What to Do After a Car Accident in Ontario | Expert Steps to Follow

No one expects to get into a car accident. When it happens, the shock and adrenaline can make it almost impossible to think straight. But what you do in those first few minutes and hours is incredibly important for your safety, your legal rights, and any future insurance claims.

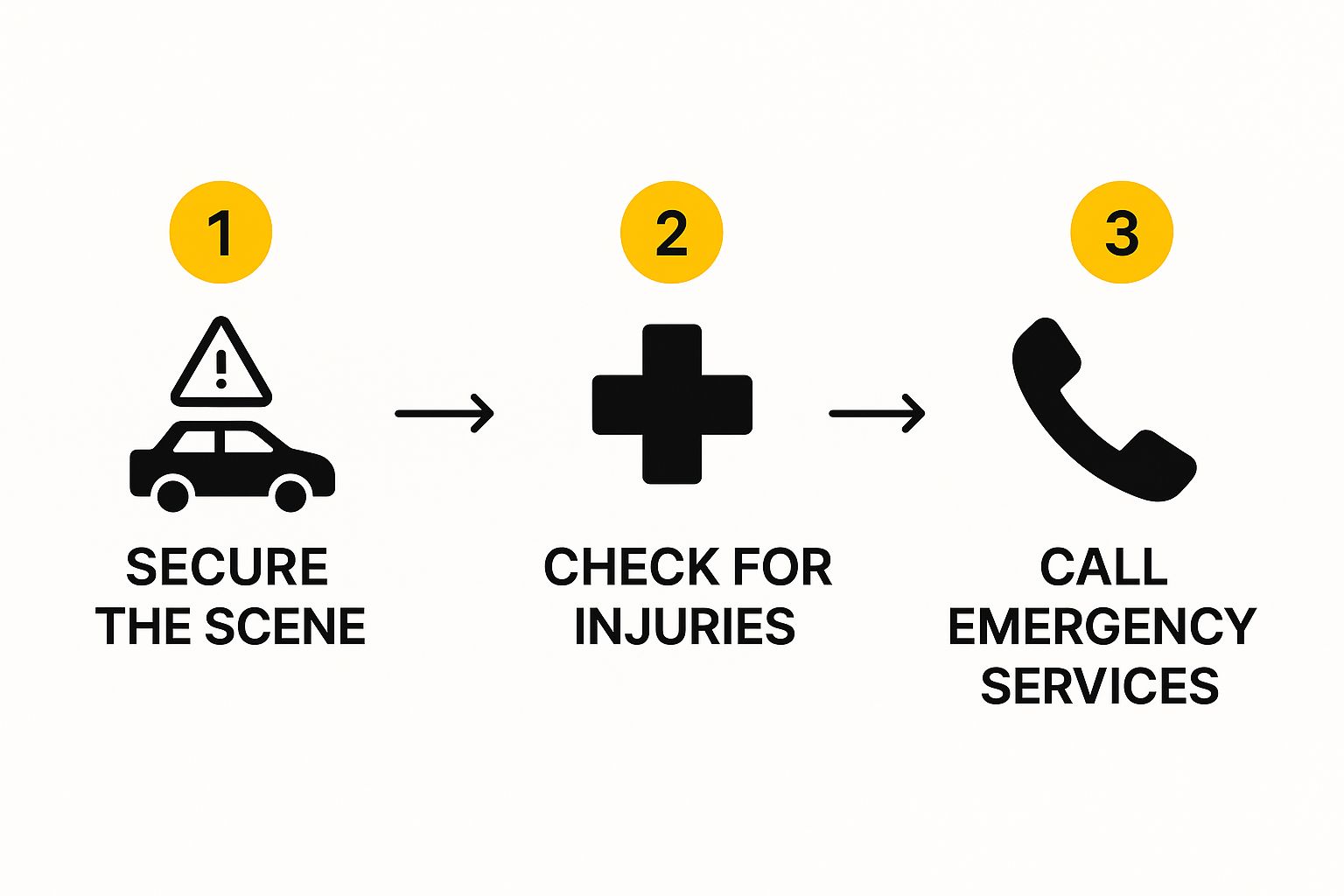

Here’s a breakdown of the immediate steps you need to take right at the scene.

Your First Moves at the Scene of an Accident

The seconds after a collision are a blur of noise and confusion. Your first instinct might be panic, but taking a deep breath and focusing on a few key actions can make all the difference. Think of it as a priority list: people first, then safety, then the details.

The absolute first priority is health. Check on yourself and anyone else in your car. Are you hurt? Is anyone complaining of pain? If there’s any doubt at all, call 911 right away. Things like whiplash or concussions aren’t always obvious, and what feels like minor soreness can be a sign of a more serious injury.

Securing the Scene and Ensuring Safety

Once you’ve checked for injuries, the next job is to prevent another accident from happening. Flip on your hazard lights immediately—this is the universal signal for caution.

If the accident was minor and your car is still driveable, the best thing to do is carefully move it to the shoulder or a nearby side street. Getting out of the flow of traffic is crucial. However, if the damage is significant, if there are serious injuries, or if you’re unsure, leave the vehicles exactly where they are. Don’t risk making things worse. Your safety is worth more than clearing a lane.

This image really simplifies the core priorities in that initial, chaotic moment.

It’s a simple but powerful reminder: make the scene safe, check on everyone’s well-being, and then call for help.

Fulfilling Your Legal Duties in Ontario

Ontario’s Highway Traffic Act is very clear about your responsibilities after a collision. You can’t just drive away. You are legally required to stop, offer assistance to anyone who might be hurt, and exchange specific pieces of information with the other driver(s).

A quick but crucial point: In 2020 alone, Ontario saw over 23,000 car collisions that led to personal injuries. This statistic isn’t just a number; it underscores why these on-the-scene protocols are so vital for getting people the help they need and ensuring legal accountability.

Failing to stop and provide your information isn’t just rude—it can result in serious fines and even criminal charges.

To make this easier, here’s a quick-reference checklist for the information you absolutely must collect from the other party at the scene.

At-the-Scene Information Exchange Checklist

| Information to Collect | Why It’s Important | Where to Find It |

|---|---|---|

| Full Name and Address | To identify the other driver for insurance and legal purposes. | Driver’s Licence |

| Driver’s Licence Number | The primary identifier for the driver in official records. | Driver’s Licence |

| Phone Number | For direct contact by you, your insurer, or your lawyer. | Ask the driver directly. |

| Licence Plate Number | Identifies the specific vehicle involved in the accident. | The vehicle’s licence plate. |

| Insurance Company & Policy Number | Essential for initiating the insurance claim process. | The pink insurance slip in their glove box. |

Having this table handy on your phone or in your glove box can be a lifesaver when you’re feeling flustered and trying to remember everything.

Documenting Everything and What to Avoid Saying

Your smartphone is your most powerful tool right now. Before the scene is cleared, become your own investigator. Take photos and videos of everything you can think of.

- Get wide shots of the entire scene to show the context.

- Take close-ups of the damage to all vehicles involved.

- Capture the final positions of the cars on the road.

- Photograph any skid marks, broken glass, or other debris.

- Snap pictures of nearby traffic signs or signals.

Now, for the “what not to do” part. When you’re talking to the other driver, be polite but be careful. The single most important rule is to never admit fault or apologize. A simple “I’m so sorry” can be twisted into an admission of guilt by an insurance adjuster later on.

Stick to the facts. Exchange information and that’s it. If you’re feeling shaken up or pressured, it’s a good time to remember your rights. Understanding how a personal injury lawyer in Hamilton, Ontario can help you navigate these conversations will give you the confidence to protect your interests from the very beginning.

Reporting the Collision in Ontario

Once the dust has settled at the scene, your next move is to navigate the official reporting process. Knowing exactly when and how to report a car accident isn’t just a good idea in Ontario—it’s a legal requirement that protects you and gets your insurance claim rolling. The rules are pretty specific, so let’s break them down.

Most drivers have heard of the $2,000 rule. If the total damage to all vehicles looks like it’s over that amount, you have to report it to the police. But there’s a far more important rule that always comes first: if anyone has been injured in any way, even if it seems minor, you are legally required to report the accident right away.

Police on Scene vs. a Trip to the Reporting Centre

Sometimes, the police will come directly to you, especially if there are serious injuries, a criminal offence like impaired driving is suspected, or the vehicles are dangerously blocking traffic.

However, in many parts of the GTA and other urban areas like Burlington and Mississauga, you’ll likely be instructed to go to a Collision Reporting Centre (CRC). This is the standard procedure when no one needs an ambulance and the cars are still driveable.

Think of a Collision Reporting Centre as a one-stop shop for getting the official paperwork started. It’s a dedicated facility where you can report a collision involving only property damage in a safe and controlled setting, away from the roadside.

The process at a CRC is surprisingly streamlined. You’ll provide your driver’s licence, ownership, and insurance, give your side of the story, and present the other driver’s information. Centre staff will then photograph the damage to your vehicle and help you complete the official police report. You’ll walk out with a stamped form—the proof your insurer needs to open a claim.

Why the Police Report is So Important

That police report, whether it’s filed on the side of the road or at a CRC, becomes the foundation of your entire insurance claim. It’s the official, neutral record of the event.

This single document verifies the who, what, where, and when of the collision. It’s the primary piece of evidence an insurance adjuster will use to determine who was at fault according to Ontario’s strict Fault Determination Rules.

Don’t be tempted to skip this step. The Ministry of Transportation of Ontario is very clear: you must report accidents involving injuries, deaths, or property damage over $2,000. Not doing so can lead to fines and, more critically, could seriously complicate or even void your insurance claim. Considering Ontario saw 23,689 injury-causing collisions in 2020 alone, it’s a step you can’t afford to miss. You can find more details in these Canadian traffic statistics.

Starting Your Insurance Claim the Right Way

Once you’ve dealt with the scene and filed any necessary police reports, your next move is to get in touch with your insurance company. I know this part can feel daunting, but being prepared and understanding the Ontario system puts you in the driver’s seat. It all begins with a simple, but very important, phone call.

Don’t put this off. Insurers have timelines for a reason, and dragging your feet can create needless complications. A delay might make them question the severity of the damage or even your injuries. Your job is to kickstart the process and create a clear, official record right from the get-go.

What Ontario’s No-Fault Insurance Really Means

Let’s clear up one of the most common points of confusion: Ontario’s “no-fault” insurance system. It’s a term that trips a lot of people up, leading them to believe that nobody is ever found responsible for a crash. That’s a myth.

“No-fault” simply dictates who you deal with for your claim. In Ontario, you work directly with your own insurance company for benefits and vehicle repairs, no matter who caused the accident. This structure is designed to get you access to crucial support—like medical treatments or income replacement—without having to wait for the insurers to spend months figuring out who was to blame.

Fault is absolutely still determined. Insurers use a specific set of guidelines called the Fault Determination Rules to assign responsibility behind the scenes. The “no-fault” system just changes who pays your benefits upfront.

It’s a critical piece of the puzzle to understand. For a deeper dive, check out our guide on what no-fault insurance in Ontario means for your situation.

Getting Access to Your Accident Benefits

That first call to your insurer is what officially opens your claim for Accident Benefits. This is a mandatory part of every auto policy in the province, there to help you recover. These benefits are available to you, any passengers in your vehicle, and even pedestrians or cyclists involved, regardless of who was at fault.

Think of Accident Benefits as your primary safety net. They can cover a surprisingly wide range of things, such as:

- Medical and Rehabilitation: Costs for physiotherapy, massage therapy, chiropractic sessions, and medical equipment that OHIP doesn’t cover.

- Income Replacement Benefits (IRBs): If you’re unable to work because of your injuries, this benefit can replace a portion of your lost income.

- Attendant Care: For more severe injuries, this helps pay for a personal support worker or long-term care facility.

- Other Expenses: This could include things you wouldn’t expect, like help with housekeeping or the cost of retraining for a new career if you can’t return to your old one.

How to Talk to the Insurance Adjuster

Shortly after you report the accident, your file will be handed over to an insurance adjuster. This is the person from the insurance company who will be your main point of contact. Their role is to investigate what happened, assess the damages, and ultimately decide what benefits you’re entitled to.

It’s essential to remember that the adjuster works for the insurance company. While most are perfectly reasonable, their objective is to manage the claim efficiently and control costs for their employer.

When you speak with them, be polite and stick to the facts. Don’t guess or speculate about what happened or how you’re feeling. Provide the information they ask for, but never feel pressured into giving a recorded statement or accepting a quick settlement offer before you fully understand your rights and the long-term impact of your injuries.

Your Health Is Always the Top Priority

The immediate aftermath of a car accident is a whirlwind of shock, confusion, and adrenaline. It’s easy to think, “I feel okay, I can just go home.” But brushing it off, even after a minor-seeming collision, is one of the biggest mistakes you can make. Your well-being must come first.

That rush of adrenaline is a powerful painkiller. It can completely mask serious injuries in the minutes and hours after a crash. You might feel a little rattled but otherwise fine, only to wake up the next day in agony. This is why getting checked out by a doctor is non-negotiable.

Why a Doctor’s Visit Is Non-Negotiable

Some of the most common injuries from a car accident—like whiplash, concussions, or deep soft-tissue damage—don’t always show up right away. What seems like a bit of soreness can quickly escalate into a chronic, debilitating problem if you don’t get it looked at.

Just as importantly, that initial medical visit creates an official, time-stamped record of your injuries. This documentation is gold. It directly connects the collision to your physical condition, which is absolutely crucial for any insurance claim or legal steps you might need to take later on.

Tapping Into Your Accident Benefits

When you see a doctor or go to a clinic, you need to be very specific: tell them your injuries are from a motor vehicle accident. This isn’t just a small detail; in Ontario, it’s the key that unlocks the right kind of support. It ensures your treatments are routed through your auto insurer’s Accident Benefits, preserving your personal or workplace health plans for other needs.

A common pitfall we see is when people just say “my back hurts” without explaining why. You have to explicitly link the pain to the accident. This starts the proper documentation trail from day one and is vital for getting the therapies you’re entitled to.

It’s worth getting familiar with the full range of support available. You can learn more about how Accident Benefits in Ontario cover your recovery. This isn’t just about a one-time doctor’s visit; it often includes ongoing care crucial for a full recovery, such as:

- Physiotherapy to help you regain mobility and strength.

- Chiropractic care for dealing with spinal misalignments.

- Massage therapy to work on muscle pain and stiffness.

- Psychological support to help you cope with the emotional trauma.

Your family doctor is the best starting point. They can assess your needs and provide referrals to specialists who can help you get back on your feet.

How Fault Is Determined in Ontario Collisions

After a crash, the first question everyone asks is, “Who was at fault?” It’s a loaded question, and the answer has nothing to do with who apologized at the scene or what your gut tells you. In Ontario, fault is determined by a strict set of guidelines called the Fault Determination Rules, which are part of the province’s Insurance Act.

Think of these rules as the official playbook for every insurance company. They lay out dozens of common accident scenarios and assign a percentage of fault to each driver. This isn’t about blaming people; it’s a standardized system created to keep the claims process consistent and fair for everyone involved.

Common Scenarios and How Fault Is Decided

So, how does this work in the real world? The rules cover nearly every situation you can imagine, from a fender bender in a Burlington parking lot to a multi-car pile-up on the QEW. Understanding a few common examples can help you know what to expect.

Here are a few classic scenarios:

- Rear-End Collisions: If you get hit from behind, the driver who hit you is almost always found 100% at fault. The law is clear: drivers must always leave enough space to stop safely.

- Left-Turn Accidents: When a driver turns left and gets hit by an oncoming car, the turning driver is typically held 100% at fault. The onus is always on them to wait until the coast is clear.

- Parking Lot Incidents: Picture a car pulling out of a parking spot and hitting another vehicle driving down the main lane. The driver pulling out of the space is usually considered 100% at fault.

A common myth is that fault has to be 100% or nothing. The truth is, the rules absolutely allow for shared responsibility, where fault can be split between multiple drivers.

The Role of Contributory Negligence

This brings us to the idea of contributory negligence, or what’s more commonly known as shared fault. Sometimes, the actions (or inaction) of more than one driver led to the accident. In these situations, fault can be divided—say, 75/25 or even 50/50.

For instance, imagine one driver speeds through an intersection just as another driver makes a rolling stop instead of coming to a complete halt. The Fault Determination Rules might assign a portion of the blame to both of them for their roles in the crash.

This is becoming incredibly important with the rise of distracted driving. Shockingly, recent data from Ontario shows that distracted driving is now a factor in 64% of all car accidents. With deaths from distracted driving having doubled since 2000, it’s a massive factor that adjusters look at when piecing together what really happened. Find out more about the impact of distracted driving on accidents.

Getting a handle on these rules is the first step toward understanding your position. For a deeper dive into your rights and the legal journey ahead, our guide on Ontario car accident law offers crucial information. Being well-informed helps you navigate conversations with your insurer and gives you the confidence to know your options if you disagree with their fault assessment.

Answering Your Lingering Car Accident Questions

Once you’ve handled the immediate aftermath of a car accident, a whole new set of questions inevitably pops up. The initial shock wears off, and the practical, nagging worries start to set in. We hear these same concerns time and again from our clients in Burlington and across the GTA, so let’s tackle them head-on.

Think of this as your guide for those tricky “what-if” moments.

Can My Insurance Company Make Me Use Their Preferred Body Shop?

Absolutely not. In Ontario, you have the legal right to choose your own auto repair facility. Your insurer might provide a list of their “preferred” shops, which can sometimes make direct billing easier, but you are never obligated to use them.

My advice? Get an estimate from a mechanic you already know and trust. There’s peace of mind in knowing someone you’re comfortable with is handling the repairs on your vehicle.

What Happens if It Was a Hit-and-Run?

Even if the other driver flees the scene, you’re not left without options. Every single auto insurance policy in Ontario includes Uninsured Automobile Coverage. This is precisely for situations like a hit-and-run or an accident with an uninsured driver.

It is absolutely critical to report a hit-and-run to the police immediately. Your insurance company will require a formal police report to even begin processing a claim under this coverage—it’s non-negotiable.

In some specific cases, you might also be able to access benefits through Ontario’s Motor Vehicle Accident Claims Fund (MVACF).

How Long Do I Have to File a Lawsuit?

This is where the clock is ticking. In Ontario, the law sets a strict deadline, known as a limitation period. Generally, you have a two-year window from the date of the accident to file a lawsuit for personal injuries.

If you miss that two-year mark, you could permanently lose your right to sue. This is why it’s so crucial to consult with a personal injury lawyer long before that deadline approaches. They can help you understand your legal options and walk you through the specifics of motor vehicle accident compensation.

Will My Insurance Premiums Increase if the Accident Wasn’t My Fault?

It shouldn’t. If you are determined to be 0% at fault for the collision based on Ontario’s Fault Determination Rules, your premiums should not go up because of that specific claim.

A word of caution, though: some policies have clauses about overall claim frequency, regardless of fault. It’s always smart to have a quick chat with your insurance broker to clarify exactly how your own policy is written.

Trying to figure out the next steps after an accident can feel overwhelming. At UL Lawyers, our team is focused on helping people from Burlington to all corners of the GTA understand their rights and get the support they need. If you’re feeling lost or just have questions, we offer free, no-obligation consultations to help you find your footing. Contact us 24/7 to get the answers you need at https://ullaw.ca.

Related Resources

Find a Car Accident Lawyer in Mississauga Fast

Continue reading Find a Car Accident Lawyer in Mississauga FastNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies