What to Do After a Car Accident in Ontario: A Practical Guide

The seconds after a car accident are a blur of adrenaline and shock. The screech of tires and the force of impact leave most people disoriented. It’s completely normal to feel overwhelmed, but what you do in these first few minutes is absolutely critical—both for your immediate safety and for any insurance or legal matters that follow.

Knowing the right steps can make a world of difference. Your top priority, above all else, is safety. Before you do anything, take a moment to breathe and get your bearings.

Your First Moves at the Scene of the Accident

Assess for Injuries and Ensure Safety

First, check yourself for injuries. Adrenaline can easily mask pain, so do a quick mental and physical scan. Then, if you’re able, check on your passengers and the people in the other vehicle.

If anyone seems seriously hurt, do not move them. Moving someone with a potential neck or spinal injury could cause permanent damage. Your role here is simply to assess the situation, not to provide medical treatment.

Call 911 immediately if:

- Anyone is unconscious, complaining of significant pain, or has obvious injuries.

- You suspect another driver might be impaired by alcohol or drugs.

- The vehicles have sustained major damage, blocking traffic or leaking fluids.

Even if an injury seems minor at first, getting paramedics on the scene is always the safest bet. It also ensures an official police record of the incident is created, which is vital.

Secure the Scene to Prevent Further Harm

An accident scene is a dangerous place, especially on a major Greater Toronto Area (GTA) route like the 401 or the QEW. The last thing you want is a second collision. You need to make your vehicle and the surrounding area as visible as possible.

Flip on your hazard lights right away. If you have reflective triangles or flares in your emergency kit, carefully place them on the road to warn oncoming drivers.

Crucial Tip: Only move your vehicle if the accident is minor and you can pull it safely to the shoulder. If there are serious injuries, or the cars can’t be driven, leave them where they are. Wait for emergency crews to arrive and secure the scene properly.

The following checklist is designed to help you remember these critical on-scene priorities in a high-stress moment.

On-Scene Accident Checklist

| Priority Action | Why It Is Important in Ontario |

|---|---|

| Check for Injuries | Your health and the health of others is the absolute first priority. Adrenaline can mask pain. |

| Call 911 | Creates an official record and gets immediate medical and police assistance to the scene. |

| Secure the Area | Prevents secondary accidents by making the scene visible to other drivers. |

| Report to Police | Legally required if injuries occur or total damage is over $2,000. |

| Avoid Admitting Fault | Saying “I’m sorry” can be used against you by insurance companies. Stick to factual statements. |

Keeping these simple points in mind can protect both your well-being and your legal rights in the crucial minutes after a crash.

Know When to Report the Accident

In Ontario, the law is very clear. The Highway Traffic Act requires you to report a collision to the police if anyone is injured or if the combined damage to all vehicles appears to be more than $2,000.

With the sky-high cost of vehicle repairs today—from sensors to bodywork—it’s surprisingly easy for a minor-looking fender-bender to exceed that $2,000 threshold. Failing to report can result in fines and cause serious headaches with your insurance claim down the road. If the police don’t come to the scene for a minor collision, you’ll need to go to a Collision Reporting Centre yourself.

Maintain Composure and Avoid Common Mistakes

It’s a natural human reaction to say, “I’m sorry,” after an incident. You have to fight that urge. In the context of a car accident, an apology can be twisted into an admission of legal fault by an insurance adjuster or the other party’s lawyer.

Your conversations with the other driver should be calm, professional, and limited to exchanging necessary information. Leave the determination of fault to the insurance companies and, if necessary, legal experts. You can get a better understanding of how this works by reading our detailed guide on Ontario’s vehicle accident laws and their implications.

By staying calm and methodical, you build a strong foundation for the days and weeks to come.

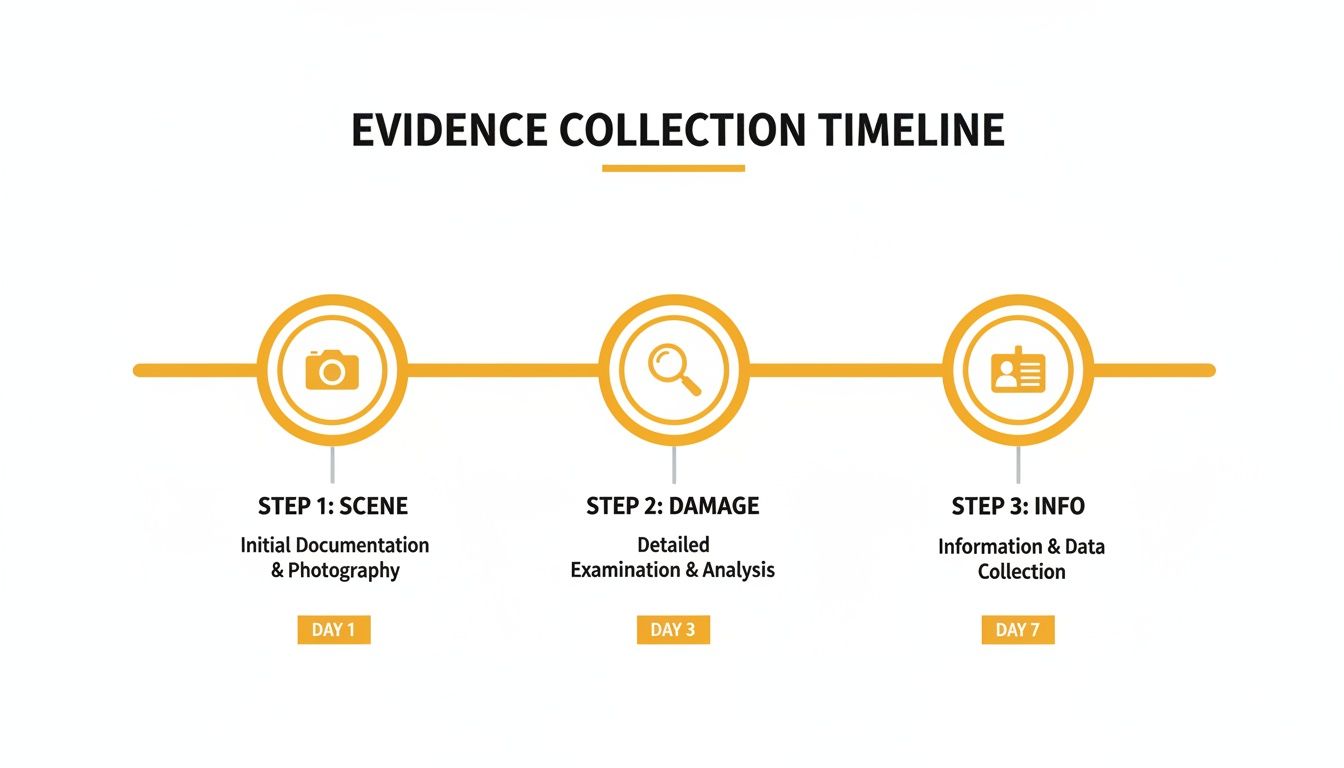

Gathering Evidence: Your First, Most Critical Task

Once you’ve made sure everyone is safe and first responders are on their way, your next priority is to shift into documentation mode. What you do in these first few minutes can make or break your insurance claim later on.

Think of yourself as a detective at the scene. The evidence you collect right now—before vehicles are towed and memories get hazy—is priceless. Your smartphone is the single most powerful tool you have.

Turn Your Phone into an Evidence-Gathering Machine

This is where you need to be thorough. Don’t just snap a couple of quick pictures of the dent in your door. You want to create a complete visual narrative of exactly what happened and where it happened.

Take way more photos and videos than you think you’ll ever need. You can always delete them later. Walk around the entire area and capture everything from every possible angle.

Here’s a mental checklist to run through:

- The Big Picture: Start from a distance. Get wide shots showing where the cars ended up, how they’re positioned relative to each other, and the general layout of the road or intersection.

- The Damage Details: Now, get up close. Methodically photograph the damage on all vehicles involved, not just yours. Capture every scratch, dent, and broken part from multiple angles.

- The Scene Itself: Look down. Are there skid marks on the pavement? Is there broken glass or other debris scattered around? Photograph it all before it gets cleaned up.

- Road & Weather Conditions: Take pictures of the road surface. Was it slick with rain or covered in black ice? Were there any massive potholes, construction zones, or other hazards that played a role?

- Signs and Signals: Capture any and all traffic signs and signals in the area. A photo of the stop sign the other driver ran, or a speed limit sign, provides crucial context.

A Pro Tip From Experience: Don’t just focus on the cars. A picture showing that a stop sign was hidden by an overgrown tree branch, or that the road lines were faded and impossible to see, can completely shift the narrative of your claim.

The Official Information Exchange

After you’ve thoroughly documented the scene with your phone, it’s time to exchange information with the other driver(s). In Ontario, this isn’t just a courtesy; it’s a legal requirement. Stay calm and polite, but be firm in getting what you need.

The easiest and most accurate way to do this is to simply ask to take a clear photo of their driver’s licence and their pink insurance slip. This prevents any mistakes that can happen when you’re trying to scribble down details while shaken up.

You are legally required to give and receive the following details:

- Full Name and Address (as shown on their driver’s licence)

- Driver’s Licence Number

- Vehicle Owner’s Name and Address (this is important if the driver doesn’t own the car)

- Licence Plate Number

- Insurance Company Name and Policy Number

Getting this right is crucial for a smooth claims process. For a more detailed breakdown of your legal obligations, you can learn more about the law surrounding car accidents in Ontario right here on our site.

Finding and Talking to Witnesses

An independent witness can be the single most important factor in a disputed claim. Their version of events is seen as impartial and can instantly solve a “he-said, she-said” stalemate.

If you see people who stopped after the crash, approach them calmly. Don’t be pushy. A simple, “Excuse me, did you happen to see what just happened?” is all it takes to start the conversation.

If they say yes, just ask for their name and phone number. Let them know your insurance company might want to give them a quick call. Resist the urge to ask them for their whole story on the spot—that’s not your job, and it can make people uncomfortable. Your only goal is to secure a way for the professionals to contact them later.

Navigating Ontario’s No-Fault Insurance System

“No-fault insurance” is probably one of the most misunderstood terms in Ontario. When drivers hear it, they often think it means no one is found to be at fault for an accident. That’s a common myth, but it’s not how the system works at all.

Fault is absolutely determined after a collision. The “no-fault” part simply means you’ll deal directly with your own insurance company for immediate benefits and support, no matter who caused the crash. It’s designed to get you fast access to medical care and financial help without waiting for the other driver’s insurer to accept responsibility.

Unlocking Your Statutory Accident Benefits

This immediate support is called the Statutory Accident Benefits Schedule (SABS). These benefits are a standard, mandatory part of every single auto insurance policy in Ontario and are your first line of financial defence after an accident.

SABS are designed to cover a wide range of needs that pop up after a crash, including:

- Medical and Rehabilitation Benefits: This covers things like physiotherapy, chiropractic treatments, massage therapy, and prescription drugs.

- Income Replacement Benefits: If your injuries prevent you from working, these benefits can replace up to 70% of your gross weekly income, capped at $400 per week unless you’ve purchased optional coverage.

- Attendant Care Benefits: For more serious injuries, this covers the cost of an aide to help with personal care, such as dressing or bathing.

- Other Expenses: This can include costs for housekeeping, home maintenance, or even travel to your medical appointments.

Imagine you’re rear-ended on the 401 and left with painful whiplash. Thanks to SABS, your physiotherapy sessions can be covered right away. You don’t have to wait months while the insurance companies argue about who was at fault. You get the treatment you need, when you need it.

The Clock Is Ticking: Critical Deadlines You Cannot Miss

Getting access to these benefits hinges on one thing: acting fast. The insurance system in Ontario is built on strict deadlines. If you miss them, you could lose your right to benefits, even if your claim is completely legitimate.

Key Takeaway: The insurance company isn’t going to chase you down. It’s your responsibility to report the accident and get your application in on time. Failing to meet these deadlines can lead to an outright denial of your claim.

Here’s a quick look at the most important deadlines you need to follow.

| Action Required | Deadline | Consequence of Missing Deadline |

|---|---|---|

| Notify Your Insurer | Within 7 days of the accident | The insurer can delay or deny your claim. |

| Submit Application for Accident Benefits (OCF-1) | Within 30 days of receiving the forms | Your benefits will be denied until the completed form is submitted. |

This table shows just how quickly you need to move to protect your rights.

This process of gathering evidence at the scene is the first critical step that feeds into your report to the insurance company.

Your First Call With the Insurance Adjuster

That first phone call to your insurance company is a big deal. The person on the other end, the adjuster, works for the insurer. Their job is to manage the claim and limit the company’s financial payout. While they are there to process your claim, you need to be mindful of what you say.

Stick to the basic facts of what happened. Don’t guess, don’t speculate, and never admit fault. A simple, polite “I’m not feeling well” is much better than the automatic “I’m okay.” That little phrase can be recorded in your file and used against you later if your injuries turn out to be more serious.

For a deeper dive into how this all works, our guide explains no-fault insurance in Ontario and what it really means for you.

The Danger of a Quick Settlement Offer

Don’t be surprised if an adjuster calls you soon after the accident with a lump-sum settlement offer. When you’re stressed, out of work, and watching bills pile up, that quick cash can seem like a lifeline.

Be extremely careful here. Accepting that offer means you have to sign a final release, which legally closes your claim forever. You give up any right to ask for more money down the road, no matter what happens with your health.

The reality is, many serious injuries—especially soft tissue damage or psychological trauma—don’t show their true colours for weeks or even months. An offer that seems reasonable today could be painfully inadequate once you understand the long-term impact on your life. Never sign anything without speaking to a personal injury lawyer first.

Protecting Your Health and Your Claim

After the chaos of a crash dies down, a dangerous thought often creeps in: “I feel fine, so I must be okay.” Honestly, this is one of the biggest mistakes you can make—for your health and for any future insurance claim.

The adrenaline surging through your body after a collision is a powerful painkiller. It can easily hide the symptoms of serious injuries for hours, sometimes even days or weeks. That nagging stiffness you feel today could easily become chronic pain down the road.

That’s why getting a full medical assessment as soon as possible is non-negotiable. Whether it’s at the hospital, a walk-in clinic, or your family doctor’s office, this first visit is about more than just a check-up. It creates the single most important piece of evidence for your entire claim.

Why Your Medical Record is Your Most Powerful Tool

Every conversation you have with a doctor, every note they take, and every report they file becomes an official, time-stamped record. This paper trail is what connects your physical injuries directly back to the moment of the accident.

Without that crucial link, an insurance adjuster has an open door to argue your injuries happened later or were caused by something else entirely. Even a delay of a few days can plant a seed of doubt they can use to challenge your claim.

When you see a doctor, don’t hold back. Be as detailed as you can.

- Describe every single ache, pain, or strange sensation you’re experiencing.

- Explain how the injuries are disrupting your life—are you having trouble sleeping, sitting at your desk, or doing basic chores around the house?

- Mention any cognitive changes, no matter how small. Think “brain fog,” dizziness, or persistent headaches.

This level of detail ensures your medical file paints an accurate picture of your suffering, which is absolutely vital for calculating fair compensation. Our guide on accident benefits in Ontario goes into more detail on how these documented injuries translate into real support.

The Team Approach to Your Recovery

Your family doctor is often just the beginning. Depending on what you’re dealing with, your recovery might involve a whole team of healthcare professionals. Each one plays a unique role in your rehabilitation—and in building a rock-solid claim.

This team could include:

- Physiotherapists to help you get your strength and movement back.

- Chiropractors to work on musculoskeletal alignment, especially spinal issues.

- Massage Therapists to deal with painful soft-tissue damage.

- Psychologists or Counsellors to help you process the trauma of the accident itself.

Every specialist provides reports and treatment plans that contribute to the story of your recovery. Sticking to your appointments and following their advice is essential. It shows the insurance company you’re serious about getting better, which backs up the severity of your injuries.

Important Takeaway: The strength of your personal injury claim is built on the foundation of consistent and thorough medical documentation. Every appointment, report, and prescription receipt is a piece of evidence that tells the story of how the accident has impacted your life.

The Sneaky Nature of Delayed Symptoms

Some of the most common car accident injuries are notorious for showing up late. Whiplash, for example, might not hit you with its full force for 24 to 48 hours. The effects of a concussion can also be subtle at first, with cognitive issues only becoming obvious later on.

Picture this: you get into a fender-bender in a Burlington parking lot. You feel a bit shaken up but tell everyone you’re fine and head home. Two days later, you wake up with a monster headache, a neck so stiff you can barely move, and a wave of dizziness. If you didn’t see a doctor right away, the insurer might question whether these symptoms are truly from the accident.

Putting your health first is paramount. Understanding your treatment options, such as Chiropractic Care After a Car Accident, is a key part of that. A prompt medical opinion protects you from these kinds of challenges and, more importantly, ensures you get the care you need before a small problem becomes a major one.

Knowing When to Call a Personal Injury Lawyer

After a crash, you’re suddenly dealing with a mountain of new tasks. Calls from insurance adjusters, doctor’s appointments, and trying to get your car fixed—it’s completely overwhelming. It’s natural to wonder if you can just handle it all yourself.

You might be asking, “Do I really need a lawyer?” But from our experience, the better question is, “What am I risking if I don’t have one?”

For a minor tap in a parking lot with zero injuries, you might be fine on your own. But the second things get even a little complicated, the game changes. An experienced lawyer isn’t just an advisor; they become your advocate and your shield, protecting you from the tactics insurance companies often use to pay out as little as possible.

Clear Signals It’s Time to Get Legal Advice

Some situations are immediate red flags. If you see any of these, it’s a sign you need to speak with a personal injury lawyer right away. Trying to navigate these scenarios alone can seriously compromise your right to fair compensation for your injuries and other losses.

You should make the call if:

- You or a passenger were injured. This is the number one reason. Any injury at all—from whiplash or a concussion to broken bones or even psychological trauma like anxiety—needs a legal expert to make sure you get the benefits and compensation you need to recover.

- Your insurance benefits get denied or cut off. This happens more often than you’d think. If your insurer suddenly stops paying for your physio or denies your income replacement claim, you need an advocate to fight back.

- The insurance company is pressuring you. Are you getting constant calls urging you to take a quick, lowball settlement? Are they asking you to sign documents you don’t fully understand? A lawyer can step in, stop the pressure, and protect you.

- Fault is being disputed. If the other driver is trying to blame you for the accident, you need someone on your side. A lawyer will immediately start gathering evidence, tracking down witnesses, and building a case to prove what really happened.

Understanding Your Two Types of Claims

In Ontario, a car accident can lead to two very different types of claims. It’s crucial to understand how both work.

First, you have your claim for Statutory Accident Benefits (SABS). These are often called “no-fault benefits.” You claim these from your own insurance company to cover things like immediate medical treatments and a portion of your lost income, no matter who caused the collision.

Second, you might have a tort claim. This is a lawsuit you file directly against the at-fault driver and their insurance company. A tort claim is meant to recover compensation for damages that SABS simply doesn’t cover, such as:

- Pain and Suffering: For the physical pain and emotional toll the accident has taken on your life.

- Future Care Costs: To pay for long-term medical needs that go beyond what SABS provides.

- Additional Income Loss: For lost earnings above the basic $400 per week SABS limit.

- Losses for Family Members: To compensate family members for the services they now have to provide for you.

A tort claim is your only way to be compensated for the full, human cost of your injuries. It addresses the profound impact the accident has had on your quality of life, which no-fault benefits were never designed to do.

Demystifying the Cost of Legal Help

The biggest thing that holds people back is the fear of legal fees. We get it. But here’s the good news: almost every reputable personal injury firm in Ontario, including ours, works on a contingency fee basis.

You’ve probably heard this called a “no-win, no-fee” arrangement. It means you pay absolutely nothing upfront. Your lawyer covers all the costs of building your case, from hiring experts to filing court documents. They only get paid a percentage of the final settlement or court award if they win your case. If you don’t win, you don’t owe a dime in legal fees.

This system gives everyone access to justice, no matter their financial situation. It allows you to have a powerful legal team in your corner without any out-of-pocket risk. When you’re up against a massive insurance company, it’s smart to learn more about the benefits of hiring a lawyer for an insurance claim to ensure your rights are fully protected.

Answering Your Questions After a Car Accident in Ontario

When you’re dealing with the fallout from a car accident, your head is spinning. It’s a chaotic time filled with confusing legal jargon and procedures you’ve never had to think about before. Let’s clear up some of the most common questions we hear from drivers across Ontario.

Do I Really Need to Go to a Collision Reporting Centre for a Minor Crash?

This is a big point of confusion for a lot of people, and the short answer is yes, you often do.

In many parts of Ontario, including Toronto and the surrounding GTA, you’re legally required to report the crash at a Collision Reporting Centre. This applies if the police don’t come to the scene, no one has serious injuries, and the combined damage to all vehicles looks to be more than $2,000 (which, with modern cars, is almost any noticeable damage). You have to get this done within 24 hours. Skipping this step can create major headaches for your insurance claim and could even land you a fine.

Can I Be Found Partially to Blame for the Accident?

Absolutely. It’s rarely a black-and-white situation. Ontario’s insurance system uses a concept called contributory negligence, which is just a legal term for sharing the blame.

After an accident, an insurance adjuster will look at all the facts and assign a percentage of fault to each driver involved. They don’t just pull these numbers out of thin air; they follow a very specific set of guidelines called the Fault Determination Rules. For example, say another driver blows through a stop sign and hits you. You might think they’re 100% at fault, but if it’s found you had a clear line of sight and enough time to brake but didn’t, you could be assigned 10% of the fault. That percentage directly reduces the amount of compensation you can get from a lawsuit for your pain and suffering.

Key Insight: Fault isn’t always an all-or-nothing game in Ontario. Even a small percentage of fault can significantly lower what you can recover in a personal injury claim, which is why it’s such a critical part of your case.

What if the Other Driver Was Uninsured or Took Off?

Getting hit by someone who is uninsured or who flees the scene is a nightmare scenario, but you’re not left high and dry. Your own Ontario auto insurance policy has built-in protections for exactly this kind of situation.

- Uninsured Automobile Coverage: This is a mandatory part of every car insurance policy in Ontario. It lets you claim for your injuries and vehicle damage through your own insurance company, up to your policy limits.

- Accident Benefits: You are still completely entitled to claim your standard Statutory Accident Benefits (SABS) to cover things like medical treatments and lost income.

- The “Fund of Last Resort”: If you were a pedestrian or cyclist hit by an uninsured or unknown driver and don’t have your own auto insurance policy, you may be able to get compensation from a government safety net called the Motor Vehicle Accident Claims Fund (MVACF).

How Long Do I Have to Sue the At-Fault Driver?

This is incredibly important: there’s a strict clock ticking. In Ontario, the legal deadline for filing a lawsuit (a “tort claim”) for personal injuries is called a limitation period.

You have exactly two years from the date of the accident to file your lawsuit. If you miss that deadline, your right to sue the at-fault driver for damages—like pain and suffering, future care costs, or long-term income loss—is gone forever. There are very few exceptions to this rule, making it absolutely crucial that you speak with a personal injury lawyer long before that two-year mark is up to make sure your rights are protected.

Trying to navigate the aftermath of a car accident is tough, but you don’t have to go through it by yourself. The legal team at UL Lawyers has the experience to guide you through every step, from handling the insurance adjusters to fighting for the full compensation you deserve. If you’ve been injured, contact us for a free, no-obligation consultation to understand your rights and options. Visit us at https://ullaw.ca to learn more.

Related Resources

The Essential Guide to the Law About Car Accidents in Ontario

Continue reading The Essential Guide to the Law About Car Accidents in OntarioNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies