Short Term Disability in Ontario Explained

When a sudden illness or injury keeps you from working, the last thing you want to worry about is how you’re going to pay your bills. That’s where short term disability in Ontario comes in. It’s a critical financial support system that replaces a portion of your income when you’re temporarily unable to work.

Think of it as a bridge. It’s designed to cover your immediate financial needs for a limited time—usually up to six months—helping you get from the point of injury or illness back to your job without a financial crisis.

Understanding Your Financial Safety Net

It is helpful to think of short term disability (STD) benefits as paycheque insurance. When a health issue unexpectedly takes you out of the workforce, this insurance kicks in. It replaces a percentage of your lost income, making sure you can still cover your mortgage, groceries, and other essentials while you focus on recovery.

It’s a vital safety net that keeps a temporary health problem from spiralling into a major financial disaster.

In Ontario, this support generally flows from two main sources. Knowing where your coverage comes from is the first step in understanding your rights and what to expect.

Sources of STD Coverage

Most of the time, short term disability coverage is part of a group benefits plan offered by your employer. These are private insurance plans, and the specifics—like how much you get paid and for how long—are all laid out in your policy documents.

But what if your job doesn’t offer a private plan? Don’t worry, you’re not necessarily out of luck. You might be eligible for the federal government’s Employment Insurance (EI) Sickness Benefits. This is a public program that provides temporary financial help to eligible Canadians who can’t work for medical reasons.

The key takeaway is that your immediate financial support will likely come from either your workplace benefits package or a federal program. Both are designed to provide stability during a difficult time.

To give you a clearer picture, let’s break down the essential components. The table below offers a quick, high-level summary of what you can generally expect from short term disability in Ontario.

Short Term Disability in Ontario at a Glance

This table provides a high-level summary of the essential components of Short Term Disability benefits in Ontario.

| Benefit Aspect | Typical Coverage Details |

|---|---|

| Purpose | To provide income replacement for a temporary period due to non-work-related illness or injury. |

| Duration of Benefits | Usually covers a period ranging from a few weeks up to a maximum of six months. |

| Benefit Amount | Typically pays 50% to 85% of your regular pre-disability earnings. |

| Main Providers | Primarily offered through employer-sponsored group insurance plans or federal EI Sickness Benefits. |

This overview sets the stage for a deeper dive into how these benefits work, who qualifies, and how to navigate the application process.

How Your STD Coverage Actually Works

Trying to understand your short-term disability (STD) coverage can feel a bit like learning the rules of a new board game. But once you know how the pieces move—how your benefits are calculated, how long they last, and when they kick in—you can navigate the whole process with a lot more confidence.

In Ontario, most STD benefits come from group insurance plans sponsored by employers. Your insurance policy is the official rulebook for that game. It’s packed with key terms that define everything, so getting familiar with them is your first and most important step. Let’s break down two of the biggest ones: the elimination period and the benefit period.

The Waiting Game: The Elimination Period

Before any money starts flowing, you’ll almost always have to go through an elimination period. Think of it as a mandatory waiting period that starts the day you become disabled and ends the day your benefits can officially begin.

It’s a lot like the deductible on your car insurance; it’s a portion of time you have to cover on your own, usually by using up your sick days. For most short-term disability plans in Ontario, this waiting time is typically around one to two weeks, but you’ll need to check your specific group benefits plan to know for sure.

How Long Do Benefits Last?

Once you’ve cleared the elimination period, your benefit payments will start. The length of time you can receive these payments is called the benefit period. Most STD plans will pay out for a set number of weeks, often capping out at six months (or 26 weeks).

If your disability continues past that point, the next step would usually be to transition onto a long-term disability (LTD) plan, provided you have one.

It’s crucial to remember that your STD plan is a temporary bridge. It’s designed to provide immediate income replacement for a defined period, not indefinitely. Knowing your benefit period helps you and your healthcare provider plan for what comes next in your recovery.

Calculating Your Benefit Amount

So, the big question: how much can you actually expect to receive? Your benefit is almost always calculated as a percentage of your regular, pre-disability earnings. While the exact number depends on your policy, most plans in Ontario will pay somewhere between 60% and 85% of your gross weekly income.

In Ontario, private employer plans are often compared to the federal government’s Employment Insurance (EI) Sickness Benefits, which sets a kind of benchmark. How STD plans are structured is influenced by both these government standards and what an employer chooses to offer. For example, when EI periodically increases its maximum payout to keep up with wage changes, it sets a new standard for private plans to aim for.

This is exactly why it’s so important to check your coverage details early on—it helps you avoid any surprises or delays when you need that income replacement the most. You can learn more about these complexities by reading this detailed STD guide from a Canadian law firm that dives deeper into how it all works for Ontario workers.

Who Qualifies for STD Benefits in Ontario?

Figuring out if you qualify for short-term disability in Ontario can feel a bit daunting, but it’s more straightforward than you might think. It’s not some secret code. Really, it just comes down to a checklist of requirements set by your employer’s insurance provider.

The first thing they’ll look at is your job status. Most policies require you to be an actively employed, full-time employee when your disability starts. If you’re a part-time or contract worker, you might not be covered, so digging into your specific benefits package is essential.

Many plans also have a waiting period before you’re even eligible to make a claim. This usually means you need to have been with the company for a certain amount of time, often around three months. It’s the insurer’s way of making sure the coverage is for established employees.

The Cornerstones of Eligibility

Once you’ve cleared the basic employment hurdles, a successful claim really rests on a few key pillars. Insurers are looking for solid, consistent proof that you genuinely can’t do your job. Getting this right is non-negotiable.

The absolute most critical piece is providing sufficient medical proof. We’re not talking about a simple doctor’s note here. Your insurer will need:

- A Formal Diagnosis: A recognized medical condition, properly diagnosed by a qualified healthcare professional.

- Objective Medical Evidence: This is the hard data—things like X-rays, lab results, specialist reports, or other clinical findings that back up the diagnosis.

- Confirmation of Inability to Work: Your doctor must explicitly state that your medical condition prevents you from performing the key duties of your specific job.

The insurer needs to see a clear, undeniable line connecting your diagnosis to your inability to work. Without that medical certification, a denial is almost guaranteed.

Your insurance policy is a contract. To qualify for benefits, you must prove that you meet the definition of “total disability” as outlined in that specific contract. This definition is the ultimate test your situation will be measured against.

Common Reasons for Ineligibility

Knowing why a claim gets denied is just as important as knowing how to qualify. One of the biggest roadblocks is the pre-existing condition clause. If your disability is linked to an illness you were treated for just before your coverage kicked in, the insurer may use this exclusion to deny your claim.

Other common reasons for denial include self-inflicted injuries, a disability that results from committing a crime, or failing to be under the regular care of a doctor.

It’s also good to know that in Ontario, employer-provided plans generally have to meet a certain standard. They must provide benefits at least as good as the federal EI Sickness Benefits, which means covering a minimum of 55% of your weekly earnings up to a set maximum. This provides a crucial safety net for eligible workers. To get a more detailed breakdown, a helpful 2025 guide from an Ontario law firm can shed more light on the specifics.

Your Step-by-Step Application Guide

Applying for short-term disability benefits in Ontario can feel like you’re staring at a mountain of paperwork. But if you break it down, it’s really just a series of straightforward steps. Let’s walk through it together.

The absolute first move you need to make is telling your employer you can’t work because of a medical issue. This simple conversation is the starting gun for the whole process. Your HR department will then give you the claim forms from your company’s insurance provider.

Nailing the Paperwork

That application package you receive is usually a three-part affair: a section for you, one for your employer, and another for your doctor.

Your part is all about personal details, your job specifics, and an honest account of your illness or injury. Be as clear and thorough as you can.

Your employer handles their section by confirming your role, salary, and employment dates. But the real linchpin of your application is the statement from your physician.

Your doctor’s report is critical. It needs to be a detailed, objective medical statement that spells out your diagnosis, clearly explains why you can’t perform your job duties, and provides an estimated recovery timeline. Claims often get delayed or denied because this medical information is too vague.

Don’t Miss the Deadlines

When it comes to insurance, deadlines are everything. Your policy will have a strict timeframe for submitting your completed application. Missing that deadline could mean losing out on your benefits entirely, so keep a close eye on the calendar.

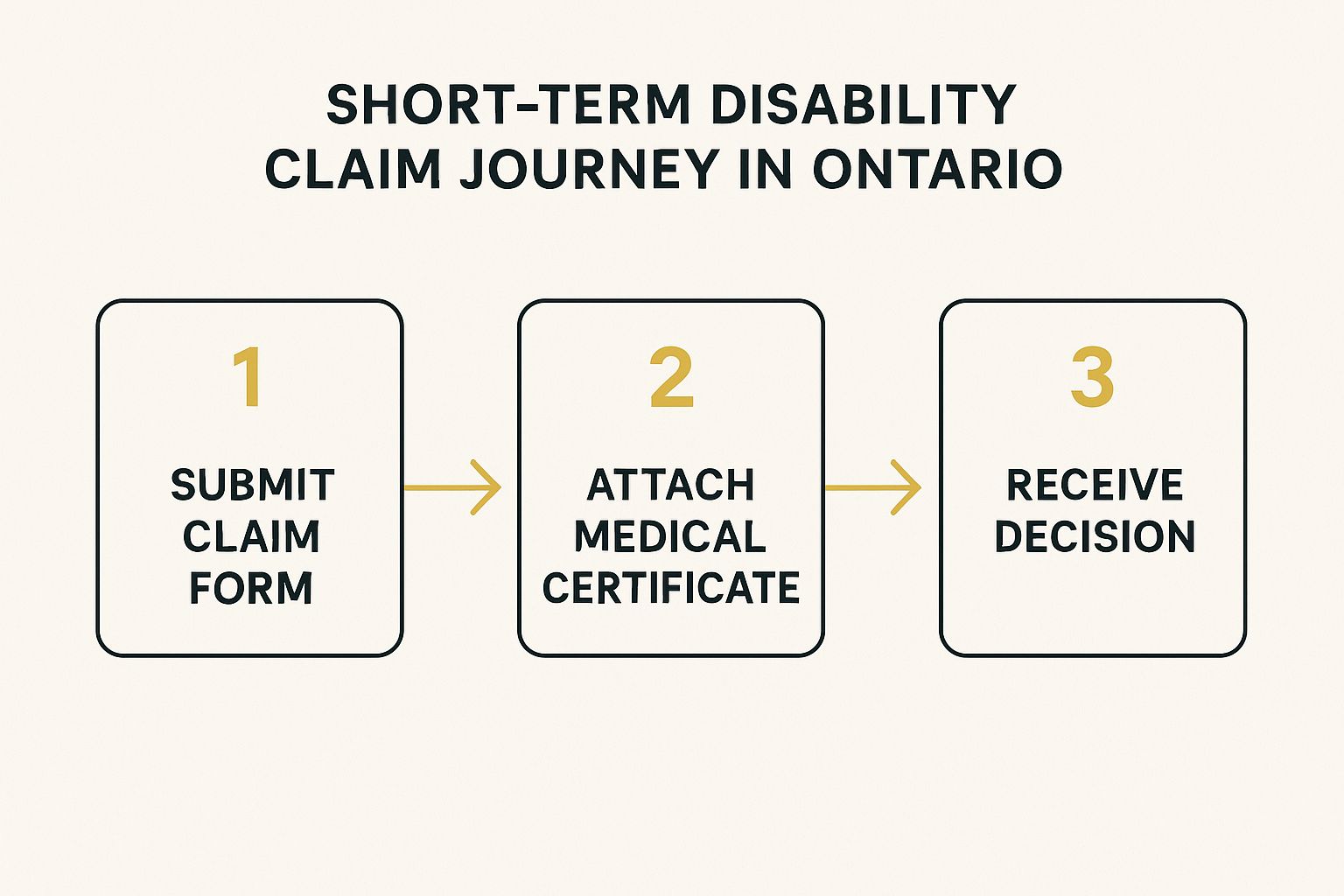

To make it even clearer, here’s a look at the basic flow of the claims process.

As you can see, it comes down to a few key actions: get the forms in, make sure your medical proof is solid, and then wait for the insurer’s decision.

Once you’ve sent everything in, the insurance company’s work begins. An adjudicator—the person who reviews your claim—will go over your entire file. They’ll look at your job duties, your doctor’s notes, and all the medical records to decide if your situation fits the policy’s definition of disability. This can take a few weeks, so try to be patient while they assess your short-term disability in Ontario claim.

What to Do If Your Claim Is Denied

It’s a gut-punch, no question. You’ve been dealing with a health issue, you’ve done the paperwork, and then the letter arrives: your short-term disability claim has been denied. It’s easy to feel defeated, but this is rarely the end of the road.

Think of a denial not as a final “no,” but as the insurance company saying, “we need more information.” You absolutely have the right to challenge their decision, and often, it’s a matter of clearing up a misunderstanding or providing stronger evidence.

So, Why Was My Claim Denied?

The first thing you need to do is grab that denial letter and read it carefully. The insurer is required to tell you exactly why they rejected your claim. Most of the time, it boils down to a few common reasons, and they’re not always about whether you’re actually sick or injured.

- Not Enough Medical Proof: Sometimes, your doctor’s notes are too general. The insurer is looking for specific, objective medical evidence (like test results or specialist reports) that clearly explains why you can’t perform your job duties.

- You Missed a Deadline: Insurance policies are strict. If you submitted your application or other required documents late, it can trigger an automatic denial.

- Simple Paperwork Mistakes: It happens. A missing signature, an incomplete form, or a simple administrative error can be enough for the insurer to reject the claim.

- The Fine Print (Policy Exclusions): The insurer might argue your situation isn’t covered. This could be due to a pre-existing condition clause or another specific exclusion detailed in your policy document.

Figuring out the exact reason is your key to planning a successful appeal.

A denied claim isn’t a personal judgment on your health. It’s an administrative hurdle. Your job now is to give the insurance company the specific proof they need to check off all the boxes required by your policy’s definition of disability.

The Appeal: Your Next Move and When to Call for Backup

With the denial letter in hand, you can officially start the appeal process. This usually begins with writing back to the insurer. You’ll need to directly address their reasons for the denial and, most importantly, provide new and better evidence to back up your claim.

This is where you might need to go back to your doctor or specialist. Getting more detailed medical reports, new test results, or a formal opinion from a specialist can make all the difference.

But let’s be realistic—navigating an insurer’s internal appeal process can feel like you’re running in circles. If they deny your appeal, or if their reasoning just doesn’t add up, it’s probably time to get some professional help. A Canadian disability lawyer can look at your file with a fresh set of eyes, spot the weaknesses in the insurer’s case, and guide you on what to do next. Sometimes, that means taking legal action to get the benefits you’re entitled to.

Understanding Your Rights and Next Steps

Short-term disability is your crucial first line of defence, but it’s important to see it as just one piece of a much larger support network here in Ontario. Think of it as the immediate response team. It’s built to give you a financial bridge for a specific amount of time, but what happens if your recovery stretches out longer than just a few months?

Knowing where STD fits into the bigger picture is the key to planning your next move. For many people, it’s the initial safety net that comes before transitioning to Long-Term Disability (LTD) benefits, especially if their condition lasts beyond the usual six-month STD window. This transition is a common and expected path for those dealing with more serious or prolonged health challenges.

The Broader Social Safety Net

Beyond the insurance you might have through work or a private plan, Ontario has provincial programs designed to help residents who are facing significant hardship. These programs are a vital part of our social safety net, particularly for people whose disabilities keep them from returning to work or who don’t have extensive private coverage.

The two main provincial programs you should know about are:

- Ontario Disability Support Program (ODSP): This is for residents who have a substantial and prolonged disability and are also in financial need. ODSP provides help with both income and finding employment.

- Ontario Works (OW): This program gives temporary financial and employment help to people who find themselves in immediate financial need.

These government programs fill a different role than private disability insurance, but they are essential parts of the overall support system in Ontario. They make sure that even if your insurance benefits end, there are other places to turn for help.

Understanding this entire ecosystem is empowering. The sheer number of people accessing social assistance in Ontario really drives home how important these programs are. While it operates differently from insurance, ODSP provides a critical backstop for individuals facing long-term financial struggles because of a disability. Meanwhile, OW helps with more general, temporary financial distress.

Caseload numbers really highlight the need for accessible short-term disability coverage to act as a buffer before someone might have to turn to these longer-term government supports. You can get a clearer picture of the scope of these programs by reviewing the government’s official data on Ontario’s social assistance caseload statistics.

Your Top Questions About STD in Ontario, Answered

When you’re dealing with a health issue, the last thing you need is more uncertainty. Questions about your job, your finances, and what the future holds can be incredibly stressful. Let’s clear up some of the most common concerns people have about short-term disability in Ontario.

Can My Employer Fire Me While I’m on Disability Leave?

This is often the biggest worry, and for good reason. But you can breathe a little easier here. Your employer cannot fire you just because you need to take a medically-approved disability leave.

Your job is protected under Ontario’s Human Rights Code, which makes it illegal to discriminate against someone because of a disability. Firing you while on a legitimate leave would be a serious violation of your rights. In fact, your employer has a legal “duty to accommodate” your needs, up to the point of undue hardship.

Are My Short-Term Disability Benefits Taxable?

This is another common question, and the answer is: it depends on who pays the insurance premiums. It’s not a simple yes or no.

Here’s how it breaks down:

- Your employer pays 100% of the premiums: In this case, yes, the benefits you receive are considered taxable income.

- You pay 100% of the premiums: If the full cost is deducted from your paycheque, your benefits are completely tax-free.

- You and your employer split the cost: The portion of the benefits that your employer paid for is taxable.

What Happens When My Short-Term Disability Runs Out?

It’s important to remember that STD is designed to be a temporary financial bridge, usually for up to six months. So, what’s next if you’re still unable to work?

If your medical condition continues to prevent you from returning to work, the next logical step is to transition to long-term disability (LTD) benefits.

Most group insurance plans are set up for this exact scenario. The transition from STD to LTD is designed to provide continuous financial support when a disability becomes more prolonged. You’ll need to start a new application process for LTD, so it’s wise to get the ball rolling well before your STD benefits are scheduled to end.

At UL Lawyers Professional Corporation, we know how tough it can be to fight for your disability benefits while trying to focus on your health. If your claim has been denied or you’re just not sure what to do next, our experienced team is ready to step in. For a free, no-obligation consultation, you can find us at https://ullaw.ca.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies