What Qualifies for Long-Term Disability in Ontario? Find Out Now

When you’re trying to figure out what qualifies for long-term disability in Ontario, it’s easy to get fixated on your medical diagnosis. But here’s the thing: insurance companies are less concerned with the name of your condition and far more interested in how it actually stops you from working.

The entire process hinges on one critical concept: proving your condition meets your specific policy’s definition of “total disability.” It’s not about having a certain illness; it’s about demonstrating the functional impact that illness has on your ability to do your job.

Understanding Disability: The Two Key Definitions

Applying for long-term disability (LTD) isn’t as simple as handing in a doctor’s note. The insurance company evaluates your claim based on one of two very different definitions of disability. Crucially, which definition they use can change over time.

Think of it as two different qualifying rounds. For the first round, you need to prove you can’t perform your current job. But for the second round, the criteria get much tougher—you have to prove you can’t perform any job you’re reasonably suited for. This shift is one of the most common reasons a claim that was initially approved gets denied down the road.

The First Hurdle: Your “Own Occupation”

For the first 24 months of a claim, most Ontario LTD policies use what’s called the “own occupation” definition. This is the more lenient of the two tests.

Essentially, you need to provide medical evidence showing that your illness or injury prevents you from performing the essential duties of the specific job you held before you had to stop working. If you’re a dental hygienist who develops a hand tremor, making it impossible to handle your tools safely, you’d likely qualify under this definition. The focus is entirely on the tasks and responsibilities of your job.

The Second Challenge: The “Any Occupation” Test

After 24 months, the game changes. The definition of disability almost always switches to the much stricter “any occupation” standard.

Now, the burden of proof is higher. You must demonstrate that your condition is so severe it prevents you from working in any occupation for which you have the right education, training, or experience. It’s no longer about whether you can go back to your old job; it’s about whether you could work in any reasonable capacity.

This table breaks down the two definitions side-by-side.

Own Occupation vs Any Occupation Definitions

| Definition Type | What It Means | Typical Timeframe |

|---|---|---|

| Own Occupation | You are unable to perform the essential duties of your specific job. | First 24 months of disability. |

| Any Occupation | You are unable to perform any job for which you are reasonably suited by education, training, or experience. | After the initial 24-month period. |

Grasping the difference between these two definitions is absolutely essential. It explains why an insurer might pay your benefits for two years and then suddenly cut you off, even if your medical condition hasn’t improved.

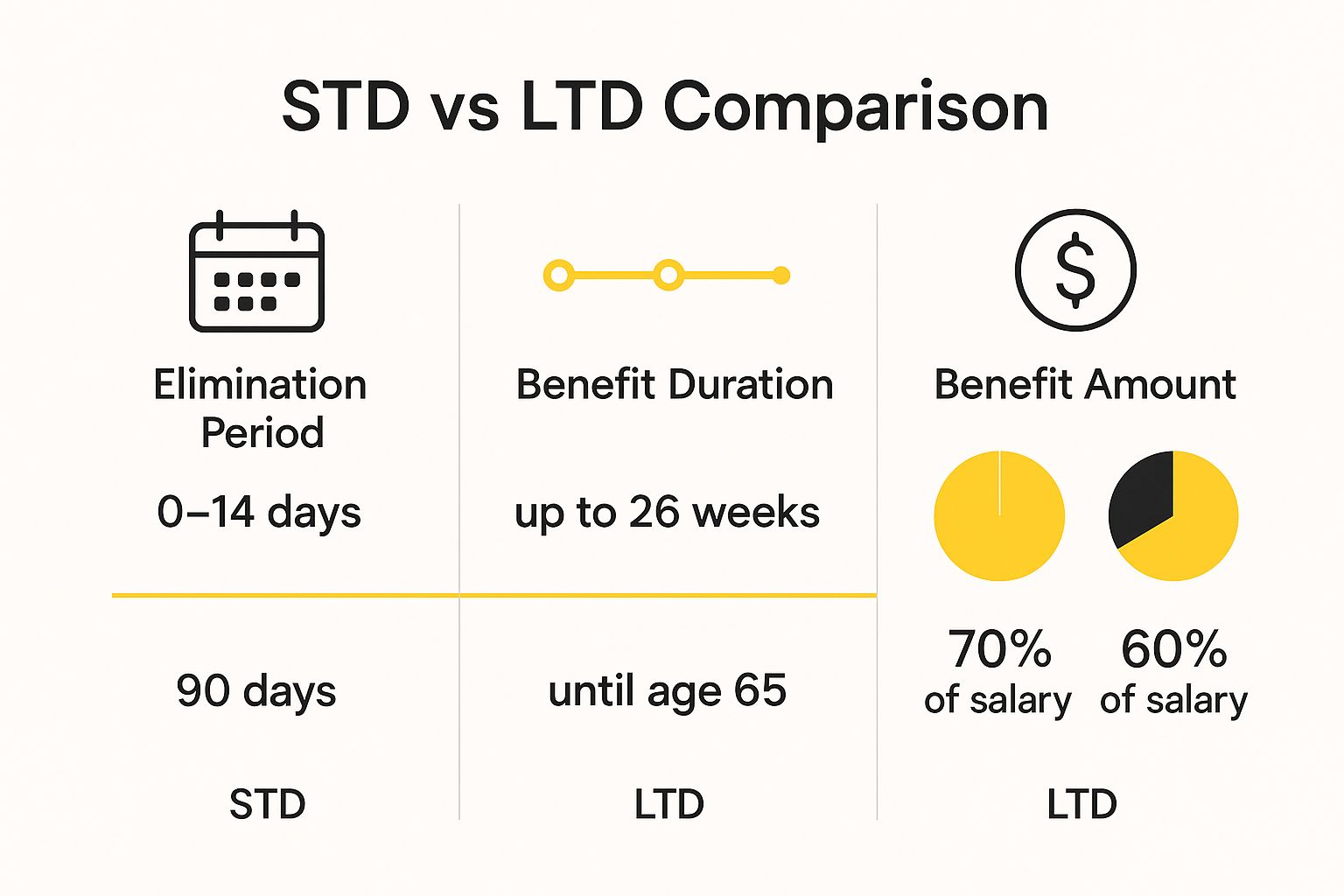

This distinction is a core part of the journey from a short-term issue to a long-term claim. For a deeper dive into that initial phase, our guide on Short-Term Disability in Ontario Explained can provide more context.

It’s also important to know that both physical and mental health conditions are treated equally under these policies. In fact, roughly 30% of all LTD claims in Canada are related to mental health conditions like severe depression, PTSD, or anxiety disorders that prevent someone from functioning at work.

Understanding these definitions is the first, and most important, step in building a strong and successful claim.

Common Medical Conditions That Qualify for LTD Benefits

While technically any medical condition could lead to a successful long-term disability (LTD) claim in Ontario, some conditions pop up far more often than others. The critical thing to understand is that a diagnosis by itself isn’t a golden ticket.

The insurance company’s main concern isn’t what you have, but what you can’t do because of it. We call these functional limitations, and they are the absolute cornerstone of your claim. You must draw a clear, undeniable line from your medical condition to your inability to perform the key duties of your job.

Think of it this way: your diagnosis is the “what,” but your functional limitations are the “so what?” An insurer needs to understand why your fibromyalgia or your back injury actually stops you from working. That’s the story your application needs to tell.

Physical Ailments and Their Impact

Many successful LTD claims are built on physical conditions that make the daily grind of a job simply impossible. These illnesses and injuries often have very clear, observable effects on a person’s ability to function.

Here are a few common examples:

- Musculoskeletal Injuries: Things like chronic back pain from herniated discs or severe arthritis can make it impossible for an office worker to sit for hours or for a warehouse employee to lift boxes.

- Chronic Pain Disorders: Conditions like fibromyalgia are notorious for causing widespread, debilitating pain. This isn’t just an ache; it’s a level of pain that can shatter concentration and make any physical effort feel monumental.

- Serious Illnesses: A cancer diagnosis is a clear example. The illness itself is one thing, but the treatments—chemotherapy, radiation—bring on a wave of extreme fatigue, nausea, and “chemo brain” that makes work completely unmanageable.

- Cardiovascular Conditions: After something as serious as a heart attack or stroke, a person’s ability to handle stress or perform physically demanding tasks can be permanently reduced.

With any of these, the secret to a strong claim is documenting how the symptoms directly interfere with the specific tasks your job requires.

The Rise of Mental Health Claims

Over the last decade, there has been a major shift. Insurance providers across Ontario are seeing a huge increase in LTD claims for mental health conditions. These claims are every bit as legitimate as those for physical injuries, but they often demand more detailed evidence to prove their disabling impact.

Mental health is not an “invisible illness” in a disability claim. Its effects—like a crushing inability to focus, memory problems, or severe anxiety—are real, measurable, and can absolutely prevent you from working. Your doctor’s job is to paint a clear picture of these functional impairments in your medical file.

Take a project manager struggling with severe anxiety. They might find it impossible to lead team meetings or manage the stress of deadlines. Or consider someone with PTSD who experiences flashbacks triggered by a normal, bustling office environment.

Depression is another condition that frequently grounds a successful claim, as its symptoms can strike at the very core of job performance. To see how this works in practice, you can read our detailed guide on whether depression qualifies as a disability in Ontario.

At the end of the day, proving what qualifies for long-term disability in Ontario always comes back to the evidence. Whether your condition is physical or psychological, a successful claim hinges on consistent medical records that translate your diagnosis into a compelling story of why you simply cannot work.

Building a Strong Case with Medical Evidence

When it comes to qualifying for long-term disability in Ontario, simply telling your insurance company you’re unable to work isn’t enough. You have to show them, and the most powerful way to do that is with a mountain of irrefutable proof. Your medical file is, without a doubt, the most critical part of your claim. It needs to be thorough, consistent, and paint a clear picture of your reality.

Think of your claim like a court case. Your medical records are the evidence you present to the judge and jury—in this situation, the insurance adjuster. A few scattered doctor’s appointments with brief notes just won’t cut it. What you need is a detailed paper trail that meticulously documents your entire health journey, from the first diagnosis right through to the point where working became impossible.

Your Doctor as Your Key Witness

Your family doctor and any specialists you’re seeing are the star witnesses in your case. The very foundation of your application rests on their clinical notes, detailed reports, and professional opinions. That’s why keeping up with regular, consistent appointments is absolutely non-negotiable.

If an insurer sees large gaps between your doctor’s visits or a history of missed appointments, they’ll raise a red flag. They might take it as a sign that your condition isn’t as serious as you claim, which can seriously undermine your credibility. Keeping a steady schedule of medical care is one of the best things you can do for your claim.

Your job is to make sure your doctor’s file tells the whole story. Be open and specific in every single appointment about how your symptoms are impacting your daily life and your ability to do your job.

Beyond Doctor’s Notes: Objective Evidence

While your doctor’s notes are essential, it’s the objective medical evidence that provides the cold, hard facts that can make a claim undeniable. This is the kind of proof that’s based on standardized tests and diagnostics, not just your own description of symptoms, making it much harder for an insurer to question.

Here are some examples of powerful objective evidence:

- Imaging Scans: An MRI clearly showing a herniated disc or an X-ray revealing advanced arthritis provides concrete, visual proof of a physical impairment.

- Blood Work: Lab results are crucial for confirming diagnoses for conditions like lupus, rheumatoid arthritis, or other autoimmune disorders.

- Neuropsychological Assessments: If you’re dealing with cognitive issues like “brain fog” from a traumatic brain injury or fibromyalgia, these formal tests provide measurable data on your memory, focus, and processing speed.

- Functional Capacity Evaluations (FCEs): These are practical tests that directly measure your physical ability to handle work-related tasks, like how long you can sit, stand, or how much you can safely lift.

Here’s a good way to think about it: telling your doctor about your back pain is your story. The MRI scan showing the ruptured disc is the irrefutable illustration that backs it all up. An adjuster can doubt how you feel, but they can’t easily argue with a diagnostic image.

This powerful mix of your subjective reports and objective test results creates the comprehensive picture your insurer needs to see. While you’re gathering this evidence, it’s also smart to explore all the support systems available. For example, many people apply for federal benefits alongside their private insurance claim, and you can learn more about that in our guide on how to apply for CPP Disability benefits.

Ultimately, your medical file needs to tell a complete and consistent story. It must clearly show a diagnosis, document your ongoing symptoms and treatments, and, most importantly, end with a clear medical opinion explaining your specific limitations. A well-organized, thoroughly documented file turns your application from a simple request into a compelling, evidence-backed case that is very difficult to deny.

How a Successful Claim Navigates the Application Process

Navigating the long-term disability (LTD) application process in Ontario can feel like trying to solve a puzzle with half the pieces missing. It’s a world of forms, strict deadlines, and a mountain of paperwork. One small mistake can lead to a frustrating delay or an outright denial, but knowing how the system works can make all the difference.

The journey starts the moment you ask your employer or the insurance company for an application package. Inside, you’ll find three crucial forms. Your main job is to make sure all three of them tell one clear, consistent story about why you can’t work.

Think of these forms as three legs of a stool. If one is shaky or doesn’t match the others, the whole thing becomes unstable.

The Three Pillars of Your Application

Getting your application approved is a team effort involving you, your employer, and your doctor. Each of you provides a piece of the puzzle, and together, they should create a complete picture for the insurance adjuster reviewing your case.

- The Employee Statement: This is your part of the story. You’ll need to describe your job, explain your medical condition, and connect the dots for the insurer by detailing how your symptoms stop you from doing your work. Be honest, but be specific.

- The Employer Statement: Your employer fills this part out. They’ll confirm your job title, duties, salary, and your last day of work. It’s really important that their description of your job matches what you’ve put in your statement.

- The Attending Physician’s Statement (APS): This is often the most critical document in the whole package. Your doctor provides the medical evidence—the diagnosis, treatments, and their expert opinion on your specific limitations and restrictions.

Consistency is everything. If you say chronic back pain prevents you from sitting for more than 20 minutes, your doctor’s report needs to back that up. Any contradictions, even small ones, can raise red flags and give the insurance company an excuse to deny your claim.

Managing Deadlines and Communication

Deadlines in the world of insurance are not suggestions; they’re firm rules. Your policy will have strict time limits for submitting your claim after you stop working. Missing a deadline is one of the quickest ways to get your claim denied before it’s even reviewed.

Once you submit your application, a case manager or adjuster will take over your file. This is your main contact. It’s smart to keep all communication professional and timely, and always keep your own written record of every phone call and email.

Even when you do everything right, denials can still happen. It’s a tough reality of the system. Don’t let it discourage you, because there is always an appeal process. If your claim is rejected, understanding what to do next is your most important task. You can learn more in our guide on what to do when your long-term disability claim is denied.

By approaching the application process methodically—with a sharp focus on consistency, deadlines, and clear communication—you can build a strong case and give yourself the best possible shot at receiving the benefits you need.

Why Securing LTD Benefits Is So Important in Ontario

Let’s be honest: when a serious health issue forces you to stop working, it’s not just about the medical diagnosis. It’s about protecting your entire life—your home, your family, and your future. The process of applying for long-term disability can feel overwhelming and lonely, but it’s a path many Ontarians have to walk. Understanding just how much is at stake is the first step toward building a strong, successful claim.

When your paycheques stop, the financial pressure mounts almost immediately. LTD benefits are there to act as a crucial financial bridge, replacing a significant portion of your income so you can keep up with the mortgage, pay your bills, and take care of your family. Without that safety net, managing a serious health condition could quickly turn into a devastating financial crisis.

The Long-Term Impact on Your Career

Beyond the immediate financial crunch, a long absence can have a ripple effect on your career. It’s a tough reality that the longer you’re away from your job, the harder it can be to get back in the game, even after you’ve recovered. This isn’t just a feeling; it’s a pattern we see time and again in the Canadian workforce.

The numbers really put this into perspective. At any given time, between 8% and 12% of Canadian workers are on leave because of an injury or illness. The most startling statistic? After just one year away from work due to a disability, only about 20% of those individuals ever manage to return to their jobs. It’s a staggering figure that highlights just how difficult it can be to restart a career. For more details on this, the Canadian Society of Professional Disability Management provides some excellent insights.

This is precisely why getting your LTD claim approved is so critical. It’s not just about the money; it’s about giving yourself the time and space to heal without the crushing weight of financial stress.

You Are Not Alone in This Struggle

Trying to figure out what qualifies for long-term disability in Ontario can feel like you’re fighting a battle all by yourself. But the truth is, you are far from alone. Every year, thousands of people across the province are in the exact same boat, filing claims and dealing with the same hurdles from insurance companies.

Securing your LTD benefits isn’t just about getting by; it’s about protecting your financial foundation and preserving your ability to recover. A successful claim gives you the breathing room to focus on what truly matters—your health and well-being.

Your situation is real, and your need for support is valid. Knowing that so many others face this challenge reinforces why every single medical report, every doctor’s note, and every form you fill out is a vital piece of the puzzle. A carefully prepared application is your best and most powerful tool in this fight.

Answering Your Top Questions About LTD in Ontario

Even when you think you have a handle on the process, specific questions always seem to pop up. Let’s tackle some of the most common concerns we hear from people across Ontario trying to make sense of their long-term disability claims.

Can I Get LTD for a Pre-existing Condition?

This is a big one, and the short answer is: yes, but with a catch. It all comes down to the fine print in your policy.

Most group plans include a pre-existing condition clause. This clause can prevent you from getting benefits if your disability is caused by an illness you were treated for right before your coverage started. This restriction usually only lasts for a set period, often the first year you’re on the plan. Once you’re past that window, the exclusion typically vanishes.

Can I Work Part-Time While on LTD?

It’s often possible, and sometimes even encouraged. Many policies include provisions for partial or residual disability benefits, which allow you to work at a reduced level—maybe fewer hours or in a less demanding role—and still receive a top-up from your benefits.

Think of it as a bridge back to the workforce. Insurers often see this as a positive step in a gradual return-to-work plan. The most important thing is to get written approval from your insurance company before you start any kind of work. Jumping the gun could put your entire benefit at risk.

What Is the Difference Between LTD and CPP Disability?

They might sound similar, but they are two completely different systems.

- Private LTD is an insurance benefit you get through a policy, usually from your employer. Your eligibility is based on the specific definition of “disability” written into that contract.

- Canada Pension Plan (CPP) Disability is a federal government program. It has its own, very strict definition of what qualifies as a “severe and prolonged” disability.

You can, and in most cases should, apply for both. Just be aware that nearly every LTD policy has an “offset” clause. This means your private insurer will reduce your LTD payment by the amount you receive from CPP Disability.

What if My Initial LTD Claim is Denied?

First, don’t panic. A denial is a roadblock, not the end of the road. You have the right to fight back.

The process usually starts with an internal appeal directly with the insurance company. If they still say no, your next step is to take legal action. The reality is that many initial denials get overturned once a strong case is built with solid medical evidence and the right legal strategy.

It is essential to act quickly if your claim is denied. Strict deadlines apply for appealing a decision, so seeking advice immediately is the best way to protect your rights and challenge the insurer’s ruling effectively.

For instance, a denial might happen if your disability came from an injury that wasn’t work-related. If you were injured in a collision, you might have other options for financial support. To learn more, check out our guide on motor vehicle accident compensation.

At UL Lawyers, we understand how overwhelming this process can be. If you’re facing a denied claim or need help starting your application in Burlington, the GTA, or anywhere in Ontario, contact us for a free consultation. Visit us at https://ullaw.ca to get the support you deserve.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies