Lawyer for Insurance Claim: When Should You Hire One?

When your insurance company denies or low-balls your claim, it can feel like you’ve hit a brick wall. It’s a frustrating and often powerless feeling, especially when you’re up against a massive corporation. But if you’re an Ontarian in this situation, you need to know you have rights and options.

The short answer for when to call a lawyer is simple: right when your insurer denies your claim, makes an insulting settlement offer, or starts dragging their feet.

Your Guide to Insurance Claim Disputes in Ontario

This guide digs deeper into that answer, showing you exactly how to level the playing field when you’re dealing with a difficult insurer. We’ll walk through the most common insurance disputes in Ontario—from car accidents and slip-and-falls to long-term disability—and show you why getting a legal professional on your side is often the most powerful move you can make.

Think about it: an insurance policy is a complex legal contract, and it’s always written by the company’s lawyers to protect their interests. The last thing you need when you’re recovering from an injury or illness is a drawn-out fight over confusing policy wording or never-ending demands for more paperwork.

An insurer’s primary goal is to protect its bottom line, which often clashes directly with your need for fair and timely compensation. This is precisely where a lawyer for insurance claim disputes becomes your most valuable ally.

Why Legal Guidance Is Crucial

Bringing in a lawyer isn’t about starting a fight; it’s about protecting your rights under Ontario law and ensuring you get a fair shake. An experienced lawyer immediately steps in to handle all the stressful back-and-forth, dissects the insurer’s reasons for their decision, and starts building a powerful case to get you what you’re owed.

Here are a few common scenarios where a lawyer’s expertise can change the outcome:

- Complex Claims: A serious car accident throws you into the complicated world of Ontario’s Statutory Accident Benefits Schedule (SABS). A lawyer knows exactly how to navigate it to make sure every single benefit you’re entitled to is identified and claimed properly. You can learn more about the complexities of accident benefits in Ontario in our detailed guide.

- Disputed Liability: In a slip and fall, the burden is on you to prove the property owner was negligent. A lawyer handles the investigation, gathering the crucial evidence needed to establish who was at fault.

- Unfair Denials: Insurers often deny long-term disability claims by insisting your condition doesn’t fit their narrow definition of “total disability.” A good lawyer knows how to challenge these interpretations with medical and legal arguments.

At the end of the day, our goal is to take you from a place of stress and uncertainty to one of strength and empowerment. With the right professional support, you can confidently fight for the benefits you deserve.

Why Insurance Companies Deny or Delay Claims

Let’s be clear: insurance companies are businesses. Like any other business in Canada, their primary goal is to protect their bottom line, which means minimizing how much they pay out in claims. While they provide a crucial safety net, this financial reality often creates a direct conflict with your need for fair and prompt compensation when you can’t work.

When you file a claim, you’re asking the insurer to make good on their end of a complicated legal contract—your policy. This document is packed with very specific definitions, exclusions, and conditions, all drafted by their own legal experts. A lawyer for insurance claim disputes understands this rulebook inside and out and knows how to argue the rules in your favour, not the company’s.

An outright denial or a seemingly endless delay isn’t always just a processing issue; it can be a deliberate business strategy. The insurer might be banking on you getting frustrated, accepting a lowball settlement, or simply giving up. It’s a tactic that saves them money but can leave you in a devastating financial position.

Common Reasons for Claim Denials

Insurance companies have a go-to list of reasons for denying a claim. While some might be legitimate, many are stretched to unfairly avoid paying. Knowing what to look for is the first step in pushing back effectively.

Here are some of the most common justifications you might hear from an insurer in Ontario:

- Alleged Misrepresentation: They claim you left out or misstated information on your original application—even something minor—and use it as an excuse to void your entire policy.

- Insufficient Medical Evidence: The insurer argues that the reports from your own doctors aren’t strong enough to prove your condition meets the specific definition of disability in their policy.

- Policy Exclusions and Limitations: They dig into the fine print and point to a specific clause, claiming your illness or the way your injury happened isn’t covered.

- Missed Deadlines: They say you didn’t get a form or a piece of information to them on time, and as a result, you’ve forfeited your right to benefits.

To see how these tactics often come up in disability claims, check out our guide on what to do when your long-term disability is denied.

Recognizing Delay Tactics and Bad Faith

Sometimes the problem isn’t a flat-out “no.” Instead, the insurer just seems to drag the process on forever. In the Canadian legal system, when an insurer acts unfairly or without a legitimate reason, it can be considered an act of bad faith. This is a serious legal issue that opens the door to claiming damages beyond just your insurance benefits.

An insurer has a legal duty of good faith and fair dealing with its policyholders. Deliberately delaying a legitimate claim, making endless and repetitive requests for documentation, or failing to conduct a timely investigation can all be signs of an insurer breaching this fundamental duty.

Keep an eye out for strategic moves like scheduling multiple “independent” medical examinations (IMEs). These are appointments with doctors paid for by the insurer. Often, these doctors are known for producing reports that favour the insurance company’s position, directly contradicting the opinions of your own treating physician. This is a classic tactic used to create “conflicting evidence” they can use to justify denying or delaying your claim.

Claims That Almost Always Require a Lawyer

Some insurance claims are straightforward. A minor fender-bender where fault is clear? You can probably handle that yourself. But other claims are legal minefields from the get-go.

When the stakes are high, trying to go it alone pits you against an insurance company’s army of experienced lawyers and adjusters. In these situations, hiring a lawyer isn’t about being aggressive; it’s about levelling the playing field to protect your rights and get what you’re owed. These are the types of claims where insurers are most likely to dig in, dispute the facts, and use confusing policy jargon to deny or lowball your settlement.

Long-Term Disability Claims

Long-term disability (LTD) claims are notorious for being denied. Insurers often hide behind their policy’s strict definition of “total disability,” sometimes completely ignoring the medical opinions from your own doctors. They might bring in their own so-called independent medical experts to create conflicting reports or even resort to surveillance to question how serious your condition really is.

Real-World Example: Think of a construction manager from Burlington who was denied LTD benefits after a severe back injury. His insurer insisted he could do “sedentary work,” even though chronic pain made it impossible for him to sit for more than a few minutes. A lawyer had to step in, gathering detailed medical and vocational evidence that proved he couldn’t hold down any job. Only then did the insurer reverse its denial and pay the benefits he was owed from day one.

Serious Motor Vehicle Accident Claims

After a serious car accident in Ontario, you’re suddenly juggling two claims: an accident benefits (SABS) claim with your own insurer and a tort claim against the driver who hit you. When injuries are severe or catastrophic, the financial costs can be staggering, covering a lifetime of medical care, rehabilitation, and lost income.

Insurers will fight tooth and nail to minimize what they have to pay on these claims. They might downplay the severity of your injuries, argue you don’t meet the strict criteria for a “catastrophic impairment,” or push you to accept a quick, lowball offer that won’t even scratch the surface of your long-term needs. You need an experienced lawyer to build the medical case, properly calculate the full lifetime cost of your injuries, and fight for a settlement that actually secures your future.

Critical Illness and Life Insurance Claims

When your family is reeling from a devastating diagnosis or the loss of a loved one, a denied insurance claim is the last thing you should have to deal with. Unfortunately, it happens all the time. Insurers often deny these claims by digging for alleged “misrepresentations” on the original application or by twisting policy exclusions to fit their narrative. They might argue a pre-existing condition wasn’t disclosed, even if it had nothing to do with the illness.

Trying to decipher the fine print while you’re grieving is an uphill battle. If your claim has been denied, understanding how a critical illness insurance lawyer in Toronto can help is a critical first step.

Slip and Fall or Occupiers’ Liability Claims

If you get hurt on someone else’s property, the burden is on you to prove the owner was negligent. You have to show they failed in their legal duty to keep their property reasonably safe, which is a high bar to clear. You can bet the property owner and their insurer will argue you were careless, not watching where you were going, or that the hazard was obvious. A lawyer is essential to investigate the incident properly, get their hands on crucial evidence like maintenance logs or security footage, and build a solid case that proves the owner was at fault.

What an Insurance Lawyer Actually Does for You

When you hire a lawyer for an insurance claim, you’re getting much more than someone to write a tough-sounding letter. You’re bringing in a strategic partner who knows how to navigate the complex legal maze designed to protect your rights under Ontario law. The whole process starts with a simple, no-pressure chat—a free case review.

In that first conversation, we’ll dive into your insurance policy. These documents are dense legal contracts written by the insurance company, for the insurance company. We’ll carefully pick it apart and stack it up against the reasons they gave for denying your claim or making a lowball offer. This first step is huge; it helps us spot the weak spots in their argument and start building our game plan.

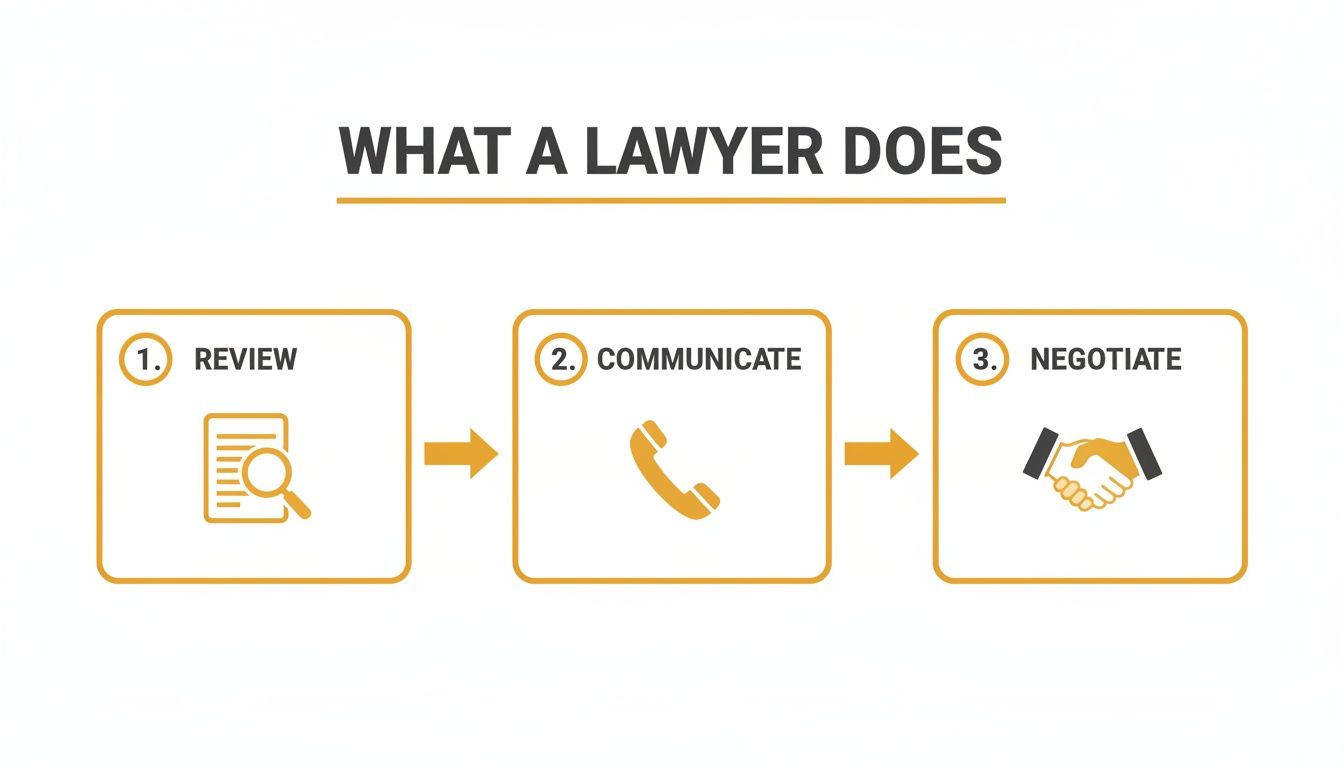

This infographic breaks down the main jobs your legal team will handle for you.

As you can see, a lawyer’s work follows a clear path: start with a deep dive into the details, then take control of the conversation, and finally, negotiate from a position of strength. Every step is about building a rock-solid case for you.

Taking Control and Building Your Case

The moment you hire a lawyer, they take over all communication. That one action can feel like a massive weight has been lifted. No more stressful calls from adjusters. No more endless requests for documents. You’re no longer in a position where you have to defend your condition or debate policy fine print. Your legal team manages all of that, so you can put 100% of your energy into your health and your family.

From that point on, our focus shifts to gathering indisputable proof. This isn’t just about collecting paperwork; it’s a proactive, methodical process. We might:

- Secure Specialist Reports: We’ll work to get detailed medical opinions from your own doctors and independent specialists who can clearly explain the true extent of your injuries or illness.

- Gather Vocational Assessments: We can bring in experts who will assess and report on how your condition genuinely affects your ability to do your job—or any other job, for that matter.

- Collect Witness Statements: We’ll talk to family, friends, and coworkers. Their firsthand stories about how your life has changed can be incredibly powerful.

Calculating Your Claim and Fighting for Fair Value

One of the most critical jobs for your lawyer for an insurance claim is figuring out the full and fair value of what you’re owed. It’s common for insurers to make offers that only cover your immediate bills, completely ignoring what you’ll need down the road. Our legal team calculates everything—future medical treatments, rehabilitation, lost earning capacity, and all the other long-term financial hits. You can learn more about how these damages are calculated by reviewing the law on personal injury in Ontario.

Once we have a fully documented case and a precise calculation of your losses, your lawyer begins negotiating with the insurer. This isn’t just a casual chat. It’s a legal argument, armed with evidence, legal precedent, and the very real possibility of a lawsuit.

If the insurance company still won’t offer a fair settlement, your lawyer won’t back down. We’ll file a lawsuit and get the litigation process rolling. While most cases in Ontario do settle before ever seeing a courtroom, it’s our willingness to go to trial that puts pressure on insurers to take your claim seriously and pay you what you rightfully deserve.

Understanding Legal Fees and Timelines in Ontario

Let’s be honest, the thought of a legal bill is enough to make anyone anxious, especially when you’re already stressed about a denied insurance claim. It’s one of the biggest reasons people in Ontario put off calling a lawyer—they’re worried they can’t afford it. The good news is, the way personal injury and disability law works is designed to solve exactly that problem.

Most seasoned insurance claim lawyers in Ontario, including us here at UL Lawyers, operate on a contingency fee agreement. It’s a straightforward model that’s all about making sure everyone has a fair shot at justice, no matter what their financial situation looks like.

What “No Win, No Fee” Really Means

A contingency fee arrangement is just what it sounds like: you don’t pay a cent in legal fees unless we win your case. Winning means we secure a settlement for you or win a court award. Our fee is simply a pre-agreed percentage of the money we recover on your behalf. This setup puts us on the same team—we only get paid when you do.

This means you can go after the benefits you’re entitled to without any upfront costs or financial risk. We cover the expenses of building a strong case for you, like getting your medical records or bringing in expert witnesses. Those costs are only paid back out of the final settlement.

A contingency fee agreement ensures your ability to stand up to a massive insurance company isn’t dictated by the size of your bank account. It levels the playing field, giving you access to the same quality of legal expertise the insurers have on their side.

Setting Realistic Timelines for Your Claim

The other big question on everyone’s mind is, “How long is this going to take?” While we all want a quick fix, it’s crucial to set realistic expectations from the start. The timeline for resolving an insurance dispute can vary widely depending on how complex your situation is.

Generally, the process unfolds in a few key stages:

- Investigation and Evidence Gathering: This is where we lay the groundwork. We’ll gather every piece of the puzzle, from your insurance policy and the denial letter to detailed medical reports and opinions from specialists.

- Negotiation: Once we’ve built a solid case, we present it to the insurance company and start talking settlement. A huge number of claims get resolved right here.

- Litigation: If the insurer digs in their heels and won’t offer a fair settlement, the next step is to file a lawsuit. This sounds intimidating, but it doesn’t mean you’re headed for a courtroom drama. In fact, over 95% of Canadian lawsuits settle before ever reaching a trial.

A straightforward case might wrap up in a few months, but a more complicated dispute involving serious injuries could take over a year to resolve properly. A good lawyer’s goal isn’t just to get a fast outcome—it’s to get the best possible outcome that protects your financial future.

How to Choose the Right Insurance Lawyer in Ontario

Let’s be clear: not every lawyer can take on a complex insurance dispute. When you’re up against a massive insurance company, finding the right legal expert isn’t just a step in the process—it’s the most critical decision you’ll make to protect your rights. You’re looking for a specialist, not someone who dabbles in insurance law on the side.

You need a lawyer for insurance claim disputes who lives and breathes this stuff. A true specialist has gone toe-to-toe with Canada’s major insurers time and again. They know the adjusters’ playbook inside and out and have a documented history of winning fair settlements and court awards for clients across Ontario.

Key Criteria for Your Search

When you start looking for a lawyer, it’s easy to get distracted by slick websites or ads. But you need to look past the surface. To make an informed decision, it can be helpful to understand the various attorney marketing strategies that legal professionals employ to reach potential clients.

Any lawyer worth their salt will offer a free, no-obligation consultation to discuss your situation. This is your interview. It’s your opportunity to ask tough questions and get a real sense of their expertise.

Here’s a practical checklist to help you evaluate your options:

- Specific Experience: Don’t be shy. Ask them directly how many cases just like yours they’ve managed. Have they successfully fought your specific insurance company before?

- Proven Track Record: Ask for proof of their success. Solid client testimonials and real-world case results are the best signs that a firm can actually deliver on its promises.

- Clear Communication: Pay attention to how they talk to you. Do they break down complicated legal jargon into plain English? You need to feel confident that you’ll be kept in the loop every step of the way.

- Personal Connection: This journey can be long and emotionally draining. It’s essential to work with a lawyer you genuinely trust and feel has your back.

The right lawyer acts as your advocate, strategist, and guide. Their primary role is to level the playing field, ensuring your voice is heard and your rights are aggressively defended against powerful corporate interests.

In the end, choosing the right lawyer boils down to two things: expertise and trust. You aren’t just hiring someone to file paperwork; you’re partnering with an advocate who will fight for your future. A great place to begin your search is by looking for a dedicated team of personal injuries lawyer near me who specialize in exactly these kinds of complex disputes.

Your Insurance Claim Questions, Answered

When an insurance company denies your claim, it’s natural to feel lost and have a lot of questions. We hear them every day from people across Ontario. Let’s clear up some of the most common ones.

How Long Do I Have to Sue an Insurance Company in Ontario?

You generally have two years to file a lawsuit after your claim is denied, as set out in Ontario’s Limitations Act. This might sound simple, but the clock doesn’t always start when you think it does. For a disability claim, for example, that two-year window usually begins ticking the moment you receive the insurer’s first clear, formal letter of denial.

Don’t guess. Missing this deadline means you could lose your right to fight for your benefits forever. It’s absolutely critical to get legal advice right after a denial to confirm your specific timeline and protect your options before they disappear.

Does Hiring a Lawyer Mean We’re Going to Court?

Almost certainly not. The reality is that the vast majority of insurance disputes in Canada—well over 95%—are settled out of court. Think of an experienced insurance lawyer as a strategic negotiator first and a courtroom litigator second.

Their job is to build such a compelling case that the insurance company is pressured to offer a fair settlement. The insurer knows your lawyer is fully prepared to take the fight to trial, and that readiness is what brings them to the bargaining table.

What Should I Do Right After My Claim Is Denied?

First, take a deep breath. A denial is often just the start of the conversation, not the end of it. Your first move should be to ask the insurance company for a detailed explanation of their decision in writing. Don’t accept a vague verbal reason.

While you wait, pull together all your paperwork: the insurance policy, any medical reports, emails, and letters you’ve exchanged with the insurer. Then, your most important step is to call a lawyer who specializes in this area for a free consultation. They can review the denial letter, check it against your policy, and tell you if the insurer’s decision is on shaky ground. From there, you can decide on the right path forward, whether that’s an internal appeal or a lawsuit.

Facing down an insurance company on your own is a daunting task, but you don’t have to do it alone. At UL Lawyers, we have a long track record of helping people in Burlington, the GTA, and across Ontario get the benefits they’re entitled to. If you’ve received a denial, contact us today for a free consultation to find out where you stand. Learn more at https://ullaw.ca.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies