe and prolonged,” which means it stops you from being able to work at any job on a regular basis.

-

Ontario Disability Support Program (ODSP): This is a provincial income support program for Ontarians in financial need who also have a significant physical or mental impairment. The impairment must be ongoing or recurring, expected to last at least a year, and create a major barrier to your ability to work, look after yourself, or be involved in your community.

Building Your Case: The Evidence You Need

No matter which door you’re trying to open, the strength of your application comes down to your medical evidence. Just having a diagnosis isn’t enough. You need to create a detailed picture of how your depression truly impacts your ability to function day-to-day.

A successful application tells a clear and consistent story. It connects your medical diagnosis to your real-world inability to work, supported by objective reports, treatment records, and detailed personal accounts of your daily struggles.

Your objective is to put together a file that’s so thorough it leaves no room for doubt. This means gathering reports from specialists like psychiatrists or psychologists, showing a consistent history of treatment (such as therapy and medication), and making sure your doctor’s notes clearly spell out your limitations.

Even with solid evidence, claims can still be unfairly rejected. If you discover your long-term disability claim was denied, it’s crucial to understand your appeal options right away. Adding your own personal account of how depression affects your life provides a powerful human element that complements the medical facts.

Why Medical Evidence Is the Cornerstone of Your Claim

Let’s get straight to the point. If you’re trying to get a disability claim for depression approved, a simple doctor’s note just saying you have it isn’t going to cut it. Not even close. Insurance companies and government agencies need to see the full story—a detailed, convincing narrative backed up by solid medical evidence.

Think of it like this: your claim is a legal matter, and you need to prove you can’t work. Your medical file is the star witness, and how well it tells your story will make or break your case.

Painting a Detailed Picture of Your Condition

The most important thing is to move beyond the simple label of “depression” and show how it actually affects your life. Insurance adjusters are trained to hunt for specific, objective details that prove just how severe and persistent your symptoms are.

This means your medical file needs to include:

- Official Diagnostic Reports: These are the formal reports from your family doctor, a psychologist, or a psychiatrist that confirm your diagnosis using established medical standards.

- A Consistent Treatment History: You need to show you’re actively trying to get better. This means records of regular therapy sessions, logs of medications you’ve tried (including notes on what worked, what didn’t, and any side effects), and a history of appointments with specialists.

- Expert Opinions from Specialists: A report from a psychiatrist or psychologist carries a lot of weight. Their expert analysis can offer a much deeper look into your condition and why it’s so disabling.

One of the biggest red flags for insurers is inconsistent treatment. If there are big gaps in your therapy or it looks like you aren’t following medical advice, they might see it as a sign that your condition isn’t as serious as you say.

Your medical evidence needs to draw a clear, undeniable line from your diagnosis to your inability to function. It has to answer one key question: “How, exactly, do the symptoms of depression stop this person from doing their job?”

Articulating Your Functional Limitations

This is where so many claims go wrong. It’s not enough for your doctor to list symptoms like “fatigue” or “poor concentration.” They have to connect those symptoms directly to your ability to work.

For instance, instead of just writing “cognitive fog,” a powerful medical report would explain that your cognitive issues make it impossible to follow multi-step instructions, meet deadlines, or remember new information—all essential tasks for your job as an accountant.

Here are a few common traps that can sink your claim:

- Vague Doctor’s Notes: Notes that are too short or don’t give any specifics about how your symptoms get in the way of your work performance.

- Focusing Only on the Diagnosis: Simply having the diagnosis isn’t enough. You have to explain the functional impairments it causes.

- Contradictory Information: Be careful what you say at your appointments. A note saying you reported feeling “fine” can seriously undermine your claim that you’re totally disabled.

By making sure your medical evidence is thorough, consistent, and laser-focused on your functional limitations, you’re building the strongest possible foundation for your disability claim. This detailed approach is everything when you’re trying to prove to an insurer that yes, depression is a disability.

Navigating the Disability Claim and Appeal Process

Trying to apply for disability benefits can feel overwhelming, especially when you’re already grappling with the weight of depression. From pulling together the right documents to finally submitting the application, every step can be draining. It’s a journey, and like any journey, having a map makes all the difference.

Unfortunately, many people in Ontario find their initial disability claim for depression is denied. That first denial can feel like a crushing blow, but it’s crucial to understand that this is often a standard part of the process for mental health claims. It is not the end of the road.

Knowing what to do next is the key to getting the benefits you need. Think of a denial not as a final verdict, but as an invitation to provide more information and build a stronger case.

Handling an Initial Denial

When that denial letter arrives, your first instinct might be frustration or even despair. Take a deep breath and look closer, because that letter contains vital information. It will outline exactly why the insurer or government body rejected your claim, giving you a clear roadmap of what you need to address.

Most disability benefit programs in Canada, including private Long-Term Disability (LTD) policies and the Canada Pension Plan Disability (CPP-D) program, have a structured appeal process. The first stage is usually an internal appeal, which is your chance to respond directly to the decision-maker.

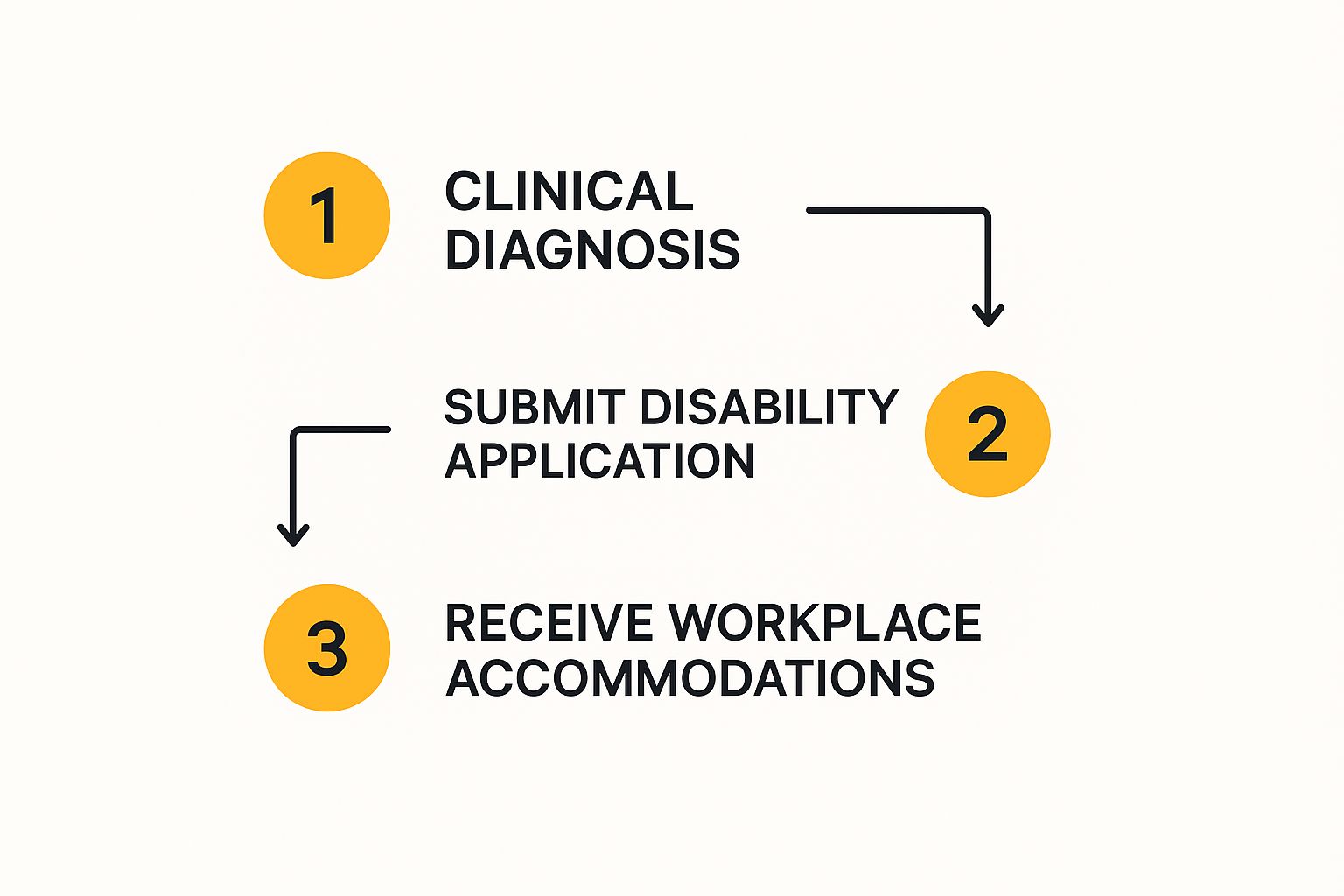

This infographic simplifies the journey from getting a diagnosis to securing the support you need.

As the visual shows, receiving workplace accommodations or benefits is the final step. It all hinges on a successful diagnosis and application, which makes the claim process itself incredibly important.

The Internal Appeal: What to Expect

The internal appeal is your opportunity to build a much stronger, more detailed case. This isn’t about just resubmitting the same paperwork and hoping for a different outcome. Instead, your goal is to systematically fill the gaps that the insurance company pointed out in their denial letter.

Here’s what this stage typically involves:

- Reviewing the Denial: Read the reasons for denial very carefully. Did they claim there wasn’t enough objective medical evidence? Did they question how severely your day-to-day life is impacted?

- Gathering More Evidence: This is the time to go back to your doctors and specialists. You might need a more detailed report from your psychiatrist or updated notes from your therapist that directly address and counter the insurer’s reasons for denial.

- Writing a Submission Letter: You or your legal representative will need to draft a letter that clearly explains why the denial was incorrect. This letter should reference all the new evidence you’ve gathered and make a compelling argument for why you are eligible.

A denial is often just a sign that your initial application didn’t tell a complete and convincing story. The appeal is your chance to revise that story with more detail, stronger evidence, and a clearer connection between your depression and your inability to work.

If the internal appeal is also denied, don’t lose hope. This is often the point where taking legal action becomes the next logical step. Consulting with a disability lawyer who serves the GTA and across Ontario can give you the expertise and advocacy needed to challenge the decision in a more formal setting, ensuring your rights are protected throughout the fight.

Understanding Your Workplace Rights and Accommodations

When you’re dealing with depression, thinking about work can feel overwhelming. But it’s important to know you have rights designed to protect you. Beyond just getting financial support, recognizing depression as a disability is about making sure you’re treated fairly on the job.

In Ontario, the law is clear. Under the Human Rights Code, your employer has a legal responsibility called the “duty to accommodate.” This isn’t just a friendly suggestion—it’s a mandatory obligation.

This duty means your employer must take reasonable steps to adjust your work environment or your tasks to help manage the limitations caused by your depression. The only exception is if doing so would cause them “undue hardship,” which is a very high legal bar to meet. Think of it as a collaborative conversation to find a solution that helps you keep working effectively.

What Reasonable Accommodations Look Like

“Reasonable accommodation” might sound a bit fuzzy, but it boils down to practical, real-world changes that can make all the difference. The idea is to tweak your role or workspace so you can still perform the core parts of your job, even with your symptoms.

Here are a few common examples of accommodations you might see in a GTA workplace:

- Modified Work Hours: Perhaps a more flexible start time to manage morning fatigue or to fit in therapy appointments.

- A Quieter Workspace: If concentration is a struggle, moving your desk away from a busy, loud area can be a simple but powerful fix.

- Changes to Job Tasks: Temporarily shifting certain high-stress or mentally demanding tasks to a colleague can provide much-needed relief.

- Increased Breaks: Allowing for short, scheduled breaks throughout the day can help you manage feelings of being overwhelmed or combat mental exhaustion.

The Accommodation Process

So, how do you actually ask for these changes? It starts with a conversation with your employer, but you’ll want to be prepared. You need to give them enough medical information to understand your needs, but this doesn’t mean sharing every personal detail of your condition.

Typically, this involves getting a doctor’s note. The key is that the note should focus on your functional limitations, not just the diagnosis. For example, instead of just saying “has depression,” a more helpful note would state that you have “difficulty concentrating for extended periods” and require specific adjustments.

In Ontario, it is illegal for an employer to discriminate against you because of a mental health disability. This means they cannot penalize you for asking for help, and they certainly cannot fire you for it. These protections are fundamental to your rights at work.

Knowing your rights is your best defence. If you’re worried about how asking for accommodation might impact your job security, our guide on the Employment Standards Act and termination offers crucial information. The ultimate goal is to get you the support you need to either stay at your job or return to it successfully.

Frequently Asked Questions

Navigating disability claims for mental health can feel overwhelming, and it’s natural to have a lot of questions. Here are some straightforward answers to the questions we hear most often from our clients here in Ontario.

Can I Get Disability Benefits If I Can Still Work Part-Time?

That’s a great question, and the answer really hinges on which program you’re dealing with. Many private Long-Term Disability (LTD) insurance policies have what’s called a partial disability clause. This means if your depression has cut your work hours and, as a result, your income, you could still be eligible for benefits.

On the other hand, government programs like the Canada Pension Plan Disability (CPP-D) are much more black and white. CPP-D requires that your condition be both “severe and prolonged,” meaning it stops you from doing any kind of substantially gainful work. The Ontario Disability Support Program (ODSP) also has its own specific rules about earned income. It’s absolutely critical to read the fine print and understand the exact definition of “disability” for your specific policy or program.

How Long Do I Need to Be Off Work Before Applying for LTD?

Most group LTD policies don’t start paying out the moment you stop working. There’s almost always a mandatory waiting window, which is officially called the elimination period. Think of it as a deductible, but for time instead of money.

This period is typically between 90 to 180 days (that’s about three to six months) where you have to be continuously unable to work before your benefits kick in. During this time, you’ll need to rely on sick leave or any Short-Term Disability (STD) benefits you might have. A good piece of advice is to get your LTD application ready before the elimination period is over to help prevent any gaps in your income.

A denial is not the end of the road; it’s a very common outcome for initial disability claims for depression. The key is to understand why you were denied and to methodically strengthen your case with more evidence during the appeal.

What Should I Do If My Disability Claim for Depression Is Denied?

First and foremost, don’t panic. Getting denied is incredibly common, especially for a condition like depression, and it is absolutely not the final word. The denial letter you receive is actually a crucial piece of the puzzle—it will outline exactly why they made their decision, giving you a clear roadmap for your appeal.

The process usually starts with an internal appeal directly with the insurance company. This is your chance to gather more medical evidence, get stronger reports from your doctors, and directly challenge the reasons they gave for the denial. If that first appeal doesn’t work out, your next step is often to pursue legal action. To see more answers like these, you can explore other common questions on our FAQ page.

If your disability claim has been denied, you don’t have to fight the insurance company alone. At UL Lawyers, our experienced team serves clients across the GTA and Ontario, ensuring your rights are protected. Contact us today for a free consultation at https://ullaw.ca.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies