Power of Attorney vs Guardianship in Ontario Explained

When you’re planning for the future, the difference between a Power of Attorney (POA) and a Guardianship in Ontario really boils down to one crucial thing: your choice versus a court’s order.

A POA is a legal document you set up while you’re mentally capable, hand-picking someone you trust to make decisions for you if you can’t. On the flip side, Guardianship is a court process that only starts after someone has lost their ability to make their own decisions and never put a POA in place.

The Critical Difference: Proactive Choice vs. Court Intervention

It’s vital for every adult in Ontario to get their head around the fundamental distinction between a Power of Attorney and a Guardianship. These aren’t just two names for the same thing; they represent two completely different legal paths with massive implications for your personal autonomy, your finances, and your family.

A Power of Attorney is all about keeping you in the driver’s seat. It gives you the power to:

- Choose your own decision-maker, selecting someone you know inside and out and trust to have your back.

- Set the ground rules by clearly defining what powers you’re granting, whether it’s for your personal care or your property.

- Keep the courts out of it, which saves your family an enormous amount of time, money, and emotional stress.

Guardianship, however, is the legal system’s last-resort safety net. It comes into play when someone can no longer manage their own affairs and has no POA. This kicks off a formal court application, requires evidence of incapacity, and ends with a judge’s ruling. It’s the court, not you, that gets the final say on who runs your life.

Comparing the Two Paths

The path you choose—or fail to choose—has consequences that will last for years. A POA is a private, straightforward document. A guardianship proceeding, in contrast, is a public, often drawn-out and expensive legal ordeal. For anyone in the GTA managing long-term disability claims or personal injury settlements, having a solid POA is non-negotiable to ensure their financial and healthcare needs are handled without interruption.

In legal planning, a Power of Attorney is an expression of your autonomy—a tool to preserve your wishes. Guardianship, while necessary at times, represents a loss of that autonomy, where decisions are placed in the hands of the court system.

To see how these concepts play out elsewhere, you can explore this overview of guardianship vs power of attorney. While the specific laws vary, the core idea of proactive planning versus reactive court action is the same. But for advice that applies directly to you, it’s always best to consult resources on Ontario’s specific wills and estate laws.

Comparing Power of Attorney vs Guardianship in Ontario

This table breaks down the core differences in a practical way, showing just how distinct these two legal tools are in Ontario.

| Feature | Power of Attorney (POA) | Guardianship |

|---|---|---|

| Origin | Created by you (the “grantor”) while you are mentally capable. | Ordered by a court after you are found to be incapable. |

| Timing | Proactive – Prepared well in advance of any potential incapacity. | Reactive – Initiated only after incapacity has already occurred. |

| Decision-Maker | Your choice. You appoint an “attorney” you personally trust. | A judge’s choice. The court appoints a “guardian.” |

| Oversight | Primarily a private matter with no ongoing court supervision needed. | Requires constant court supervision, including annual reporting. |

| Cost & Time | Relatively low cost and quick to arrange with a lawyer. | Can be extremely expensive and time-consuming due to the court process. |

Ultimately, a Power of Attorney is an instrument of empowerment, while a Guardianship is a remedy for a crisis. Planning ahead makes all the difference.

How a Power of Attorney Upholds Your Choices

Think of a Power of Attorney as your personal directive—a legal tool that ensures your voice is heard even when you can no longer speak for yourself. It’s a proactive strategy. You create it while you have the full mental capacity to make sound decisions, hand-picking a trusted person to manage your affairs if needed. This is a world away from guardianship, which is a reactive measure imposed by a court after you’ve lost capacity.

In Ontario, a POA is all about maintaining control over your own future by choosing who steps into your shoes. This person, called your “attorney,” is legally required to act in your best interests. The whole point is to preserve your autonomy and avoid the courts altogether, which is a critical difference in the power of attorney vs. guardianship debate.

The Two Pillars of a POA in Ontario

Ontario law thoughtfully splits the Power of Attorney into two separate documents, each serving a unique purpose. This allows you to appoint the right person for the right job, recognizing that the skills needed for managing finances are very different from those required for making personal care decisions.

- Continuing Power of Attorney for Property: This document gives your chosen attorney the authority to handle your financial life. We’re talking about everything from paying your bills and managing investments to buying or selling a house. The key here is the word “continuing”—it means the document stays in effect even if you later become mentally incapable.

- Power of Attorney for Personal Care: This POA is focused on your well-being. It covers decisions about your health care, where you live, what you eat, your safety, and other personal matters. Your attorney for personal care can only step in once a healthcare professional or assessor has determined you’re incapable of making these decisions on your own.

You can name the same person for both roles, or you can pick different people whose strengths align with each responsibility. The most important thing is choosing someone you trust implicitly to honour what you would have wanted.

The Legal Framework and Your Attorney’s Duties

Your appointed attorney doesn’t get a free pass to do whatever they want. They operate under a strict set of legal duties outlined in Ontario’s Substitute Decisions Act, 1992. This legislation is a crucial safeguard that spells out an attorney’s responsibilities in no uncertain terms.

These duties include:

- Acting diligently and always in good faith.

- Explaining their role and responsibilities to you.

- Encouraging you to participate in decisions as much as you’re able.

- Keeping meticulous records of every financial transaction made on your behalf.

A Power of Attorney is fundamentally an instrument of trust. The law provides the structure, but its effectiveness hinges on appointing an attorney who will genuinely respect your known wishes and act with integrity and care.

It’s also critical to remember that your attorney’s power ends the moment you do. The legal document specifying that your power of attorney expires at death is absolute; it doesn’t give them any authority to manage your estate. That’s what a will is for.

Creating Your POA and Why it Matters

Getting a valid POA in place in Ontario is a pretty straightforward process. You must be at least 18 for a property POA (16 for personal care) and be mentally capable when you sign it. You’ll need to sign the document in front of two witnesses, who must also sign. While you can find templates online, it’s always a good idea to speak with a lawyer to make sure the document is legally solid and tailored to your situation. For a deeper dive into financial management, you can learn more about a Power of Attorney for Property in our detailed guide.

Taking this step isn’t just about convenience—it’s a vital protective measure. A POA is a proactive, cost-effective way to avoid guardianship by appointing trusted agents before a crisis hits. According to Ontario’s Office of the Public Guardian and Trustee (OPGT), setting up a POA can take just a few days, with legal fees often as low as $300-$800.

Unfortunately, statistics from the Law Society of Ontario show that a significant portion of adults in the province have not prepared a POA. This gap is a major reason so many families end up in lengthy and stressful guardianship proceedings.

Navigating the Ontario Guardianship Process

When someone loses the mental capacity to make their own decisions and there’s no Power of Attorney (POA) in place, families are often thrown into a tough, confusing situation. This is where the court-supervised guardianship process begins. It’s a formal, public procedure that acts as a last resort to protect a vulnerable person, and it’s a world away from the private, personal choice involved in setting up a POA.

Getting guardianship isn’t a simple family affair; it happens in an Ontario courtroom. The process kicks off when a concerned person—usually a family member, but sometimes a friend or even an institution—files an application to be appointed as a guardian for someone they believe can no longer manage their own affairs.

The key difference here is timing. A POA is proactive—you set it up in advance. Guardianship is purely reactive. It’s a legal intervention that happens after a crisis has already hit, stripping an individual of their right to make their own choices. The court’s job is to protect the person’s best interests, but that means taking their decision-making power away and giving it to someone else.

The Application and Capacity Assessment

The first step is a formal application to the Ontario Superior Court of Justice. This is far more than filling out a form. It’s a complex legal submission that demands solid evidence proving the person’s incapacity. The applicant has to show the court, in detail, why the individual can no longer make responsible decisions about their finances or personal care.

A non-negotiable piece of this evidence is a capacity assessment. This isn’t a quick note from the family doctor. In Ontario, the assessment must be done by a specially trained and designated capacity assessor. They conduct a thorough evaluation to determine if the person can understand information and appreciate the consequences of their decisions. This report is the bedrock of the application; without it, the case goes nowhere.

The applicant also has to draft two critical documents for the court to review:

- A Management Plan that spells out precisely how they will handle the person’s money, property, and other assets.

- A Guardianship Plan that describes how they will make choices about the person’s healthcare, living arrangements, and general well-being.

These aren’t just suggestions. They are binding blueprints that the court will examine closely to make sure they are practical, comprehensive, and genuinely serve the person’s best interests.

The Downsides: Costs and Loss of Autonomy

While guardianship is sometimes unavoidable, it comes with serious drawbacks that really underscore the value of planning ahead with a POA. The most immediate hurdles are the time and money.

From start to finish, the process usually takes three to six months, and it can easily drag on longer if the application is contested or hits a snag. All the while, the individual’s affairs are effectively frozen, which adds a huge amount of stress to an already difficult time. The financial cost is also significant, with legal fees for a straightforward guardianship application typically running anywhere from $5,000 to over $15,000.

But the biggest cost of guardianship is the total loss of personal autonomy. A judge—a stranger—decides who will control your life. This court-imposed arrangement removes the personal trust and choice that lie at the very heart of a Power of Attorney.

What happens if no family member or friend can step up? The court can appoint the Office of the Public Guardian and Trustee (OPGT). This government agency acts as a guardian of last resort for thousands of people in Ontario. While the OPGT provides a vital safety net, its involvement makes the process even more impersonal, further removing decisions from the individual and their close relationships. To learn more about other proactive legal tools, check out our guide on Living Wills in Ontario.

Comparing Authority, Control, and Legal Oversight

When you’re weighing a Power of Attorney (POA) against a guardianship in Ontario, the core difference really comes down to this: a POA is a private choice, and guardianship is a public process. One is built on trust you place in someone you choose; the other is a legal intervention managed entirely by the courts. This single distinction ripples through every aspect, from how they start to how they’re supervised.

The activation process is a perfect example. A Power of Attorney for Personal Care only kicks in after a medical professional confirms you’re incapable of making your own healthcare decisions. A Continuing Power of Attorney for Property can be structured to take effect on a specific date you choose, or similarly, upon a doctor confirming incapacity. Crucially, no court is involved.

Guardianship is the polar opposite. It can only be activated through a formal court application, a hearing, and a judge’s order after evidence of incapacity is presented. This process immediately makes your private affairs a matter of public record, and the final decision rests with a judge, not with you.

The Scope of Decision-Making Power

With a Power of Attorney, you are in the driver’s seat. As the “grantor,” you define the scope of your attorney’s authority. You can grant them broad powers to handle everything or put very specific limits on what they can and can’t do, ensuring the document perfectly reflects your wishes.

A guardian’s power, on the other hand, is dictated by the court. A judge issues a detailed order spelling out precisely which decisions the guardian is permitted to make. Ontario law also follows a “least restrictive” principle, meaning the court will only grant the powers deemed absolutely necessary. The goal is always to preserve as much of your personal autonomy as possible.

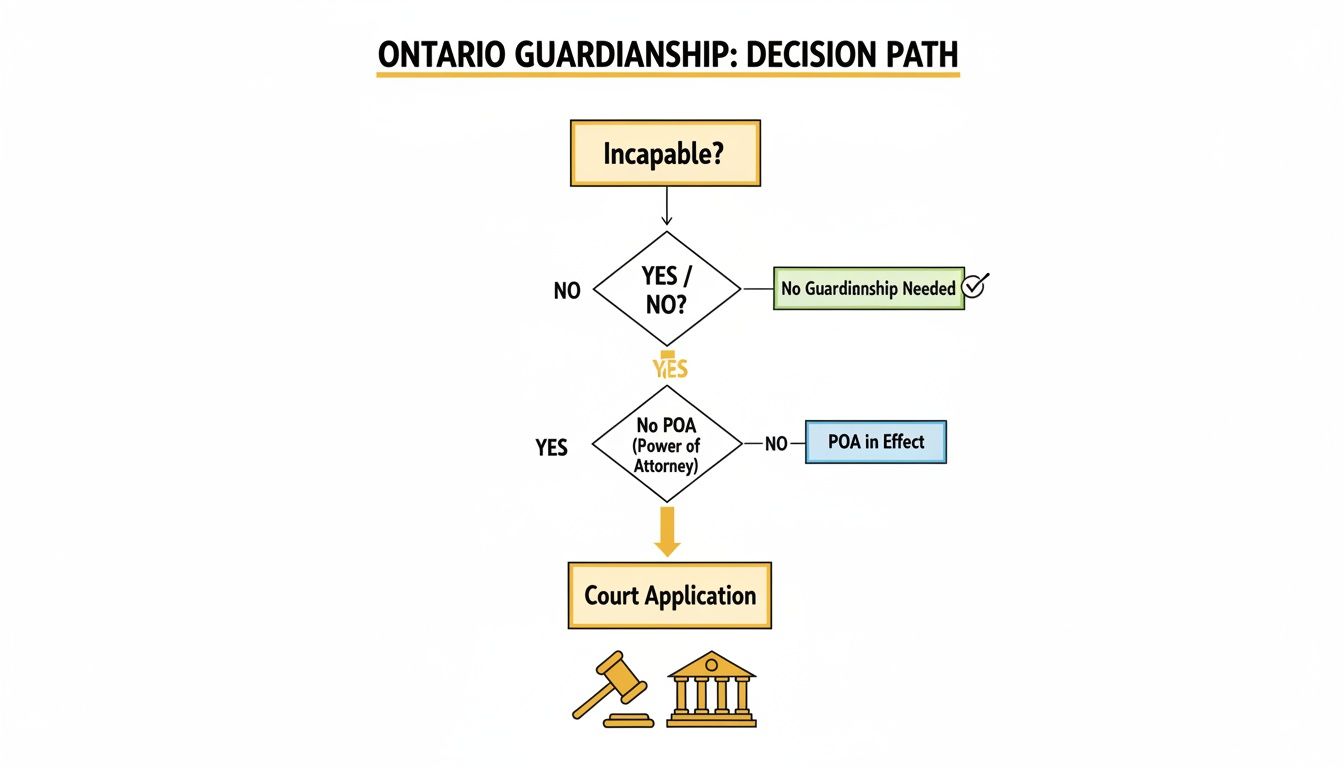

This flowchart illustrates the path to a court application for guardianship—a route taken only when someone is deemed incapable and has no POA.

As you can see, the court process is designed as a last resort, triggered by the combination of incapacity and a failure to plan ahead.

Let’s break down the key practical differences. This table offers a clear, side-by-side view of how these two legal tools stack up in the real world.

Feature Analysis of POA vs Guardianship in Ontario

| Comparison Point | Power of Attorney | Guardianship |

|---|---|---|

| Initiation | Voluntary. Created by you while you have capacity. | Involuntary. Initiated through a court application by a third party. |

| Decision-Maker | Your choice. You appoint someone you trust (your “attorney”). | Court-appointed. A judge selects the guardian, who may be a family member or the Public Guardian and Trustee. |

| Activation | No court involvement. Triggered by incapacity (for Personal Care) or a specified date/event (for Property). | Activated only by a formal court order after a hearing. |

| Oversight | Private. The attorney must keep records but isn’t required to report to the court unless challenged. | Public and ongoing. The guardian must submit management plans and annual financial accounts to the court for approval. |

| Cost | Relatively low. Primarily legal fees for drafting the documents. | High. Includes court application fees, legal fees, and ongoing accounting costs. |

| Privacy | Completely private. Your personal and financial details remain confidential. | Public record. The court application and subsequent proceedings are generally public. |

| Flexibility | Highly flexible. You can customize the powers and set specific limitations. | Rigid. The guardian’s powers are strictly defined and limited by the judge’s order. |

The table highlights a crucial theme: a Power of Attorney empowers you to make proactive choices, while guardianship is a reactive measure that hands control over to the legal system.

Ongoing Reporting and Court Supervision

The level of ongoing oversight is perhaps the most significant practical difference between the two. An attorney acting under a POA operates on a foundation of trust. While they have a strict legal duty under the Substitute Decisions Act, 1992 to keep meticulous records, they don’t have to submit them for routine court approval. Accountability is handled privately unless someone suspects wrongdoing and challenges them in court.

Guardianship exists within a much tighter framework of judicial supervision.

A guardian is an officer of the court and is directly accountable to it. This means they must file a detailed management plan at the outset and submit annual financial reports for court approval, a process known as “passing of accounts.”

This strict oversight is there for protection, but it comes with a heavy administrative burden. In Ontario, guardianship proceedings take several months from application to appointment. A crucial step is obtaining a capacity assessment, which has associated costs. Once appointed, guardians face mandatory annual reports. By contrast, a POA avoids court entirely unless there is a dispute.

Revocation and Termination

Your ability to change your mind is another key point of difference. As long as you are mentally capable, you can revoke a Power of Attorney at any time. All it takes is a formal written statement, called a Revocation, which you provide to your attorney and any institutions they’ve been dealing with. It’s that straightforward.

Ending a guardianship is a whole different story. Because a judge ordered it, only another court order can terminate it. This involves filing a motion and providing compelling evidence that the guardianship is no longer needed—a very high legal bar to clear. This is an important distinction, as the person you name as your attorney could be the same person you name as your estate’s executor. You can learn more by reading our guide comparing a Power of Attorney vs an Executor. Ultimately, a POA is a tool you control, whereas guardianship is a process that controls you.

Real-World Scenarios: Making the Choice Between POA and Guardianship

Legal documents can feel abstract. But seeing how a Power of Attorney versus guardianship plays out in real life makes the choice crystal clear. These stories show the profound difference between planning ahead and being forced to react to a crisis.

One path preserves your independence and choices, while the other becomes a stressful, last-resort intervention when no plan was ever made.

Scenario 1: Proactive Planning After a Diagnosis

Let’s look at David, a 58-year-old from Burlington who was just diagnosed with a progressive neurological condition. He knows that, down the road, his ability to handle his finances and make healthcare choices will fade. Wanting to stay in control for as long as possible, he meets with a lawyer.

Together, they draft a Continuing Power of Attorney for Property and a Power of Attorney for Personal Care. He names his daughter Sarah, who is great with money, to manage his property. For personal care, he chooses his brother, a retired nurse who understands the healthcare system. By setting this up now, David ensures his pension gets managed, his care gets paid for, and his wishes are followed—all without a single court date.

Scenario 2: Preventing Family Fights

Now consider Eleanor, an 82-year-old widow in the GTA. She has three adult children who, to put it mildly, don’t always agree. As part of her estate plan, she creates very specific POAs. She appoints her most organized child to handle her finances, but for personal care, she names all three children jointly, requiring a majority vote to make a decision.

This was a brilliant move. It removes any guesswork about who’s in charge and forces her children to work together. By clearly defining the rules, Eleanor sidesteps the family arguments that could have easily spiralled into a messy and expensive court battle for guardianship. She protected her assets and, just as importantly, her family’s relationships.

Scenario 3: The Crisis After a Sudden Accident

Then there’s Michael. At 45, he was in a serious car accident on the QEW that left him with a severe brain injury, unable to communicate. Like many people his age, he never thought he needed a Power of Attorney.

His family is now living a nightmare. To pay his mortgage from his bank account or approve a medical procedure, they have no legal authority. Their only option is to apply to the court to become his guardian. This kicks off a public, expensive, and emotionally draining legal process.

When there’s no POA, a family’s energy is split. Instead of focusing solely on their loved one’s recovery, they’re forced to navigate a bewildering court system. The guardianship application demands capacity assessments, detailed financial plans, and a judge’s sign-off, piling stress on top of an already traumatic event.

Michael’s family will spend thousands on legal fees and wait months for a court to grant them the authority they desperately need. This situation throws the power of attorney vs guardianship debate into sharp relief—it’s the difference between foresight and crisis.

In Ontario, while courts must step in for guardianship when there is no POA, the process comes at a significant price—often many times the cost of setting up a POA. The initial guardianship application can be costly, and those costs can continue to climb with mandatory court reporting.

How to Proactively Plan Your Future

Taking charge of your future is about putting the right legal tools in place now, while you are clear-headed and fully capable. If there’s one key takeaway from the power of attorney vs. guardianship debate, it’s that proactive planning is the single best way to protect your autonomy and your family.

For almost any adult in Ontario with assets, specific healthcare wishes, or loved ones they want to shield from future stress, a Power of Attorney (POA) is the far better choice. Think of it as an instrument of empowerment, designed to make sure your voice is heard even when you can’t speak for yourself.

Key Questions to Ask Yourself

Considering a Power of Attorney is a major life decision. To figure out if it’s right for you, start by asking yourself a few honest questions:

- Who do I trust completely to handle my money if I can’t?

- Is there someone who truly gets my values and would honour my wishes for personal care?

- Do I want my family to avoid a potentially stressful and expensive court process if I become incapacitated?

- Do I have specific instructions about my home or my health that I need legally documented?

- How can I prevent potential conflict among my loved ones over who should be in charge?

If you answered “yes” to any of these, it’s a strong sign that preparing Powers of Attorney is the right move. These documents allow your chosen person to step in seamlessly, avoiding the delays, costs, and public nature of a guardianship application. Our Estate Planning Checklist for Canada is a great resource to help you think through all the details.

When to Consult a Lawyer

While the idea of a POA seems simple, getting professional legal advice is crucial for making sure your documents are solid and will hold up when they’re needed most.

Consulting a lawyer isn’t just about filling out a form. It’s about building a personalized strategy that protects you from future legal challenges, family disagreements, and costly ambiguity.

You should always sit down with a lawyer at our Burlington office or another location when:

- Choosing Your Attorney: You’re not sure who to appoint or want to name more than one person to act together or as backups.

- Defining Specific Powers: You need to give very specific or limited authority, rather than broad powers.

- Complex Family Dynamics: You foresee potential for conflict or disagreement among family members about your care or finances.

- Guardianship is Unavoidable: A loved one has already lost capacity without a POA in place, and you need guidance on navigating the court system.

An experienced lawyer makes sure your documents are perfectly aligned with Ontario’s Substitute Decisions Act, 1992, and are customized to your life. That’s how you get real peace of mind.

Common Questions About POAs and Guardianship

When you’re trying to figure out the best way to plan for the future, a lot of questions come up. Let’s tackle some of the most common ones I hear about Powers of Attorney and guardianship in Ontario.

Think of it this way: a POA is you making the choice, while guardianship is the court stepping in when no choice was made.

Can I Name More Than One Person in My Power of Attorney?

Absolutely. In Ontario, you can appoint multiple people to act as your attorney for both property and personal care. The key is deciding how they’ll work together.

You can set it up in two main ways:

- Jointly: This means all your attorneys have to agree on every single decision. It’s a great way to ensure checks and balances, but it can slow things down, especially if there’s a disagreement or someone is hard to reach.

- Jointly and Severally: This structure gives each attorney the power to act on their own. It’s far more flexible and efficient, but it requires an incredible amount of trust that each person will act in your best interests.

It’s also smart practice to name a backup, or substitute, attorney. This person is on deck to step in if your first choice can’t or won’t do the job.

What Happens If My Attorney Can No Longer Act?

Life happens. If the person you appointed passes away, becomes incapable themselves, or simply decides they can no longer handle the role, your designated backup attorney takes over. This is a seamless transition outlined right in your POA document.

This is precisely why naming a substitute is so crucial. If you don’t have a backup and your primary attorney is out of the picture while you are already incapable, your family is left with one option: going to court to apply for guardianship. That’s the exact situation a Power of Attorney is meant to prevent.

Can I Make a Power of Attorney If I Already Have a Guardian?

No, you can’t. A Power of Attorney is something you have to create while you still have the mental capacity to understand its purpose and consequences.

If a court has appointed a guardian for you, it’s because a judge has already determined that you are no longer capable of making these kinds of decisions for yourself. The court’s guardianship order takes precedence, and you lose the legal ability to grant a POA.

How Much Does It Cost to Get a Power of Attorney?

Having a lawyer properly draft your Powers of Attorney is an investment in your future autonomy, but it’s a very manageable one. In Ontario, you can typically expect the legal fees for both a Continuing Power of Attorney for Property and a Power of Attorney for Personal Care to be in the range of $300 to $800.

Compare that to the alternative. A court application for guardianship is a far more complex and expensive process. Legal fees often start around $5,000 and can easily climb past $15,000, not to mention the ongoing court and administrative costs that follow.

Planning ahead is the single best way to protect your autonomy and spare your family from a difficult and costly court process. At UL Lawyers, our experienced team in Burlington helps clients across the GTA and Ontario put clear, effective Powers of Attorney in place. Contact us today for a free consultation to secure your peace of mind.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies