Your Guide to Ontario Wills and Estate Law

At its heart, wills and estate law is all about planning for the future—specifically, how your assets are managed and distributed if you pass away or can no longer make decisions for yourself. It involves creating essential legal documents, like a Last Will and Testament and Powers of Attorney, to make sure your wishes are followed.

This isn’t just something for the wealthy. It’s a critical process for every single adult in Ontario.

Why Estate Planning Is Your Family’s Financial Blueprint

Think of an estate plan as the ultimate instruction manual you leave behind for your loved ones. It’s a detailed blueprint that spells out exactly how you want your affairs handled when you’re no longer around to manage them. Planning ahead is, fundamentally, an act of care. It’s designed to prevent confusion, sidestep potential conflicts, and lift the administrative burden from your family during an incredibly tough time.

This guide will walk you through the core concepts of wills and estate law here in Ontario. We’ll show you how a well-crafted plan guarantees your final wishes are honoured and your hard-earned assets are protected for the people you care about. From our home base in Burlington to clients all across the GTA, our goal is to help you secure your legacy.

The Purpose of a Will and Estate Plan

A solid estate plan answers the big questions that will inevitably come up. If you don’t provide the answers yourself, Ontario’s laws will step in, and the government’s plan may look nothing like what you would have wanted.

A proper plan covers several key areas:

- Asset Distribution: It clearly states who gets what—your property, money, and other assets—which helps prevent arguments among family members.

- Estate Trustee Appointment: You get to choose a trusted person or institution to be in charge of carrying out your will’s instructions.

- Guardianship for Minors: For parents, this is huge. You can name a guardian to care for your dependent children, ensuring they are looked after by someone you trust.

- Incapacity Planning: Using Powers of Attorney, you appoint someone to manage your finances and make healthcare decisions for you if you become unable to do so yourself.

An estate plan isn’t about preparing for death. It’s about organizing your life and finances to protect the people who matter most. It gives your family a clear, legally-binding roadmap to follow, taking all the guesswork out of the equation.

Why Every Adult in Ontario Needs a Plan

Too many people think estate planning is just for the rich, but that’s a dangerous myth in Ontario. If you own anything at all—a bank account, a car, a home, or even just items with sentimental value—you have an estate.

Without a will, you are considered to have died “intestate.” When that happens, Ontario’s Succession Law Reform Act kicks in and distributes your property according to a rigid, one-size-fits-all formula. This can lead to some seriously unwelcome surprises. For example, common-law partners don’t automatically have the same inheritance rights as married spouses under these rules.

Putting a proper estate plan in place puts you back in the driver’s seat. It ensures your legacy is defined by your choices, not by a government default.

The Three Pillars of Your Ontario Estate Plan

A solid estate plan is much more than just a document that gets dusted off after you’re gone. It’s a complete safety net, built to protect you during your lifetime and provide for your loved ones afterward. In Ontario, this structure rests on three essential legal pillars that work together to cover every angle.

Think of it like coaching a sports team. Your Last Will and Testament is the playbook for what happens after the final whistle—it directs how everything is settled. But what about the crucial decisions that need to be made during the game if you, the head coach, are suddenly unable to call the plays? That’s where your Powers of Attorney come in. They are your trusted team captains on the field.

Your Last Will and Testament: The Playbook

The Last Will and Testament is the document most people think of when they hear wills and estate law, and for good reason. It’s your final instruction manual for everything you own—your house, your investments, your car, even your sentimental belongings. Legally, this is all known as your “estate.”

At its core, a will does a few critical jobs:

- Appoint an Estate Trustee: This is the person or institution you put in charge of carrying out your instructions. They have the vital responsibility of managing your estate from start to finish.

- Name Your Beneficiaries: This is where you clearly state who you want to inherit your assets.

- Outline Asset Distribution: It specifies exactly how and when your property should be passed on to your beneficiaries.

- Name a Guardian for Minor Children: If you have young children, this is arguably the most important function of a will. You get to legally name the person you trust to care for them if you’re no longer around.

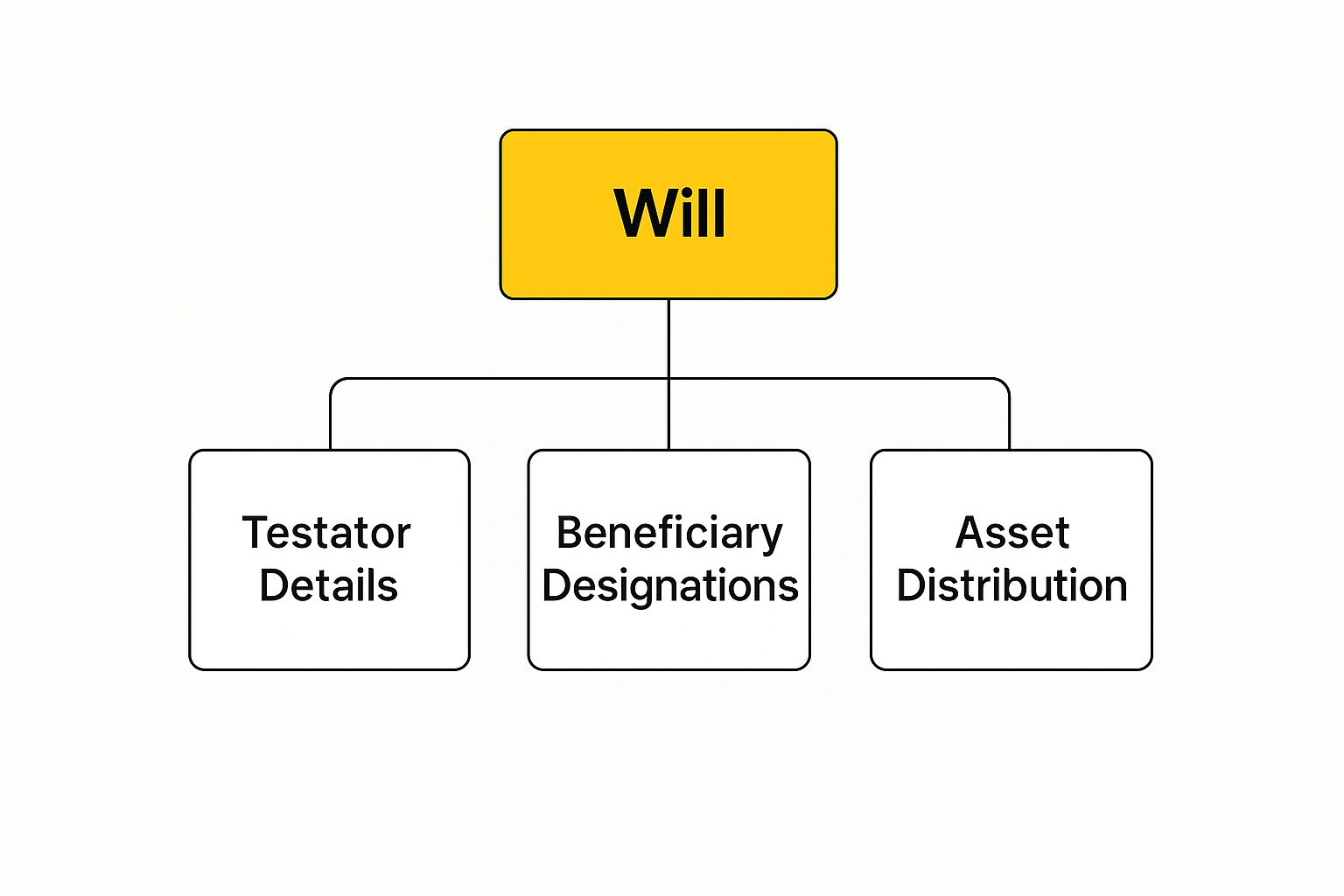

This image breaks down the fundamental pieces that make up a will.

As you can see, a will is a precise legal instrument. It’s all about creating an organized, legally binding plan for who you are, who benefits from your life’s work, and how your assets are ultimately handled.

Powers of Attorney: Your In-Game Captains

While a will only kicks in after your death, Powers of Attorney (POAs) are designed to protect you while you’re still alive. These are powerful legal documents that let you appoint someone you trust—your “attorney”—to make decisions for you if you become mentally or physically unable to make them yourself.

In Ontario, there are two distinct types, and for total protection, you really need both.

Power of Attorney for Property

This document gives your chosen person the authority to manage your financial world. It can cover everything from simple, day-to-day tasks to major financial decisions.

Their responsibilities could include:

- Paying your bills and managing your bank accounts.

- Handling your investments.

- Managing, renting, or selling your real estate.

- Collecting income or debts owed to you.

Without one, your family might have to go to court to get the legal authority to manage your finances. That process is often expensive, incredibly stressful, and can take a long time.

Power of Attorney for Personal Care

This second captain is in charge of your health and well-being. This person steps in when you can’t communicate your own wishes about medical treatments and personal care.

Their authority is crucial and covers decisions like:

- Giving or refusing consent for medical procedures.

- Choosing where you will live (for example, a long-term care home).

- Making decisions about your nutrition, hygiene, and safety.

Together, these two POAs and your will create a seamless plan. They protect you during your lifetime and ensure your legacy is handled exactly as you wished after you pass away. For a deeper dive into these topics, our extensive legal resource centre has more detailed articles.

A will looks after your property and your family after you die. Powers of Attorney look after you and your property while you are still alive. Neglecting them leaves a massive gap in your estate plan.

To help you see how these pieces fit together, here is a quick overview of the key documents involved in Ontario estate planning.

Key Estate Planning Documents in Ontario

| Document | Purpose | When It Is Used |

|---|---|---|

| Last Will and Testament | To appoint an Estate Trustee, name guardians for minor children, and direct the distribution of your assets (your “estate”). | After your death. |

| Power of Attorney for Property | To appoint someone to manage your financial affairs, including banking, investments, and real estate. | During your lifetime, if you become mentally or physically incapable. |

| Power of Attorney for Personal Care | To appoint someone to make decisions about your health care, housing, and other aspects of your personal life (like nutrition). | During your lifetime, if you become unable to make these decisions yourself. |

These three documents form the bedrock of almost every comprehensive estate plan in the province, ensuring you and your assets are protected no matter what happens.

Making Sure Your Will is Legally Bulletproof in Ontario

Putting your wishes on paper is one thing; creating a legal document that holds up in court is another entirely. For a will to be valid in Ontario, it has to meet the strict technical standards laid out in the province’s Succession Law Reform Act. Think of these rules like the building code for a house—if you ignore them, the whole structure could be condemned.

This is where we get into the nuts and bolts of making your will legally sound. We’ll walk through the absolute must-haves, from the required mental state to the precise way it needs to be signed. Getting these details right is the key to preventing your will from being challenged or, worse, thrown out by a judge, which would leave your family navigating a stressful and costly mess.

The Foundation: Testamentary Capacity

Before a will is even considered, the person making it—known as the testator—must have what the law calls testamentary capacity. This isn’t a general medical diagnosis; it’s a specific legal test of your state of mind at the exact moment you sign the will.

You don’t need to be in perfect health, but you absolutely must be able to grasp a few core concepts:

- What you’re doing: You have to understand that you’re signing a will, a document that gives away your property after you die.

- What you own: You need a general sense of your assets—your house, bank accounts, investments, and so on.

- Who you’re providing for: You must be aware of the people who might have a claim on your estate, like your spouse and children, and understand your relationship with them.

A will can be torn apart in court if there’s proof the testator didn’t have this mental capacity when they signed it. It’s one of the most common reasons for a will dispute.

A good estate lawyer protects against this by taking careful notes during your meetings. They’ll ask pointed questions to confirm your understanding, creating a professional record that serves as a powerful defence if your capacity is ever questioned down the road.

The Formalities: Signing and Witnessing Protocols

The standard, typed will in Ontario is called a formal will, and the signing process has to be perfect. The law is incredibly strict here, and there’s no room for “close enough.” A small slip-up can make the entire document worthless.

The rules are simple, but they must be followed to the letter:

- You Sign First: You, the testator, must sign the will at the very end.

- Two Witnesses, Together: At least two credible witnesses must be physically present at the same time.

- They Watch You: Both witnesses must watch you sign your name.

- You Watch Them: Both witnesses must then sign the will while you are still present and watching them.

Here’s a critical detail: anyone who is a beneficiary in the will (or their spouse) cannot be a witness. If they are, any gift they were supposed to receive is usually voided. This is why it’s so important to pick neutral, independent people for the job. You can find more answers to common questions about executing legal documents in our wills and estates FAQ section.

Holographic Wills: The Risk of a DIY Approach

Ontario law does allow for one exception to the witness rule: the holographic will. This is a will written entirely by hand and signed by the testator. No witnesses are needed.

While that might sound like a wonderfully simple shortcut, holographic wills are notoriously risky. They are almost always drafted without legal advice, which means they’re often vague, confusing, or incomplete. This uncertainty almost guarantees a trip to court, where a judge has to spend time and your estate’s money trying to figure out what you actually meant.

A professionally drafted will, by contrast, uses precise legal language that has been tested and refined over centuries. The goal is to leave no room for doubt. The modest fee for having a lawyer draft your will is a tiny price to pay to spare your loved ones from the massive legal bills that a poorly written holographic will can create.

Making Sense of the Ontario Probate Process

The word “probate” can sound intimidating, often conjuring up images of stressful court battles and endless delays. But in Ontario, the reality is much more straightforward.

Think of probate as a formal validation process. It’s the court’s official stamp of approval on a will, confirming it’s the real deal and giving your chosen Estate Trustee the legal green light to get to work.

This step is a cornerstone of wills and estate law because it provides a layer of legal protection for everyone involved. For banks, probate offers certainty that they’re releasing assets to the right person. For beneficiaries, it ensures the will being followed is truly the final, valid one. And for the Estate Trustee, it grants them the official authority to manage the estate’s affairs without being challenged.

While it might sound like a mandatory step, probate isn’t always needed. Whether it’s required really comes down to what kinds of assets the deceased owned.

When Is Probate Necessary in Ontario?

The core question is simple: does a third party, like a bank or the land registry office, need a court-certified document before they’ll hand over control of an asset? If a financial institution is holding a significant amount of money, you can bet they’ll want that formal proof to protect themselves from any liability.

Generally, you’ll need to go through probate in these situations:

- Real Estate: If the deceased owned a house or condo in their name alone, probate is required to transfer the title or sell the property.

- Significant Bank Accounts: Most banks and investment firms will freeze accounts over a certain amount (the threshold varies) until they see a probated will.

- Corporate Shares: Transferring ownership of shares in either a private or public company almost always requires a grant of probate.

That said, there are common scenarios where assets can bypass the probate process entirely, saving the estate a great deal of time and money.

Probate is a safeguard, not a penalty. It’s a legal checkpoint that confirms the will’s validity and officially empowers the Estate Trustee to begin their duties under the court’s supervision.

Assets That Can Avoid the Probate Process

With some smart estate planning, you can significantly reduce the number of assets that have to go through probate. Certain ownership structures and beneficiary designations allow assets to flow directly to their intended recipients, completely bypassing the court.

Here are a few classic examples:

- Jointly Owned Property with Right of Survivorship: When a couple owns a home as “joint tenants,” the property automatically passes to the surviving owner when one of them dies. It happens outside of the will and avoids probate.

- Assets with Designated Beneficiaries: Registered accounts like an RRSP, RRIF, or TFSA, along with life insurance policies, let you name a beneficiary. When you pass away, those funds are paid straight to that person, keeping them out of your estate and away from the probate process.

- Gifts Made During Your Lifetime: It might sound obvious, but assets you’ve already given away are no longer part of your estate and therefore aren’t subject to probate.

Understanding these distinctions is a huge part of effective estate planning and can make the administration process much smoother for your loved ones down the road.

The Key Steps of the Probate Application

When probate is necessary, the Estate Trustee (or their lawyer) applies to the Superior Court of Justice for a Certificate of Appointment of Estate Trustee with a Will. This document is the golden ticket that unlocks the estate’s assets. The process itself follows a clear sequence.

- Gathering Information and Valuing Assets: The first job is to take inventory. The Trustee needs to create a detailed list of everything the deceased owned—real estate, bank accounts, investments, even cars and personal belongings—and determine its fair market value on the date of death.

- Preparing the Application Forms: Next comes the paperwork. Several court forms need to be filled out with details about the deceased, the will, the beneficiaries, and the Estate Trustee. Crucially, the original signed will must be filed with the application.

- Calculating and Paying the Estate Administration Tax (EAT): This is essentially Ontario’s probate fee, and it’s calculated as a percentage of the estate’s total value. The tax is $0 on the first $50,000 of the estate’s value and then $15 for every $1,000 (or 1.5%) on the value above that. This estimated tax has to be paid right when the application is submitted.

- Filing with the Court and Receiving the Certificate: Once all the documents are filed and the tax is paid, the court reviews the application. If everything checks out, it issues the Certificate of Appointment. This is the moment the Estate Trustee is legally empowered to manage and distribute the estate just as the will instructs.

The Estate Trustee Job: What You Need to Know

Being named an Estate Trustee in a will is a true sign of trust, but it’s not a role to take lightly. It’s a serious commitment—think of it as being handed the keys to a complex business, complete with major legal and financial duties. The law in Ontario holds you to an incredibly high standard, expecting you to manage everything with honesty, care, and always in the best interests of the beneficiaries.

This isn’t a job for just anyone. It takes a steady hand, great organizational skills, and the emotional fortitude to make tough, impartial calls. Before you even think about accepting, it’s vital to understand what you’re signing up for, from day one right through to the end.

The Immediate First Steps

The moment the person who wrote the will (the testator) passes away, your responsibilities as Estate Trustee kick in. The first few days and weeks are a whirlwind of securing the estate and getting your bearings.

Here are the first things you’ll need to tackle:

- Locate the Original Will: This document is your roadmap. You need to find the original, signed Last Will and Testament. Photocopies usually won’t cut it for legal proceedings like probate.

- Arrange the Funeral: The will might have specific instructions for the funeral or burial. It’s your job to see that these wishes are honoured and carried out respectfully.

- Secure the Assets: This is one of your most critical initial tasks. You have to protect what’s in the estate—that could mean changing the locks on a house, putting valuables in a safe place, and notifying banks and other financial institutions to freeze accounts and prevent unauthorized transactions.

The Core Administrative Duties

Once the initial urgencies are handled, you’ll settle into the long-haul administrative phase. This is the heart of the job, where being organized and keeping meticulous records is absolutely everything. You are now the central manager for all things related to the estate.

Your core responsibilities will include:

- Inventory and Valuation: You’ll need to create a detailed list of every single asset the person owned. We’re talking bank accounts, investments, real estate, cars, even personal belongings. Then, you have to determine their fair market value as of the date of death.

- Applying for Probate: In many cases, you’ll have to apply to the court for a Certificate of Appointment of Estate Trustee. This is the official document that validates the will and gives you the legal authority to act.

- Managing Estate Finances: This involves opening a dedicated bank account for the estate, paying any ongoing bills (like hydro or property taxes), and collecting any money owed to the deceased, such as final paycheques or rental income.

At the core of the Estate Trustee’s job is something called a fiduciary duty. This is a legal and ethical obligation to act with total good faith and loyalty. It means you must always put the beneficiaries’ interests ahead of your own. A breach of this duty can have serious consequences, including being held personally liable for any losses.

Finalizing the Estate and Distribution

The last stretch involves wrapping everything up financially and getting the assets into the hands of the beneficiaries. This final stage demands incredible attention to detail to ensure every legal loose end is tied up before anyone receives their inheritance. Navigating these final steps often requires professional guidance, and the legal experts on our team have extensive experience guiding trustees through this process.

Here’s what the final phase looks like:

- Paying Debts and Taxes: First, you have to track down and pay all the deceased’s legitimate debts using estate funds. You’re also responsible for filing all the necessary tax returns—this includes a final personal tax return for the deceased and potentially a trust return for the estate itself.

- Preparing a Financial Accounting: You must provide the beneficiaries with a clear, detailed report showing every dollar that came into the estate and every dollar that went out. Transparency is key.

- Distributing the Assets: After all the debts and taxes are paid and you’ve received a clearance certificate from the Canada Revenue Agency, you can finally distribute the remaining assets to the beneficiaries exactly as laid out in the will.

Putting It All Into Action

Knowing the ins and outs of wills and estate law is one thing, but actually putting that knowledge to work is what truly protects your family. Think of everything we’ve covered as the blueprint. Now, it’s time to build the plan that will provide clarity and security for the people you care about most.

The core ideas are simple enough. You need a legally sound will to control who gets what. You need Powers of Attorney to protect you while you’re alive. And understanding probate helps prepare your chosen Estate Trustee for what’s ahead.

Your Estate Planning To-Do List

Getting started can feel like a huge task, but it doesn’t have to be. Let’s break it down into a few manageable steps to get the ball rolling. This simple checklist will help you create a plan that secures your legacy and protects your loved ones.

-

Do Your Homework (Gather Documents): Before you do anything else, start pulling together your important paperwork. This means things like property deeds, bank account details, investment statements, insurance policies, and any marriage or separation agreements. Having this file ready will make your meeting with a lawyer incredibly productive.

-

Choose Your Team: Spend some real time thinking about who you trust for the most important roles. Who is organized and responsible enough to be your Estate Trustee? Who would you trust to raise your kids as their guardian? Who will make the right calls as your Attorney for Property and Personal Care?

-

Sketch Out Your Wishes: You don’t need a formal document, but before you see a lawyer, try to outline what you want to happen. Who gets your assets? Are there specific items you want to go to certain people? Just having a rough draft of your intentions will provide a great starting point for a professional discussion.

Your most important step? Sit down with an experienced estate lawyer. This isn’t a DIY project. Professional advice is the only way to guarantee your documents are legally valid in Ontario and that your plan is perfectly tailored to your unique family and financial situation.

By taking these first few steps, you’re moving from just thinking about it to doing it. A well-crafted estate plan is a final gift to your family—it gives them a clear roadmap and lifts a heavy burden during an already difficult time. The peace of mind that comes with it is priceless.

Your Top Questions About Ontario Wills and Estates Answered

When you start digging into wills and estate law, it’s natural for a lot of questions to pop up. Getting clear answers is the first step toward protecting your family and making sure your final wishes are honoured. Here are some of the most common questions we hear from our clients in Burlington and across the GTA, with straightforward answers to help you get started.

What Happens If I Die Without a Will in Ontario?

If you pass away without a will, it’s called dying “intestate.” When that happens, you essentially lose your say in what happens to everything you’ve worked for. Your wishes become irrelevant, and the Ontario government takes over, dividing your property according to a strict, impersonal formula laid out in the Succession Law Reform Act.

The law automatically gives your assets to your closest relatives, like a spouse or children. But here’s a critical point many people miss: common-law partners have no automatic inheritance rights under this system. This can lead to truly heartbreaking situations. Without a will, you also give up the right to name who manages your estate or who becomes the guardian for your kids, which can create a world of stress and conflict for the people you love most.

How Often Should I Update My Will?

Think of your will as a living document, not something you write once and file away forever. A good rule of thumb is to pull it out for a review every 3 to 5 years just to make sure it still makes sense for your life.

Even more importantly, certain life events should trigger an immediate update. If any of these happen, it’s time to call your lawyer:

- You get married or divorced.

- You start or end a common-law relationship.

- A new child or grandchild arrives through birth or adoption.

- Your financial picture changes significantly, for better or worse.

- Someone named in your will, like a beneficiary or your Estate Trustee, passes away.

An outdated will can be just as damaging as having no will at all. It can create a legal mess that doesn’t reflect your current reality or relationships, leading to the kind of confusion and conflict you were trying to prevent in the first place.

Are DIY Will Kits a Good Idea in Ontario?

You can legally use a do-it-yourself will kit, but frankly, it’s a huge gamble. These fill-in-the-blank templates are generic by design and simply can’t account for the unique details of your family and financial situation.

The risk of making a mistake is incredibly high. Vague wording, incorrect witnessing, or other simple errors can get the entire document thrown out by a court. If your will is declared invalid, it’s as if you died without one—and your estate gets divided by the government’s rules. The money you might save upfront is nothing compared to the potential cost of future legal battles and family fallouts. The only way to be certain your will is solid, valid, and does exactly what you want it to is to have it professionally drafted by a lawyer.

Navigating the world of wills and estates can feel overwhelming, but it doesn’t have to be. At UL Lawyers Professional Corporation, we work with people across Ontario to build solid estate plans that deliver security and true peace of mind. To talk about your situation, schedule your free consultation with UL Lawyers Professional Corporation today.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies