Long Term Disability Denied in Canada? What To Do Next

Receiving a letter denying your long-term disability claim feels like a punch to the gut. It’s easy to feel panicked and overwhelmed, but the most important thing to do right now is to stay calm and take a very specific first step: immediately request your entire claim file from the insurer. This file is the playbook the insurance company used to deny you, and it’s exactly what you need to start building your appeal.

What To Do When Your LTD Denial Letter Arrives

That denial letter in your hands can feel devastating. After everything you’ve been through—countless doctor’s visits, endless forms—this rejection can leave you feeling completely lost and worried about your financial future.

But this isn’t the end of the road. In fact, it’s the start of the appeal process, and what you do in these first few days is absolutely critical. It’s okay to take a moment to absorb the news, but then it’s time to move forward with a clear, methodical plan. Keep in mind, Canadian insurance companies are businesses, and unfortunately, denials are a routine part of how they operate. This letter is just their opening argument, not the final verdict.

Carefully Read the Denial Letter

Your first real task is to read that denial letter from top to bottom. Then read it again. Don’t just glance at the rejection part; the insurer is legally required to explain why they denied your claim, and this document lays out their entire case against you.

Be on the lookout for specific details:

- What are the exact medical reasons they give for the denial?

- Do they refer to specific clauses in your policy or their own definition of “disability”?

- Are there names of any doctors or medical consultants who reviewed your file?

- What is the deadline to submit your appeal? This is the single most important piece of information in the entire letter.

Missing that appeal deadline could mean losing your right to fight their decision for good. Circle it, highlight it, and put it on every calendar you have.

Document Everything from This Point Forward

From this moment on, you need to become a meticulous record-keeper. Start a new file—physical or digital—and put every single piece of correspondence related to your claim in it. Every phone call, every email, every letter is now potential evidence for your appeal.

Get a notebook and log every interaction. Write down the date, the time, and the full name of the person you spoke with at the insurance company. Add a quick summary of what was discussed.

A detailed communication log isn’t just about being organised; it creates a powerful, undeniable record of events. This paper trail can be your best friend later on, whether you’re in an internal appeal or a legal battle. It stops the insurer from being able to claim a “misunderstanding” or that paperwork was never received.

This habit transforms a chaotic situation into a manageable one. For instance, if an insurance agent tells you something important over the phone, follow up immediately with a polite email confirming what was said. This simple step creates a written record of a verbal conversation, which is infinitely stronger than trying to rely on memory alone. It protects you and methodically builds the foundation for your challenge.

So, Why Was Your LTD Claim Denied? Let’s Break It Down

To build a strong appeal, you have to get inside the insurance company’s head and figure out exactly why they said no. That denial letter isn’t just a rejection; it’s a roadmap of their arguments. Your job is to take that map and find a better route.

Let’s be blunt: insurance companies are businesses, and part of their business model involves denying claims. It’s a frustrating reality that forces people into a fight to get the benefits they’ve paid for and are entitled to. As you can see in many long-term disability denial cases, these reasons often fall into a few common categories.

Understanding these common denial tactics is the first step in dismantling the insurer’s case and building your own.

Common Reasons for LTD Denials in Canada

This table breaks down the most frequent reasons insurance companies deny long-term disability claims, helping you identify the specific issue in your case.

| Reason for Denial | What It Means for You | How to Address It |

|---|---|---|

| Insufficient Medical Evidence | The insurer claims your medical files don’t adequately prove your disability. This is common for conditions like fibromyalgia, chronic fatigue, or mental health issues that lack a single “definitive” test. | Gather more detailed reports from your doctors. Ask them to focus on how your condition limits your specific abilities (e.g., sitting, concentrating, lifting). Consider specialist evaluations or functional capacity tests. |

| Their Doctor Disagrees with Yours | The insurance company’s “Independent Medical Examiner” (IME) says you can work, directly contradicting your own physician’s opinion. | Challenge the IME report. Highlight the long-term relationship and detailed knowledge your treating doctor has versus the IME’s brief, one-time assessment. Your lawyer can argue the superior weight of your doctor’s evidence. |

| Change in Disability Definition | Your policy likely shifted from “own occupation” to “any occupation” after 24 months. The insurer is now arguing you could do some kind of work, even if it’s not your old job. | Provide evidence that you cannot perform any job you’re suited for by education, training, or experience. This often requires vocational assessments and detailed medical opinions on your functional limitations. |

| Surveillance Evidence | The insurer hired a private investigator who filmed you doing something they believe contradicts your claim (e.g., carrying groceries, driving). | Context is everything. A 15-second video clip doesn’t show the pain you were in afterward or that you couldn’t leave the house for the next two days. Be prepared to explain the full context of any activities. |

| Administrative Errors | You may have missed a deadline, filled out a form incorrectly, or failed to provide requested information on time. | Review all correspondence carefully to pinpoint the error. While frustrating, these can sometimes be corrected by providing the missing information, though you may still need to appeal the decision. |

By pinpointing the exact reason for your denial, you and your legal team can focus your efforts and gather the precise evidence needed to counter the insurance company’s position effectively.

The “Not Enough Medical Evidence” Argument

One of the go-to reasons you’ll see is “insufficient medical evidence.” This is a vague, catch-all phrase that can mean a few different things. The insurer might be saying your doctor’s notes lack detail, or that your objective tests—like an MRI or a CT scan—don’t fully explain the level of pain and limitation you’re reporting.

This happens all the time with conditions like chronic pain, depression, or anxiety, where there isn’t a single lab test that can “prove” the disability. Insurers love to exploit this, framing your condition as being based on “subjective complaints” without objective proof. Don’t let this discourage you; it’s a common tactic, not a final verdict on your health.

When Their Doctor Disagrees with Your Doctor

It’s a classic move. The insurance company sends you for an “Independent Medical Examination” (IME) with a doctor they hired and paid. Shockingly, that doctor’s report often comes back saying you’re perfectly capable of working, completely contradicting what your own family doctor and specialists have been saying for months or even years.

The insurer will then seize on this one report, giving it more weight than all the others combined. They’ll use the opinion of a doctor who met you for an hour to overrule the healthcare professionals who have actually been managing your treatment.

This is a critical point of attack for your appeal. The foundation of your case rests on demonstrating that the continuous, detailed reports from your long-term medical team provide a far more accurate picture of your functional limitations than a one-time assessment from the insurer’s hand-picked doctor.

The Two-Year “Any Occupation” Trap

This is a major tripwire, and it almost always happens right around the two-year mark. Most group disability policies in Canada have a definition of disability that changes over time.

- Own Occupation: For the first 24 months, you’re considered disabled if you can’t do the main duties of your own job. A roofer with a serious back injury easily qualifies.

- Any Occupation: But after 24 months, the goalposts move. Now, to keep getting benefits, you have to prove you’re unable to do any job for which you have the right education, training, or experience.

Insurers use this changeover as a prime opportunity to cut off benefits. They’ll argue that even though the roofer can’t climb ladders anymore, maybe they could work a desk job or as a cashier. Suddenly, in their eyes, you’re no longer “totally disabled.” Understanding this shift is absolutely crucial for gathering the right kind of evidence to show you truly can’t work in any suitable capacity.

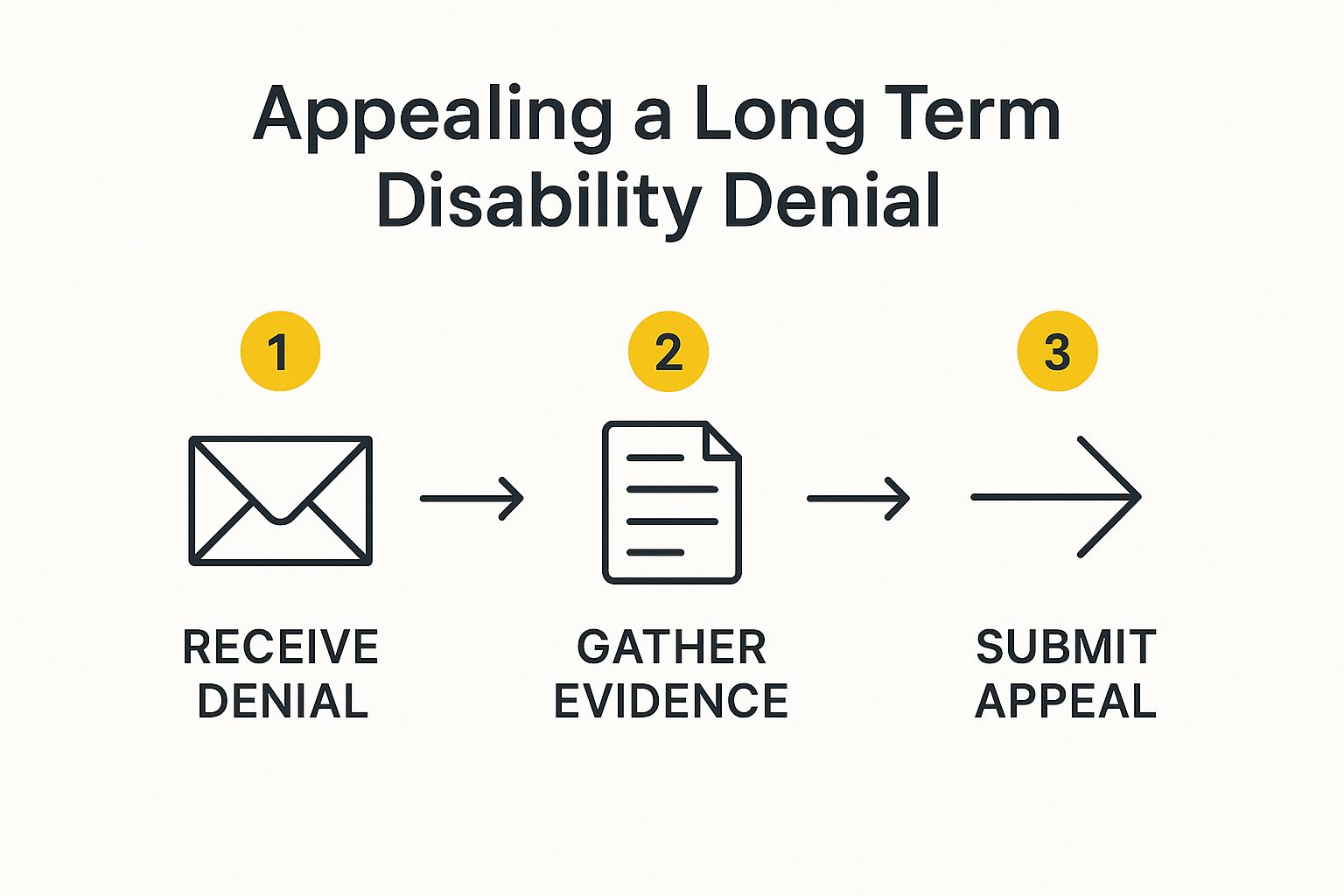

Building a Powerful Appeal Package

When that denial letter for your long-term disability claim lands in your mailbox, it can feel like a final verdict. But it’s not. It’s the start of the next phase: the internal appeal. In Canada, most insurance policies make this a mandatory step before you can even think about suing.

It’s tempting to see this as just another piece of bureaucratic red tape, but that’s a huge mistake. The internal appeal is your first, and often best, shot at overturning the decision by presenting a rock-solid case. This isn’t about just sending back the same old forms. It’s about building a file so compelling that the insurer’s own people have to reverse their decision.

A well-organised appeal shows them you mean business and are fully prepared to fight for the benefits you’re entitled to.

This visual roadmap lays out the key moves, from the moment you get the denial to gathering fresh evidence and submitting a comprehensive appeal. It gives you a clear path to follow.

Your First Move: Get Your Entire Claim File

Before you do anything else, you need to send a formal written request to the insurance company for a complete copy of your claim file. This is your right, so don’t be shy. This file is a treasure trove of information.

It contains every single piece of paper related to your claim: every doctor’s report, all the internal notes and emails between adjusters, any reviews from their paid consultants—basically, it’s their entire strategy laid bare.

Going through this file with a fine-tooth comb is absolutely critical. You get to see exactly what they focused on and, more importantly, what they conveniently ignored. Did their medical consultant only look at a fraction of your records? Do the internal notes show a clear bias from the start? This information is pure gold and will shape your entire appeal strategy.

Gather New, Persuasive Evidence

Just writing a letter stating you disagree won’t get you anywhere. You need to hit them with a wave of new, targeted medical evidence that directly dismantles the reasons they gave for the denial.

A strong evidence package usually includes things like:

- Updated Medical Reports: Go back to your family doctor and any specialists you see. Give them a copy of the denial letter so they understand what they’re up against. Ask them to write a detailed report that specifically counters the insurer’s conclusions.

- Narrative Letters from Your Doctors: A detailed letter from your main doctor that paints a clear picture of your day-to-day struggles and limitations can be incredibly persuasive—much more so than dry clinical notes. The letter needs to explicitly connect your diagnosis to your inability to do your job.

- New Specialist Opinions: If the insurance company questioned a specific part of your diagnosis, get an opinion from a specialist in that field. An authoritative assessment can shut down their arguments.

- A Functional Capacity Evaluation (FCE): This is a series of tests run by an occupational therapist that produces hard, objective data on your physical and even cognitive limits. It measures things like how long you can sit, stand, lift, or focus, leaving very little room for the insurer to argue.

The whole point is to add so much credible new information to your file that their original reason for denying you simply falls apart.

Think of your initial claim as your opening argument. The internal appeal is your rebuttal—it’s your opportunity to counter every single point the insurer made, armed with fresh evidence they’ve never seen before.

It’s also helpful to remember that while you’re focused on your long-term benefits, the entire disability landscape is always in flux. For example, some provincial workers’ compensation systems may adjust benefit rates annually. You can discover more about how these calculations impact disability benefits. This context just highlights how crucial precise and current documentation is in any disability claim.

When to Bring in a Disability Lawyer

If your internal appeal for long-term disability gets denied, it can feel like you’ve hit a brick wall. This second denial often stings even more than the first. But this isn’t the end of the road. It’s simply the point where the process shifts from dealing with the insurer on their turf to taking legal action on yours.

If your internal appeal for long-term disability gets denied, it can feel like you’ve hit a brick wall. This second denial often stings even more than the first. But this isn’t the end of the road. It’s simply the point where the process shifts from dealing with the insurer on their turf to taking legal action on yours.

While you can technically hire a lawyer at any point, this is the most critical moment to get one on your side. With the internal appeal process exhausted, your only remaining option is to file a lawsuit. Let’s be frank: trying to take on a multi-billion-dollar insurance corporation and their legal team by yourself is not a fair fight.

An experienced Canadian disability lawyer knows the playbook. They understand the tactics insurers use to deny claims and, more importantly, they know how to counter them. They immediately level the playing field, taking over all communication and shielding you from the stress of dealing with adjusters directly.

Don’t Miss Your Legal Deadline

Once you receive that final denial letter, a legal clock starts ticking. This is called a limitation period, and it’s the absolute deadline you have to file a lawsuit. If you miss this window, you lose your right to sue and recover your benefits—no matter how strong your case is.

In most Canadian provinces, the limitation period is two years from the date the insurer issued the final denial. This is a hard deadline that you absolutely cannot ignore.

Waiting too long to contact a lawyer is one of the most devastating mistakes you can make after getting a final denial. The moment you get that “no,” your next call should be to get legal advice. You need to protect your rights before any deadlines expire.

Hiring a lawyer right away ensures all the legal paperwork is filed correctly and on time. This alone can save your claim from being thrown out on a technicality.

Finding the Right Disability Lawyer

Choosing your legal representative is a massive decision. You need someone who lives and breathes Canadian disability insurance law, not a general-practice lawyer who dabbles in it. A true specialist will have a deep understanding of how insurers in Canada operate and which legal arguments actually win in court.

When you have your initial consultation, treat it like an interview. Come prepared to ask some direct questions:

- How much of your practice is dedicated specifically to long-term disability claims?

- Have you gone up against my insurance company before?

- How do you get paid? Do you work on a contingency fee basis?

- Based on what I’ve told you, what’s your initial take on a strategy for my case?

You’re choosing a partner for one of the biggest fights of your life. Make sure you feel confident in their expertise and comfortable with their approach before you sign anything.

How Contingency Fee Agreements Work

The cost of hiring a lawyer is, understandably, a huge worry for people whose income has just been cut off. The good news is that most disability lawyers in Canada work on a contingency fee basis.

What does that mean for you? You pay no upfront fees. Zero. The lawyer only gets paid a percentage of the money they recover for you, whether that comes from a negotiated settlement or a court award.

If they don’t win your case, you don’t owe them any legal fees. This model is a game-changer because it gives everyone access to top-tier legal help, regardless of their financial situation. It allows experts to secure substantial settlements for clients who were wrongfully denied. While every case is different, lawyers have successfully recovered millions for clients facing denied LTD benefits. You can learn more about settlements secured in wrongful denial cases.

When your long-term disability claim gets denied and you’re forced to consider legal action, you’ve entered a world where a single detail can make or break your case. The rules aren’t the same across Canada, and your success often comes down to understanding the specific laws in your province.

One of the first and most critical hurdles is the limitation period. Think of this as a non-negotiable legal deadline. It’s the window of time you have to file a lawsuit against the insurance company after they’ve given you their final “no.” If you miss it, you lose your right to sue—permanently. It doesn’t matter how strong your case is.

Provincial Timelines are Everything

It’s a huge mistake to assume the rules are the same from one province to the next. While there has been some effort to harmonize laws, crucial differences remain.

For instance, in provinces like Ontario and British Columbia, you generally have a two-year limitation period. But when does that two-year clock actually start ticking? It’s typically from the date your right to sue begins, which is usually when you receive a clear, final denial of your benefits.

But it’s not always that cut and dry. The law often says the clock starts when the loss is “discovered.” Pinpointing that exact date can be tricky, which is why having an experienced disability lawyer is so important. They know how to calculate it correctly so your claim isn’t thrown out on a technicality before it even gets started.

Common Law Can Be Your Ally

Outside of Quebec, Canada operates under a common law system. This has given rise to a legal principle that can be a game-changer in your fight: contra proferentem.

What does this mean in plain English? If a clause in your insurance policy is vague or ambiguous, a court will interpret it in a way that favours you—the person insured—not the insurance company that drafted the confusing contract.

We’ve all seen them. Insurance policies are often dense, technical documents filled with jargon. An insurer might deny your claim based on their own complex definition of “total disability,” a definition that seems deliberately unclear.

This is where contra proferentem comes in. Your lawyer can argue that any ambiguity in the policy shouldn’t be held against you. This legal principle gives you leverage and stops insurers from hiding behind poorly worded clauses to justify a denial.

Understanding these regional legal details is non-negotiable. It’s about protecting your rights and making sure a missed deadline or a confusing policy term doesn’t sink your entire case. A lawyer who lives and breathes your province’s specific laws can turn these nuances from potential pitfalls into major advantages.

Common Questions About LTD Denials in Canada

Getting that denial letter for your long-term disability claim can feel like hitting a brick wall. It’s a stressful, confusing time, and a thousand questions are probably running through your mind. Let’s walk through some of the most common ones we hear from Canadians trying to figure out their next steps.

Can My Insurance Company Make Me See Their Doctor?

Yes, they can. It’s a standard—and often frustrating—part of the process. Your policy almost certainly has a clause that says you have to go to an “Independent Medical Examination” (IME). The insurer chooses the doctor and pays for the appointment.

While you have to go, you don’t have to go in unprepared. Refusing the appointment can give the insurance company an easy reason to deny your claim for non-compliance. So, go to the appointment, but protect yourself. You have the right to bring a chaperone with you. Afterwards, sit down and write down everything you remember—what questions were asked, what tests were done, and how long the actual examination lasted. This can be invaluable if the doctor’s report comes back looking biased or factually incorrect.

What if I Try to Return to Work but Can’t Continue?

It’s a scenario we see all the time. You feel a bit better, you miss your job, and you want to give it a shot. But what if it’s too soon?

The good news is that most Canadian LTD policies have a recurrent disability clause for this very situation. If you try to go back to work but have to stop again because of the same disability within a certain window (usually six months), you can often restart your benefits without having to go through a new waiting period.

The key here is communication. Let your insurer know before you attempt to return to work. If it doesn’t work out, tell them immediately. Get a letter from your doctor explaining exactly why you had to stop.

A failed work attempt isn’t a failure in your claim. It’s actually strong proof that your disability is real and prevents you from holding down a job consistently.

Should I Appeal Internally or Sue Immediately?

This is a huge decision, and honestly, there’s no single right answer without looking at the specifics of your case. This is where getting advice from a disability lawyer is crucial.

Often, going through the insurer’s internal appeal process is the logical first move. It’s your chance to formally rebut their reasons for the denial and, more importantly, add new medical evidence to your file that strengthens your claim.

However, sometimes a lawsuit is the better option right off the bat. If the denial is based on flimsy reasoning or you’re getting close to the two-year legal deadline to file a lawsuit (known as the limitation period), a lawyer might advise you to skip the internal appeal to protect your rights. An expert can look at the insurer’s denial letter and your evidence to map out the smartest path forward for you.

Facing a long-term disability denial can feel like an uphill battle, but it’s not one you have to fight on your own. The team at UL Lawyers Professional Corporation is here to advocate for people who have been wrongfully denied the benefits they paid for and deserve. We know the insurers’ playbooks and how to build a strong case to counter them. For a free, no-obligation consultation to discuss your claim, please visit us at https://ullaw.ca.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies