Severance Pay Calculator Ontario Guide

Losing your job is a stressful experience, and the severance package your employer offers can feel like the final, non-negotiable word. While a severance pay calculator ontario tool gives you a quick estimate, the real power comes from understanding the crucial difference between the legal minimums and what you’re actually owed under the law.

This guide will walk you through that distinction, helping you see why the first offer is rarely the best one.

Your Guide to Ontario Severance Pay

When your employment is terminated, the numbers in that severance offer can be intimidating. But here’s a critical piece of advice from my experience: in Ontario, that initial offer is almost always just a starting point. Many employers will only present the bare minimum required by law, banking on the hope that you’ll simply sign and move on.

The secret is knowing that two different legal systems are working in parallel here:

- The Employment Standards Act (ESA): Think of this as the absolute floor—the legal minimum severance pay your employer must provide. It’s a straightforward, formula-based safety net.

- Common Law: This is where your true entitlement often lies. Common law looks beyond a simple formula and considers a whole host of personal factors to figure out what a fair and reasonable notice period looks like. This almost always results in a much larger severance package.

The ESA Minimums: A Starting Point, Not the Finish Line

The Employment Standards Act (ESA) lays out the basic rules for who gets statutory severance pay in Ontario. To even qualify for this baseline amount, you generally need to have worked for your employer for at least five years.

On top of that, your employer must either have a global payroll of at least $2.5 million or be part of a mass termination where 50 or more employees are let go within a six-month window because a significant part of the business is closing.

The ESA formula is simple: one week of regular pay for every year you worked, up to a maximum of 26 weeks. But it’s vital to understand that most employees are entitled to much more than this through common law—potentially up to 24 months’ pay, depending on their situation. You have a two-year window from your dismissal date to file a claim. You can learn more about the provincial framework for severance pay in Ontario to see the specifics.

Key Takeaway: Never assume the first offer is the best one. The ESA is just the legal floor. Your common law rights often mean you are entitled to a significantly larger package that truly reflects your age, role, and years of service.

Why Your Full Story Matters

This is where the law gets personal, and for good reason. Unlike the rigid ESA formula, common law takes a more holistic, human approach.

It recognizes that a 58-year-old senior manager with two decades of company loyalty will have a much harder time finding a comparable new job than a 28-year-old in a junior role. This is why common law considers factors like your age, the seniority of your position, your salary, and even the current job market for your field. All these elements are weighed to determine a severance package that provides a realistic financial cushion while you find your next opportunity.

Figuring Out if You Qualify for Severance Pay

Before jumping into any calculations, the very first thing you need to do is figure out if you’re even entitled to severance pay under Ontario law. A lot of people assume it’s automatic, but it isn’t. The province’s Employment Standards Act (ESA) lays out some very specific rules that act as the legal floor for what you’re owed.

The rules are pretty black and white. To even be in the running for this minimum severance, you must have been with your employer for at least five years. This isn’t about short-term gigs; it’s designed to recognize a long-term commitment to the company.

But your time with the company is only half the story. The law also looks at the employer’s size, making sure this obligation falls on larger businesses that are better equipped to handle it.

The Two Big Employer Conditions

For you to qualify for ESA severance, your employer has to meet one of two key conditions. They don’t need to meet both, just one.

-

The Payroll Rule: Your employer’s total annual payroll is $2.5 million or more. This is a big one. It’s a global number, which means it counts wages for every single employee, even those working outside of Ontario or Canada. If you’re working for a small local branch of a huge multinational corporation, that parent company’s massive payroll is what counts.

-

The Mass Layoff Rule: Your job was cut as part of a major downsizing where 50 or more employees were let go from the same location within a six-month window because the employer is permanently shutting down all or part of the business.

These two conditions catch most long-serving employees at bigger companies. The global payroll detail is especially important—it stops large corporations from sidestepping their responsibilities by breaking up their operations into smaller, local entities.

Termination Pay is Not the Same as Severance Pay

This is a critical distinction that trips many people up. Termination pay and severance pay are often talked about together, but they are two completely separate things under the law. They have different rules and serve different purposes.

- Termination Pay (or Pay in Lieu of Notice): This is what nearly everyone gets if they’ve worked for more than three months and are fired without cause. It’s meant to cover the wages you would have earned during a proper notice period.

- Severance Pay: Think of this as an extra payment. It’s specifically for long-serving employees to compensate them for their years of loyalty and the seniority they’ve lost. You only get this if you hit that five-year mark and your employer meets one of the two conditions we just covered.

Basically, termination pay is the standard, while severance pay is an additional benefit for long-tenured staff at larger organizations. It’s a key part of Ontario’s labour laws, ensuring that employees of companies with a global payroll over $2.5 million or those impacted by a mass layoff get extra financial support. If you want to dig deeper into these rules, you can discover more insights about these specific triggers and your rights.

Here’s how it plays out in the real world: Imagine Sarah worked for seven years at a Toronto tech startup. The company has 40 employees and a payroll of $2 million. When she’s let go, she gets termination pay but no severance pay because the company’s payroll is under the $2.5 million threshold.

Now, consider Mark. He also worked for seven years, but at the small Canadian office of a global manufacturing giant. He gets both termination pay and severance pay because the company’s worldwide payroll is in the hundreds of millions. Same years of service, totally different outcome.

Figuring Out Your Minimum ESA Entitlement

Alright, so you’ve confirmed you qualify for statutory severance. Now for the part everyone wants to know: what’s the number? Calculating your minimum entitlement under Ontario’s Employment Standards Act (ESA) is actually pretty straightforward, but the devil is in the details—specifically, what counts as your “regular wages.”

This isn’t just your base salary. Your “regular wages” for a typical work week include the total amount you’d normally earn, excluding overtime. Think base pay, but also add in any commissions, non-discretionary bonuses (the kind you can count on), and other consistent payments you receive. Nailing this figure is the first and most critical step.

The ESA Severance Formula

The government has laid out a clear formula for this. It’s designed to be simple and directly rewards your length of service.

The calculation is: One week of regular wages for every full year you’ve worked, plus a pro-rated amount for any partial year.

There’s a cap, though. The maximum you can receive under the ESA is 26 weeks. So even if you’ve been with the company for 30 years, your statutory minimum severance tops out at 26 weeks’ worth of pay. It’s important to see this for what it is: the legal floor, not the ceiling.

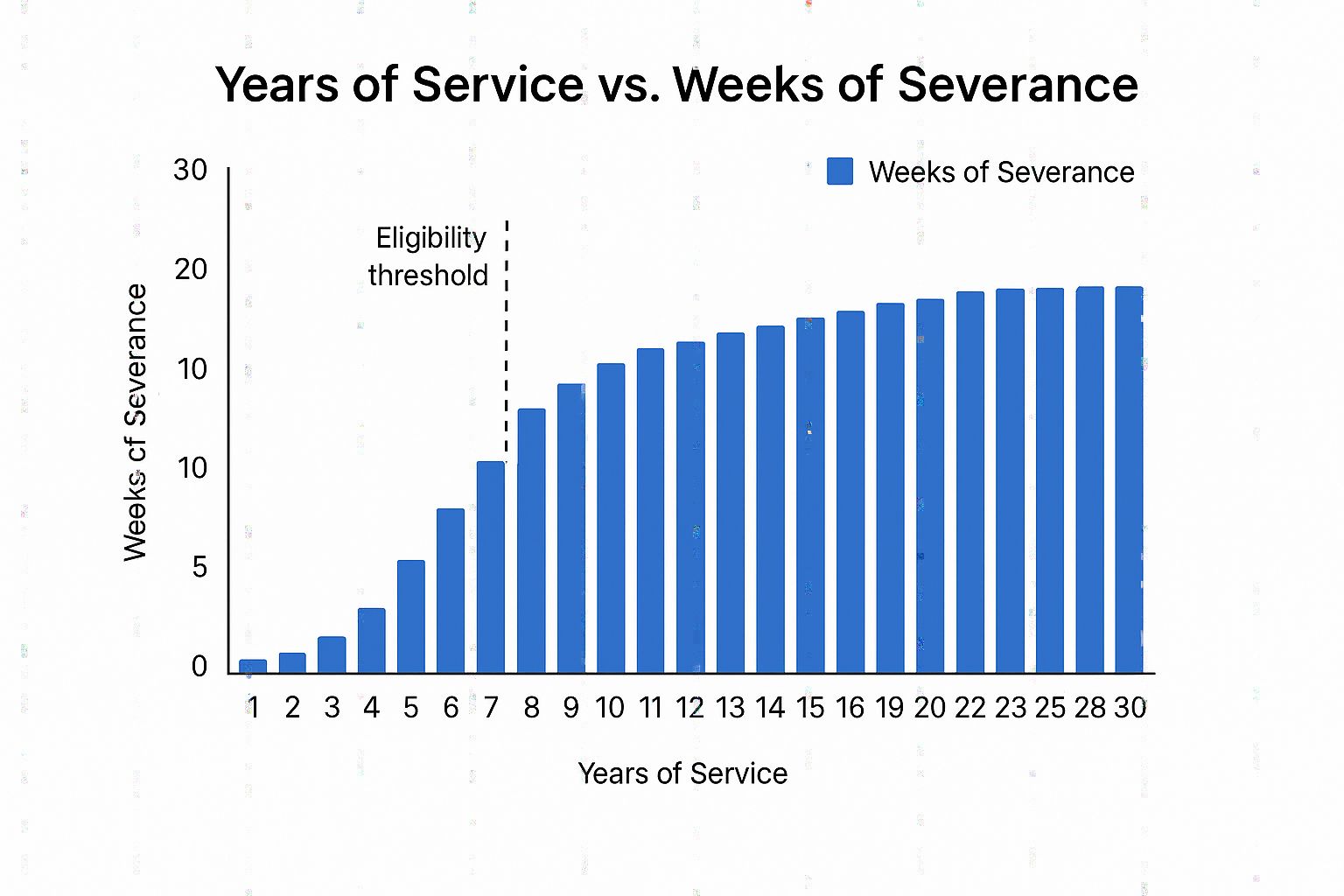

This visual helps show how your minimum entitlement builds up over time, starting from that crucial five-year mark and climbing toward the 26-week maximum.

As you can see, once you’re past the five-year threshold, the amount grows in lockstep with your service, directly reflecting your commitment.

Real-World Calculation Examples

Let’s ground this in reality. Here’s how the formula plays out in a couple of common scenarios I see all the time.

Example 1: Maria, the Marketing Coordinator Maria has been with her company for 7.5 years. Her regular weekly wages, including her salary and consistent bonuses, come out to $1,200.

- For her 7 full years: 7 years × $1,200/week = $8,400

- For her partial year (6 months): 0.5 years × $1,200/week = $600

- Total ESA Severance: $8,400 + $600 = $9,000

So, Maria is legally entitled to a minimum of 7.5 weeks of severance pay.

Example 2: David, the Senior Accountant David is a long-term employee with 15 years at his firm. His regular weekly pay is $2,000.

- Calculation: 15 years × $2,000/week = $30,000

David’s minimum ESA entitlement is 15 weeks of severance pay.

Crucial Takeaway: While a severance pay calculator for Ontario is a great tool for a quick check, never forget that this is just your minimum legal right. Your common law entitlement, which considers factors like your age and role, is often significantly higher.

To give you a quick reference, here’s how the ESA minimums break down based on your years of service.

ESA Severance Pay Entitlement by Years of Service

This table summarizes the minimum severance pay you can expect under the Employment Standards Act once you’ve crossed the five-year eligibility threshold.

| Years of Service | Minimum ESA Severance Pay (in weeks) | Notes |

|---|---|---|

| 5 years | 5 weeks | This is the minimum service length to qualify for ESA severance. |

| 10 years | 10 weeks | Entitlement equals one week per year of service. |

| 15 years | 15 weeks | Continues to scale with each full and partial year worked. |

| 20 years | 20 weeks | The formula remains consistent as you approach the cap. |

| 26 years | 26 weeks | This is the maximum entitlement under the ESA, regardless of tenure. |

| 30+ years | 26 weeks | The entitlement is capped at 26 weeks, even for very long-term employees. |

Remember, this chart only reflects the statutory floor. To truly understand what you might be owed, it helps to see how these minimums stack up against common law entitlements. You can learn more about the Ontario severance pay chart details to get a fuller picture, which is essential knowledge to have before you start any negotiations.

Why Common Law Severance Is What You’re Really After

The number you get from any online severance pay calculator for Ontario is usually just the starting point—the bare minimum required by the Employment Standards Act (ESA). Think of that number as the legal floor, not the ceiling of what you’re likely owed.

Here’s the part many employers hope you don’t know: most non-unionized employees in Ontario are actually entitled to much more compensation under a different set of rules called common law. This is where the unique details of your career and situation really matter.

Looking Beyond the Basic Formula: The Bardal Factors

While the ESA relies on a simple, rigid formula based on how many years you’ve worked, common law is far more nuanced. It’s designed to be more human. Courts in Ontario have long understood that a one-size-fits-all calculation doesn’t reflect the real-world challenge of finding a new job after being let go.

To figure out a fair notice period (or pay instead of notice), the courts use what are known as the “Bardal factors.” These are the four key ingredients that determine your true severance entitlement:

- Your Age: It’s a simple fact that older employees often have a tougher time finding new work. A 55-year-old will almost always be entitled to a longer notice period than a 30-year-old in a similar role.

- Length of Service: Your loyalty matters. The more years you’ve dedicated to a company, the more notice you’re entitled to when that relationship ends.

- The Character of Your Employment: This is all about your role and seniority. Finding a new job as a specialized, high-level manager is typically much harder than finding an entry-level position, so severance packages for senior roles are larger.

- Availability of Similar Employment: The courts also look at the current job market. If you work in a niche field with very few openings, your notice period will likely be extended to reflect that reality.

These factors don’t exist in a vacuum; they’re weighed together to paint a complete picture of your circumstances, moving the conversation far beyond the ESA’s basic math.

How This Plays Out in the Real World

Let’s look at a couple of examples. The difference between the ESA minimum and a common law award can be staggering.

Scenario A: The Junior Professional

- Employee: Alex, a 30-year-old junior graphic designer.

- Tenure: 6 years.

- ESA Minimum: 6 weeks’ pay.

- Common Law Reality: When you factor in Alex’s age and junior role, a common law assessment would likely put his entitlement somewhere in the 4 to 6-month range. The goal is to provide a reasonable cushion to find a similar job.

Scenario B: The Senior Manager

- Employee: Susan, a 55-year-old director of operations.

- Tenure: 15 years.

- ESA Minimum: 15 weeks’ pay.

- Common Law Reality: Susan’s case is completely different. Her age, long service, and senior position mean her job will be much harder to replace. A court would likely award her 12 to 18 months of severance, recognizing the significant challenge she faces.

The Bottom Line: Common law severance isn’t just about a quick payout. It’s about creating a financial bridge that gives you a realistic amount of time to land on your feet in a comparable new role. This is why those Bardal factors are so important.

Ultimately, your goal shouldn’t be just to make sure an employer’s offer meets the ESA minimum. It should be to understand your full entitlement under common law. That shift in thinking can be the difference between a few weeks of pay and a package that offers true financial security for months, or even more than a year.

What to Do When a Severance Offer Hits Your Desk

It’s a tough moment. That severance package is in your hands, and your mind is probably spinning. Amid the stress and uncertainty, the most powerful thing you can do is take a breath and pause. I’ve seen it happen too many times: people feel pressured and sign on the dotted line immediately. That’s the single biggest mistake you can make.

Remember, that document isn’t just about the money. It’s a legally binding contract with clauses that have permanent consequences. Your employer had their lawyers draft it; you owe it to yourself to take the time to understand it completely.

The Golden Rule: Don’t Sign Anything Right Away

Think of that first offer as a starting point. It’s almost always the company’s opening position, often calculated to meet the bare minimum legal standards, not what you might actually be entitled to under common law. When you sign it, you’re not just accepting the money—you’re waiving your right to negotiate for what you truly deserve.

The most powerful part of any severance offer is the release clause. Signing it means you legally agree to give up all rights to sue your former employer for anything related to your job or dismissal. It’s a final, irreversible decision.

Once that release is signed, the conversation is over. There’s no going back. That’s why stepping away to think isn’t just smart; it’s absolutely critical for protecting your financial future.

How to Professionally Ask for More Time

You are well within your rights to ask for time to review the package. It’s a standard, professional request, and any reasonable employer expects it. You don’t need to be confrontational.

A simple, firm statement is all it takes. Let them know you need to review the document and seek advice. A polite email usually works best. Try something like, “Thank you for this. I’ll need some time to review the details properly and will get back to you by [suggest a reasonable date, like the end of next week].” This shows you’re taking it seriously without creating friction.

Keep in mind, you have up to two years from your termination date to pursue a legal claim for severance. Asking for a few days or a week to review is a very small, and very reasonable, request.

Looking Beyond the Main Payout: The Fine Print Matters

When you get down to reviewing the offer—whether on your own or with a lawyer—you need to look past the main dollar figure. The other components of the package can dramatically change its overall value.

Here’s what to watch out for:

- Benefit Continuation: Does the offer keep your health, dental, and life insurance active? A comprehensive package should continue these benefits through the entire notice period or offer you cash in their place.

- Bonus Payouts: If you were on track to receive a bonus, your severance should include a pro-rated amount for the work you put in.

- Pension and RRSP Contributions: The offer should clarify what happens to employer contributions to your retirement savings. You don’t want to lose out on that.

- Career Transition Support: Is the company offering outplacement services like career counselling or resumé help? This is a valuable non-cash benefit that can help you land your next role faster.

Taking a bit of extra time to comb through these details ensures you’re not leaving money or crucial benefits behind. A quick signature could cost you thousands. For a professional review of your specific situation, the team at UL Lawyers Professional Corporation can offer a personalized consultation.

Your Top Questions About Ontario Severance Pay Answered

When you’re handed a severance package, a million questions can race through your mind. It’s a stressful time, and the legal jargon doesn’t help. Let’s cut through the noise and answer some of the most pressing questions people have about severance pay in Ontario, moving beyond what a basic calculator can tell you.

”Do I Have to Accept the First Severance Offer?”

No, you absolutely do not. It’s a common misconception that the first offer is final, but you are never obligated to sign on the dotted line right away.

In my experience, initial offers are often just the bare minimums required by the Employment Standards Act (ESA). They rarely account for your full entitlements under common law, which consider factors like your age, seniority, and role. You have every right to take a step back, review the offer carefully, and seek legal advice. Signing immediately almost always means you’re leaving money on the table.

”Should My Severance Package Cover My Benefits?”

Yes, it certainly should. A fair severance package isn’t just about salary. Under common law, your employer must continue your benefits—think health, dental, and disability insurance—for the entire reasonable notice period.

If for some technical reason they can’t keep you on their plan, they are legally required to pay you the cash equivalent. This is a crucial detail that’s often overlooked in initial offers but can add thousands of dollars to your final package. Don’t let it slide.

”What Happens if I Land a New Job Right Away?”

This is a great question, and the answer really hinges on how your severance is paid out.

- Lump-Sum Payment: If you get your severance in one single payment, it’s yours. Period. It doesn’t matter if you start a new job the very next day.

- Salary Continuance: This is where things get tricky. If your employer pays you every couple of weeks as if you were still an employee, they can often stop those payments once you’re officially on a new payroll.

Because of this, negotiating for a lump-sum payment is often the smarter move. It gives you financial security and peace of mind.

Key Takeaway: How you get paid matters. A lump-sum payment provides certainty, while salary continuance payments could stop the moment you find new work.

”Will I Have to Pay Tax on My Severance Pay in Ontario?”

Yes, severance pay is considered taxable income in the eyes of the CRA. However, it’s often classified as a “retiring allowance,” which can open up some tax-saving strategies. For example, you might be able to roll a portion of it directly into an RRSP to defer the tax hit.

The tax rules can be complicated and depend heavily on your personal financial situation. This is one area where it’s a really good idea to chat with a financial advisor to make sure you’re handling the payout in the most effective way.

At UL Lawyers Professional Corporation, we know that a severance offer can be confusing and intimidating. We’re here to bring clarity and expert advocacy to your situation, ensuring you get the fair outcome you deserve. For a personalized consultation, get in touch with our team at https://ullaw.ca.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies