What to Do After a Car Accident in Ontario | Essential Guide

The moments after a car crash are a blur. You’re dealing with shock, confusion, and a rush of adrenaline that can easily mask pain. It’s tough to think clearly, but what you do in these first few minutes is absolutely critical.

The most important thing? Take a breath and put safety first.

Your First Moves at the Scene of the Accident

Before you even think about insurance or exchanging details, check on yourself and your passengers. Then, if it’s safe to get out of your car, check on the people in the other vehicle. Your well-being is the number one priority.

Assess the Situation for Safety

Once you’ve made sure everyone’s immediate medical needs are handled, take a look around. Is your car sitting in the middle of a busy Toronto intersection? Are you on a blind curve on a rural highway?

If the accident was minor and the cars are drivable, Ontario’s Highway Traffic Act actually requires you to move them off to the shoulder or another safe spot. This gets you out of the path of oncoming traffic and helps prevent a second, potentially worse, collision. It also keeps the road clear for emergency services.

But if the vehicles are too damaged to move or someone is seriously hurt, leave everything exactly where it is. Just flip on your hazard lights to warn other drivers.

Expert Tip: Never try to move someone who is unconscious or complaining of serious neck or back pain. You could make the injury much worse. The only exception is if they’re in immediate danger, like a fire. Otherwise, wait for the paramedics to arrive.

When to Call the Police

Figuring out whether to call the police isn’t just a judgment call—in some cases, it’s the law. A lot of people think you need to report every minor fender-bender, but that’s not quite right in Ontario.

You are legally required to call 911 and report the crash if:

- Anyone is injured. It doesn’t matter how minor the injury seems.

- The total damage to all vehicles involved looks like it’s over $2,000. With today’s cars, that’s easier to hit than you might think. A simple bumper replacement with sensors can easily exceed that amount.

- You think another driver is impaired by drugs or alcohol.

- Someone leaves the scene without stopping (a hit-and-run).

- Public property was damaged, like a guardrail, street sign, or traffic light.

When in doubt, make the call. The police will file an official report, which is an incredibly important piece of evidence when you eventually file your insurance claim.

Once you’ve confirmed everyone is safe and the scene is secure, your focus needs to shift. What you do in the next few minutes can make a massive difference in how the next few months unfold. This is where you put on your investigator hat and start building the official record of what happened.

This documentation is the bedrock of your insurance claim. It protects you from he-said-she-said arguments and ensures the facts are on your side. Think of your smartphone as your most critical tool right now—use it to capture everything.

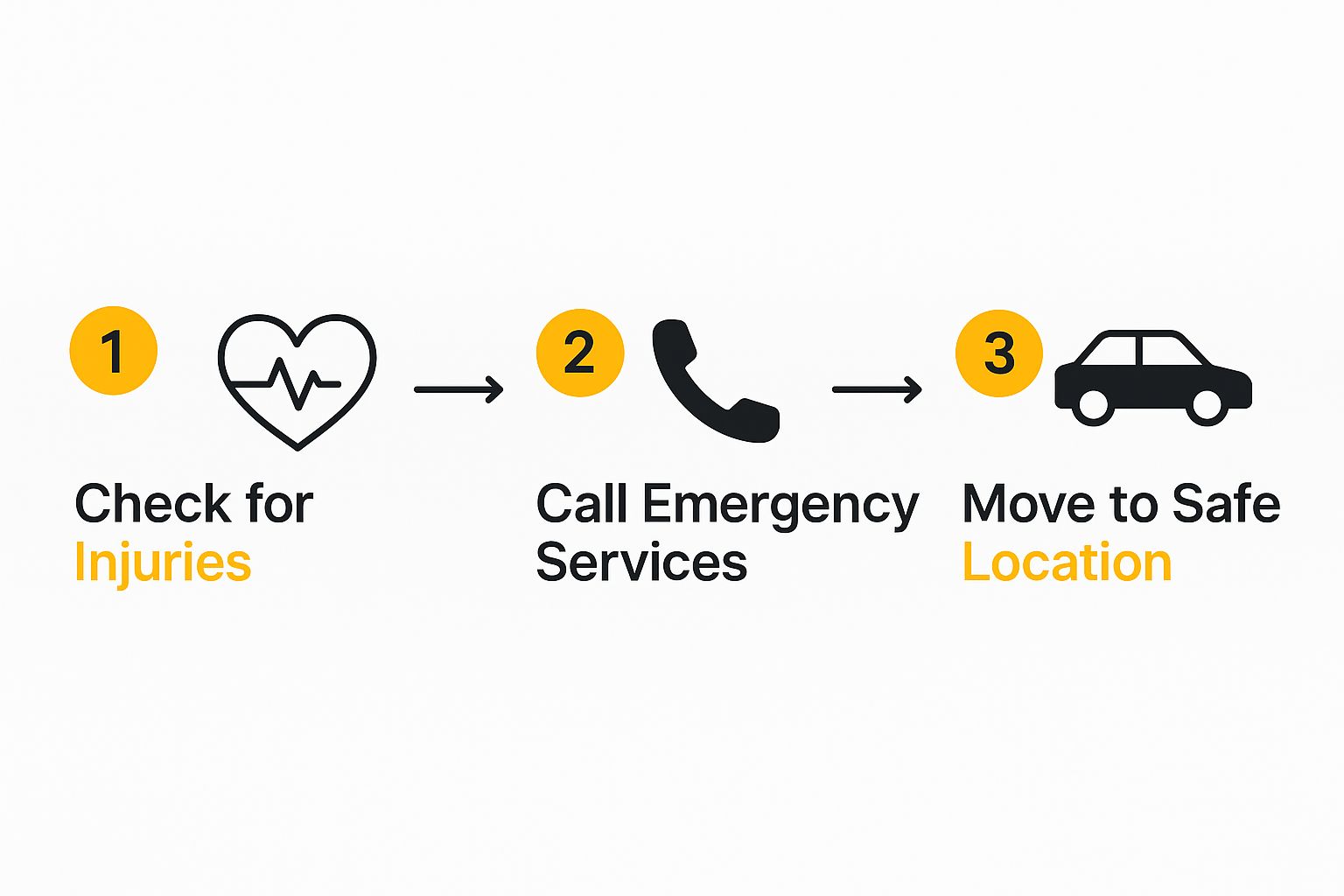

As this image shows, safety always, always comes first. But once that’s handled, it’s all about the evidence.

Photos, Photos, and More Photos

You can never have too many pictures after an accident. Start with wide shots to capture the big picture—where the cars ended up, their positions relative to intersections, and the general layout of the road. This context is incredibly important.

Then, zoom in. Methodically photograph the damage to every vehicle involved, not just your own. Get down low, stand up high, and capture every dent, scratch, and broken part from multiple angles. Close-ups are your friend here.

Don’t stop at the vehicles. Your surroundings tell a crucial part of the story. Be sure to snap photos of:

- The road itself: Are there potholes? Is it wet, icy, or covered in gravel?

- Skid marks or debris: These are often the first things to get cleared away but can be vital for accident reconstruction.

- Relevant signs and signals: Capture any stop signs, speed limit signs, or traffic lights that governed the intersection.

- The conditions: Was there blinding sun glare? Heavy fog? These factors absolutely matter.

To stay organized in the heat of the moment, a checklist can be a lifesaver. It ensures you don’t miss any critical details that your insurance company will need.

Essential On-Scene Accident Checklist

| Category | Details to Document | Why It Matters |

|---|---|---|

| Overall Scene | Wide-angle shots showing all vehicles and road layout from multiple directions. | Establishes the final resting positions of the vehicles and provides crucial context. |

| Vehicle Damage | Close-ups of damage on ALL vehicles involved, from various angles. | Provides clear, indisputable proof of the points of impact and the severity of the collision. |

| Environmental Factors | Photos of skid marks, debris, road conditions (wet, icy), and relevant traffic signs. | Helps paint a full picture of the circumstances leading up to the accident. |

| Driver’s Documents | A clear photo of the other driver’s licence and pink insurance slip. | Guarantees you have accurate, verifiable information for your insurer and the police. |

| Witness Information | Full name and phone number of anyone who saw the accident. | An independent account can be the single most powerful piece of evidence in a disputed claim. |

This checklist isn’t exhaustive, but it covers the absolute must-haves. Having this information locked down before you leave the scene will save you countless headaches later on.

Get the Other Driver’s Details (The Right Way)

Exchanging information isn’t just a good idea; it’s the law in Ontario. Stay calm and professional, but be firm in collecting the necessary details. Don’t just rely on them reading a number off to you—ask to see the physical documents.

I’ve seen it happen time and time again: someone jots down a wrong policy number or mishears a name, and it becomes a nightmare to sort out. Politely ask to take a quick photo of their driver’s licence and insurance slip. It’s the fastest and most accurate way to get it right.

Here’s exactly what you need from every other driver:

- Full Name and Address (matching their licence)

- Driver’s Licence Number

- Contact Phone Number

- Their Insurance Company and Policy Number (from the pink slip)

- Vehicle info: Make, model, colour, and licence plate number.

Don’t Underestimate a Good Witness

If anyone stopped to see if you were okay or saw the collision happen, they could be your most valuable asset. An independent witness—someone with no skin in the game—provides a credible, unbiased account that insurance companies take very seriously.

Get their full name and phone number. A simple statement from someone who saw the other driver texting or running a red light can instantly resolve any dispute over who was at fault. It’s a simple step that can completely change the trajectory of your claim.

Your Health Is Priority Number One After a Wreck

In the moments after a car crash, adrenaline is a powerful thing. It can mask pain and make you feel perfectly fine, even when you’re not. You might be more worried about your car or just getting home, but one of the biggest mistakes you can make is skipping a medical check-up.

Putting your health first isn’t just a good idea—it’s essential. A bit of neck stiffness could easily become a chronic problem, and what feels like a minor headache might be the first clue you have a concussion.

Why You Might Not Feel Hurt Right Away

I’ve seen it countless times: someone walks away from a fender-bender feeling a bit rattled but otherwise okay, only to wake up the next morning unable to turn their head and with a splitting headache. This is completely normal.

Many of the most common injuries from car accidents have a delayed onset. Here are a few to watch out for:

- Whiplash: That classic back-and-forth snap of your head can strain your neck muscles and ligaments. The real pain, stiffness, and headaches often don’t hit their peak for 24 to 48 hours.

- Concussions: You don’t have to hit your head to get a concussion. The sheer force of the impact can be enough to jostle your brain, leading to confusion, memory trouble, or sensitivity to light that appears later.

- Soft Tissue Damage: This is a catch-all for sprains and strains to the muscles and ligaments, especially in your back and shoulders. The pain can creep up on you, seriously affecting your ability to move comfortably.

Think of it this way: your body goes into survival mode during a crash. It’s only when things calm down that it starts to send out the pain signals, letting you know something is wrong.

The Paper Trail Starts With Your Doctor

Getting checked out by your family doctor, at a walk-in clinic, or in the ER does two critical things. First, and most importantly, it gets you the care you need. Second, it creates an official medical record connecting your injuries directly to the accident.

This piece of paper is absolutely vital for your insurance claim. It’s the proof you need to access your Statutory Accident Benefits (SABS) here in Ontario.

Without a timely medical report, an insurance adjuster could easily question whether your injuries are actually from the collision. This could put your access to benefits for physiotherapy, medication, or other treatments at risk.

In Ontario, many common crash injuries like whiplash are initially categorized under the Minor Injury Guideline (MIG), which limits medical and rehabilitation benefits to $3,500. However, if your medical records clearly show your injuries are more serious, you could be entitled to far more support. You can read the specifics on the Financial Services Regulatory Authority of Ontario’s page about the Minor Injury Guideline.

My advice? Start a file from day one. Keep track of every symptom, every doctor’s visit, every prescription, and every receipt. This log will become an invaluable record of how the accident has truly affected your life.

Navigating Your Insurance Claim in Ontario

Once you’ve dealt with the immediate aftermath of the accident—your health and safety always come first—it’s time to turn your attention to the insurance company. This is a critical step. How you handle that first phone call can set the tone for your entire claim, so you want to get it right from the start.

Reporting the accident isn’t just a good idea; it’s a legal requirement. Under Ontario’s Insurance Act, you have to notify your insurer as soon as you reasonably can. If you wait too long, you’re giving them an easy reason to question your claim or, in the worst-case scenario, deny it completely.

Making the First Report

Before you pick up the phone, take a deep breath and get your notes in order. Having the details you gathered at the scene handy will make the call go much more smoothly and help you stay on track.

Make sure you have this information ready:

- Your insurance policy number.

- The exact date, time, and location of the crash.

- The other driver’s full name, licence number, and their insurance information.

- The police report number, if the police were involved.

- A straightforward, factual summary of what happened.

When you’re on the phone, your only job is to report the facts. Don’t guess about who was at fault or downplay your injuries. Just tell them what happened from your point of view. Let the adjusters do the investigating.

Keep it simple and factual. A good script is: “There was a collision at this location, at this time, involving these vehicles.” Never, ever say things like, “I’m so sorry, it was my fault,” or even, “I feel fine.” Adrenaline is a powerful painkiller, and admitting fault can be devastating to your claim.

Understanding Ontario’s No-Fault System

The term “no-fault” insurance trips a lot of people up. It’s a bit of a misnomer. It doesn’t mean no one is to blame for the accident. What it really means is that you’ll deal with your own insurance company for things like benefits and vehicle repairs, no matter who caused the collision.

The system is designed this way to get you the help you need, faster. After you report the crash, your insurer will send you an Application for Accident Benefits (OCF-1) form. This is incredibly important. You have to fill it out and send it back within 30 days of getting it. This is the official trigger to start accessing your benefits for medical treatment, rehabilitation, and any lost income.

While you’re dealing with your insurer, they are working behind the scenes to figure out who was at fault using a set of guidelines called the Fault Determination Rules. That decision will impact future insurance premiums, but it doesn’t stop you from getting the immediate support you’re entitled to. Your priority is to give them clear information and hit every deadline to protect your right to those benefits.

So, When Should You Actually Call a Personal Injury Lawyer?

Let’s be honest, most minor fender-benders in Ontario don’t end up in a lawyer’s office. If everyone walks away with a few scrapes and the insurance companies are playing nice, you can often handle it yourself. But the moment things get complicated, you’re entering a whole new world.

It’s not just about a simple disagreement. When you’re facing serious injuries, an uninsured driver, or an insurance provider that’s giving you the runaround, that’s your cue. Bringing in a legal professional isn’t about being difficult; it’s about protecting your future.

Red Flags You Can’t Ignore

There are a few situations that should immediately set off alarm bells. These are the moments when trying to manage a claim on your own can go from challenging to a full-blown mistake. Remember, insurance companies have teams of professionals working to protect their bottom line; a lawyer is there to protect yours.

You should seriously consider a consultation if you run into any of these scenarios:

- You’ve Suffered a Serious or Permanent Injury: We’re talking about more than just a bit of whiplash. If you have broken bones, a concussion, or any injury that will require ongoing care, the claim’s complexity and value just shot way up.

- The Blame Game Starts: The other driver or their insurer is pointing the finger at you, but you know that’s not how it happened. A lawyer’s job is to dig up the evidence—from police reports to witness statements—and build a solid case that shows the truth.

- Your Own Insurer is Pushing Back: This one can be a shock. You’ve paid your premiums, but now your own insurance company is delaying or outright denying your medical or income benefits. That’s a clear signal you need an advocate.

- You Get a “Lowball” Offer: Be very wary of a quick, small settlement offer. It’s often a tactic to get you to sign away your rights before you even know the full extent of your injuries and long-term costs. A lawyer can tell you what your claim is actually worth.

The Financial Side of Things

Beyond getting your immediate medical bills and lost wages covered, a lawyer becomes absolutely essential if you need to sue for pain and suffering. This is known as a tort claim, and the system in Ontario has some major financial hurdles built into it.

In Ontario, there’s a statutory deductible on awards for pain and suffering. Think of it as the insurance company’s built-in discount. Unless your injuries are deemed serious enough to surpass a specific monetary threshold, a big chunk of your settlement is automatically taken away.

For example, in 2023, that deductible was $44,430.89. If your pain and suffering damages were valued at less than $147,000, that first $44,430.89 would be subtracted from your final award.

You can see the official numbers on the Financial Services Regulatory Authority of Ontario’s website. A good lawyer knows how to build a case with medical evidence to prove your injuries are serious enough to overcome these legal hurdles, fighting to get you every dollar you deserve.

Common Questions After an Ontario Car Accident

After the initial shock of a car accident wears off, your mind can start spinning with questions. Even if you’ve handled everything at the scene, the path forward can feel foggy. Let’s clear up some of the most common worries people have after a collision in Ontario.

How Is Fault Determined in an Ontario Car Accident?

It’s a common misconception that the police officer who shows up at the scene decides who’s at fault. In reality, they’re there to document the incident, not to make a final ruling for insurance purposes.

The real decision-makers are the insurance companies. They rely on a very specific set of guidelines known as Ontario’s Fault Determination Rules. An adjuster will look at the facts of your accident—where the vehicles made contact, the layout of the road, and what each driver was doing—and match it to one of the scenarios in the rulebook. From there, they assign a percentage of fault to each driver, ranging anywhere from 0% to 100%.

This is a big deal. Even though Ontario has a “no-fault” system for accessing initial benefits, that fault percentage is what dictates whether your insurance premiums will go up.

Will My Insurance Rates Go Up If I Was Not at Fault?

This is the question that keeps a lot of drivers up at night. The good news is, if you are found 0% at fault, your insurance rates shouldn’t increase because of the claim. That’s precisely what you pay your premiums for—protection when something happens that isn’t your fault.

But it’s always smart to be sure. Some policies have fine print about the number of claims you make over time, regardless of fault.

Your best bet is to have a quick chat with your insurance broker. They can pull up your specific policy and give you the straight goods on how a not-at-fault claim might affect you down the road.

What Are the Time Limits for Taking Action?

This is where you absolutely cannot afford to delay. The moment the accident happens, a legal countdown begins. Missing these deadlines isn’t just a minor slip-up; it can completely prevent you from getting the compensation you need.

Here are the key timelines you need to burn into your memory:

- Tell Your Insurer: You have just 7 days to notify your insurance company about the accident.

- Submit Your Benefits Application: Once your insurer sends you the application package, you must complete and return it within 30 days to get your accident benefits started.

- File a Lawsuit: For injuries, you generally have a two-year window from the date of the collision to file a lawsuit against the at-fault driver.

These deadlines are firm. Letting one slide by can mean losing your right to benefits and compensation for good.

Navigating the aftermath of a car accident is complicated, but you don’t have to do it alone. If you’ve been injured or are struggling with your insurance claim, the team at UL Lawyers Professional Corporation is here to help protect your rights and guide you through the process. We offer free consultations to help you understand your options. Visit us at https://ullaw.ca to learn more.

Related Resources

Find a Car Accident Lawyer in Mississauga Fast

Continue reading Find a Car Accident Lawyer in Mississauga FastNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies