Estate Planning Checklist Canada: 7 Essential Tips for 2025

Navigating the complexities of estate planning can feel overwhelming, but it is one of the most crucial steps you can take to protect your family and secure your assets. For residents of Ontario, from Burlington to the broader GTA, understanding the specific legal landscape is paramount. Procrastination or misinformation can lead to significant emotional and financial strain on your loved ones, creating unintended tax burdens, family disputes, and lengthy legal challenges in provincial courts. A well-structured plan ensures your wishes are respected and that the wealth you’ve built is transferred smoothly and efficiently.

This comprehensive estate planning checklist for Canada breaks down the process into seven manageable, actionable steps. We will move beyond generic advice to provide detailed insights, practical examples, and Ontario-specific considerations, ensuring you have a clear roadmap for your future. This guide is designed to empower you with the knowledge needed to make informed decisions, ensuring your final wishes are clearly documented and legally sound.

Inside, you will find a detailed breakdown of essential components, including drafting a will, establishing powers of attorney for property and personal care, and reviewing beneficiary designations on accounts like RRSPs and TFSAs. We will explore advanced strategies such as tax planning, the strategic use of trusts, and assessing life insurance needs. Whether you are just beginning to consider your legacy or need to review an existing plan, this checklist provides the clarity and direction required to confidently secure your family’s future and protect your hard-earned assets.

1. Creating a Will: The Cornerstone of Your Estate Plan

A Last Will and Testament is arguably the most critical component of any comprehensive estate planning checklist in Canada. This legal document serves as your official instruction manual, detailing exactly how your assets (your “estate”) should be managed and distributed after your death. Without a valid will, you die “intestate,” and provincial law dictates who inherits your property. In Ontario, this process is governed by the Succession Law Reform Act, which may lead to an outcome that starkly contrasts with your actual wishes.

Creating a will allows you to maintain control. You can designate beneficiaries for specific assets, outline the distribution of your remaining (“residue”) estate, and, most importantly for parents, name a legal guardian for your minor children. This single document prevents family disputes, reduces administrative delays, and ensures your loved ones are cared for according to your directives.

Real-World Scenarios in Ontario

- For a Young Family: A couple in Toronto with two young children can use their wills to name a trusted sibling as guardian. They can also establish a testamentary trust, ensuring their children’s inheritance is managed responsibly by a trustee until they reach a mature age, such as 25.

- For a Business Owner: An entrepreneur in Mississauga can draft a will with a specific clause addressing their corporate shares. This ensures the business succession is handled separately from their personal assets, preventing operational disruption and providing clarity for their family and business partners.

- For Specific Bequests: An individual in Ottawa might wish to leave a C$20,000 legacy to a local animal shelter. Their will can specify this charitable gift before dividing the rest of their estate equally among their nieces and nephews, guaranteeing their philanthropic goals are met.

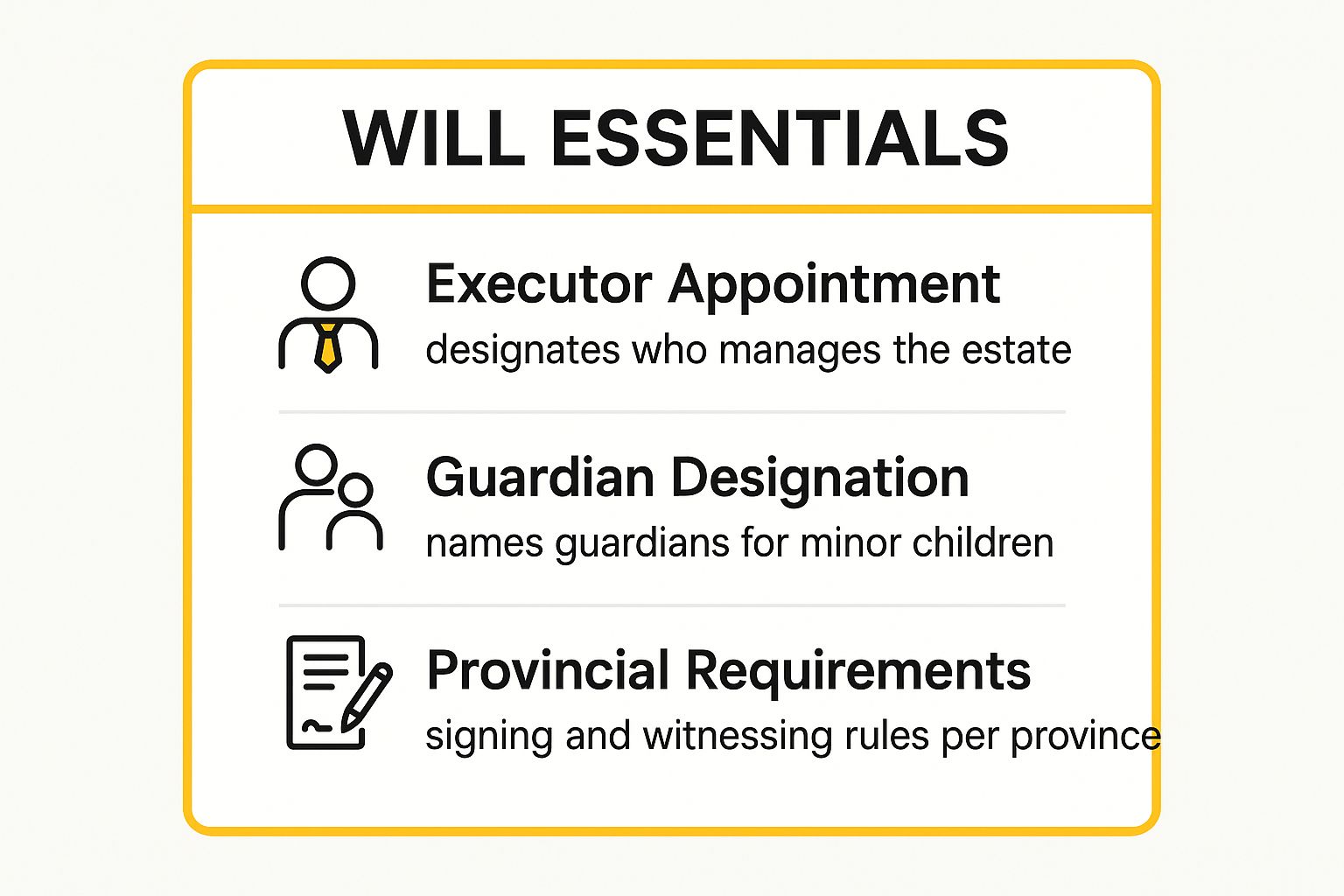

The infographic below highlights the fundamental components every valid will should address.

As shown, a properly drafted will goes beyond simple asset division; it structures the entire administration of your estate, from appointing a trusted executor to safeguarding your children’s future.

Actionable Tips for Your Will

Key Insight: A will is not a “set it and forget it” document. Treat it as a living part of your financial plan that must adapt to your changing life circumstances to remain effective.

- Regular Reviews are Crucial: Revisit your will every 3-5 years, or immediately following major life events like marriage, divorce, the birth of a child, or a significant change in financial status.

- Ensure Proper Storage: Store the original signed will in a secure yet accessible location. Avoid a personal safety deposit box, as it may be sealed upon your death, causing delays. Inform your executor of the will’s location.

- Draft a Letter of Wishes: For personal effects with more sentimental than monetary value or for funeral preferences, prepare a separate, non-binding letter of wishes. This keeps the will clean and focused on legal and financial matters.

- Seek Professional Guidance: The legal requirements for a valid will in Ontario are precise. Engaging a law firm ensures your document is legally sound, accurately reflects your intentions, and minimizes the risk of challenges during the probate process. If you need more information about this stage, you can learn more about how to probate a will in Ontario.

2. Establishing Power of Attorney

While a will addresses the management of your estate after death, a Power of Attorney (POA) is a critical legal document that protects you during your lifetime. It allows you to appoint a trusted individual, known as your “attorney,” to make financial and legal decisions on your behalf if you become mentally or physically incapacitated. Without a valid POA, your family would face a costly and lengthy court process in Ontario to be appointed as your guardian of property, causing significant stress during an already difficult time.

In Ontario, there are two main types of POAs: a Continuing Power of Attorney for Property allows your attorney to manage your financial affairs even after you become incapable, while a Power of Attorney for Personal Care authorizes your appointed attorney to make healthcare and personal life decisions. Establishing these documents is a cornerstone of a complete estate planning checklist in Canada, ensuring your affairs are managed seamlessly by someone you trust, according to your wishes.

Real-World Scenarios in Ontario

- For an Aging Parent: A senior in Oakville can appoint their financially savvy adult child as their attorney for property. This allows the child to pay bills, manage investments, and handle banking transactions if the parent develops dementia and can no longer manage their own finances.

- For a Small Business Owner: A business owner in Hamilton can grant a specific or limited POA to their business partner. This would authorize the partner to sign contracts or access business accounts only if the owner is hospitalized after an accident, preventing operational paralysis.

- For Unexpected Illness: A young professional in Burlington who suffers a sudden, severe illness can rely on their appointed attorney to manage their mortgage payments and file their taxes. This prevents their financial obligations from falling into arrears while they focus on recovery.

These scenarios illustrate how a Power of Attorney acts as a vital safeguard, providing a clear plan for managing your affairs when you are most vulnerable.

Actionable Tips for Your Power of Attorney

Key Insight: Choosing your attorney is one of the most important decisions in estate planning. This person must be trustworthy, capable of managing complex financial or healthcare decisions, and willing to act in your best interests.

- Choose Your Attorney Wisely: Select someone with integrity and financial acumen. It is crucial to have an open conversation with your chosen person to ensure they understand and are willing to accept the significant responsibility.

- Appoint Alternates: Name at least one alternate attorney in your POA documents. This ensures you are still protected if your first choice is unable or unwilling to act when the time comes.

- Clearly Define Authority: Your POA can be general, granting broad powers, or specific, limiting the attorney to certain tasks like selling a property. Tailor the document to grant only the authority you are comfortable with.

- Meet Provincial Requirements: The legal requirements for a valid Power of Attorney, such as having witnesses, are strict in Ontario. Using an experienced lawyer ensures your document is compliant with Ontario’s Substitute Decisions Act, 1992 and will be honoured by financial institutions. If you need assistance, you can find out more about our wills and estate law services.

3. Creating a Power of Attorney for Personal Care (Living Will)

While a will addresses your financial legacy, a Power of Attorney for Personal Care, sometimes referred to as an advance directive or living will, is a crucial legal document that addresses your personal and medical legacy. This document is a key part of any comprehensive estate planning checklist for Canada, as it outlines your specific wishes for healthcare and medical treatment in the event you become mentally incapable of making or communicating those decisions yourself. It allows you to appoint a substitute decision-maker, your “attorney for personal care,” to act on your behalf.

Without this directive, critical healthcare decisions could fall to family members who may be uncertain of your wishes, or worse, disagree on a course of action during an already stressful time. In Ontario, the Health Care Consent Act outlines a strict hierarchy of who can make decisions for you if you haven’t appointed someone. Creating a Power of Attorney for Personal Care ensures your values and beliefs regarding medical interventions, palliative care, and end-of-life choices are respected, removing the burden of uncertainty from your loved ones.

Real-World Scenarios in Ontario

- For a Senior: A senior in Barrie can use their Power of Attorney for Personal Care to name their eldest daughter as their attorney and specify their preference for palliative comfort care over aggressive life-sustaining treatments if they are diagnosed with a terminal illness with no hope of recovery.

- For Specific Beliefs: An Ottawa resident who has specific religious beliefs that affect medical choices, such as views on blood transfusions, can clearly articulate these instructions in their directive, ensuring medical staff and their appointed attorney adhere to these deeply held values.

- For Pre-Surgical Planning: A patient in Kingston facing a high-risk surgery can prepare a directive that appoints their spouse as their attorney for personal care. It can include detailed instructions on pain management preferences and their desire to avoid a permanent vegetative state, providing clear guidance for a potential worst-case scenario.

The directive empowers your chosen representative to make informed decisions that align with your expressed values, from routine medical choices to the most profound end-of-life considerations.

Actionable Tips for Your Power of Attorney for Personal Care

Key Insight: Your Power of Attorney for Personal Care is a conversation starter as much as it is a legal document. Open and honest discussions with your appointed decision-maker and family are essential to ensure your wishes are truly understood and can be carried out effectively.

- Discuss Wishes with Your Attorney: Don’t just sign the document. Have a detailed conversation with your chosen substitute decision-maker about your values, fears, and specific preferences for various medical scenarios. Ensure they are willing and able to take on this significant responsibility.

- Be Specific but Flexible: While you can outline specific treatments you wish to accept or refuse, it’s also wise to include statements about your broader values regarding quality of life. This gives your attorney guidance when facing unforeseen medical situations not explicitly covered in the document.

- Distribute Copies Appropriately: Provide copies of the signed directive to your substitute decision-maker, your doctor, and other close family members. Keep the original in a safe but easily accessible place, not in a safety deposit box that may be sealed upon your incapacitation.

- Consult Medical and Legal Professionals: Discuss potential medical scenarios with your doctor to understand the implications of your choices. Engaging a lawyer ensures your directive is legally valid in Ontario and accurately reflects your intentions, preventing potential challenges or confusion.

4. Beneficiary Designations Review

Beyond your will, one of the most powerful and often overlooked tools in a Canadian estate planning checklist is the direct beneficiary designation. Available on registered accounts like RRSPs, RRIFs, TFSAs, pension plans, and life insurance policies, this feature allows these assets to bypass your estate entirely. The funds pass directly to your named beneficiaries, avoiding the probate process, associated fees (known in Ontario as the Estate Administration Tax), and potential delays.

This direct transfer is efficient and private, but it carries a significant risk if not managed carefully. A beneficiary designation supersedes any instructions in your will. If your will states your entire estate goes to your spouse, but your ex-spouse is still named as the beneficiary on your C$500,000 life insurance policy, those funds will go to your ex-spouse. This makes a regular review of these designations an absolutely critical task.

Real-World Scenarios in Ontario

- For a Divorced Professional: A Toronto engineer, following their divorce, immediately reviews their RRSP and life insurance policies. They update the beneficiary from their ex-spouse to their two children, ensuring their primary assets are directed according to their new family structure and intentions.

- For Proactive Planning: A teacher in London, Ontario, names her husband as the primary beneficiary of her pension plan. To account for unforeseen events, she also names her three children as contingent beneficiaries, ensuring the pension benefits will be distributed to them if her husband predeceases her.

- For Strategic Asset Allocation: A retiree in Niagara designates his adult children as the direct beneficiaries of his RRIF. Simultaneously, he names his spouse as the beneficiary of his TFSA, allowing for a tax-efficient rollover of that account while ensuring other assets are distributed directly to the next generation.

Actionable Tips for Your Beneficiary Designations

Key Insight: Beneficiary designations operate outside of your will. Treating them as an afterthought can accidentally disinherit loved ones and completely undermine your primary estate plan.

- Review All Designations Annually: Make it a yearly financial habit to review every account with a beneficiary designation. Create a master list of these accounts to ensure none are missed.

- Update After Major Life Events: Immediately update your designations after events like marriage, divorce, the birth or adoption of a child, or the death of a named beneficiary. This prevents outdated and unintended distributions.

- Coordinate with Your Overall Plan: Ensure your beneficiary designations work in harmony with your will, not against it. For instance, if your will creates a trust for a minor child, you might name the estate as the beneficiary on a policy so the proceeds can fund that trust.

- Name Contingent Beneficiaries: Always name a backup or contingent beneficiary. This provides a clear line of succession if your primary beneficiary is unable to inherit the asset, preventing it from defaulting to your estate. For answers to other common questions, you can find frequently asked questions about beneficiary designations and estate planning here.

5. Tax Planning and RRSP/RRIF Strategies

A key, yet often overlooked, part of a comprehensive estate planning checklist in Canada is proactive tax planning. Upon death, you are deemed to have sold all your capital property at fair market value, triggering a final tax bill for your estate. This “deemed disposition” can significantly erode the value of assets passed to your heirs, especially for registered accounts like Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs).

Effective tax strategy focuses on minimizing this final tax liability. By strategically structuring your assets and registered accounts, you can defer or reduce the taxes payable by your estate. This ensures more of your hard-earned wealth is transferred to your beneficiaries rather than to the Canada Revenue Agency (CRA). Thoughtful planning can prevent the forced liquidation of assets simply to cover a substantial tax bill.

Real-World Scenarios in Ontario

- For a Surviving Spouse: A couple in Kitchener can structure their RRSPs and RRIFs to name each other as the beneficiary. Upon the death of the first spouse, the full value of their registered accounts can “roll over” to the surviving spouse on a tax-deferred basis, avoiding immediate taxation and preserving the capital.

- For Philanthropic Goals: A retired professor in Guelph with a large, appreciated stock portfolio can donate some of these securities to a registered charity in their will. This strategy eliminates the capital gains tax on the donated shares and generates a donation tax credit that can offset other taxes on their final return.

- For Business Owners: An entrepreneur in Vaughan can utilize their lifetime capital gains exemption (LCGE) for qualified small business corporation shares. Proper planning ensures their will directs the shares in a way that maximizes this exemption, shielding a significant portion of the business’s value from capital gains tax upon their death.

As shown, strategic planning around registered accounts and capital property is essential for preserving your estate’s value for the next generation.

Actionable Tips for Tax and RRSP/RRIF Planning

Key Insight: Your final tax return is often the largest one you will ever file. Treating tax planning as an integral part of your estate plan is not just about saving money; it is about fulfilling your legacy as intended.

- Maximize Spousal Rollovers: Ensure your spouse or common-law partner is designated as the direct beneficiary (or successor annuitant for a RRIF) on your registered accounts to allow for a tax-free rollover.

- Consider Charitable Giving: If philanthropy aligns with your values, planned giving through your estate can be a powerful tool to reduce taxes while supporting causes you care about.

- Review Beneficiary Designations: Regularly review the beneficiaries named on your RRSPs, RRIFs, and TFSAs. These designations bypass your will and have direct tax implications, so they must align with your overall estate plan.

- Engage a Professional: Estate tax law is complex. Working with a financial planner and an accountant who specialize in estate planning ensures your strategies are optimized, compliant with current CRA regulations, and tailored to your specific financial situation.

6. Trust Structures and Considerations

A trust is a powerful and flexible legal tool within a Canadian estate planning checklist. It is a formal arrangement where an individual (the “settlor”) transfers assets to a person or entity (the “trustee”), who holds and manages those assets for the benefit of others (the “beneficiaries”). Trusts can provide significant advantages, including tax benefits, asset protection, and precise control over how and when inheritances are distributed.

Using a trust allows you to set specific conditions on how your assets are used, which is particularly valuable for complex family dynamics. This legal structure can protect inheritances from beneficiaries’ creditors, manage funds for minors or those with disabilities, and ensure your wealth is preserved for future generations. It offers a level of customization and control that a standard will alone cannot always provide.

Real-World Scenarios in Ontario

- For Blended Families: An executive in Toronto with children from a previous marriage can establish a spousal trust. This allows their current spouse to benefit from the income generated by the estate assets for their lifetime, while ensuring the capital (the original assets) is preserved and ultimately passes to the children from the first marriage.

- For Education Planning: A Markham-based business owner can create an education trust for their grandchildren. They can fund it with specific assets and direct the trustee to distribute funds only for verified university or college expenses, ensuring the money is used for its intended purpose.

- For Beneficiaries with Disabilities: A parent in Ottawa can establish a Henson trust in their will for a child receiving Ontario Disability Support Program (ODSP) benefits. This type of trust protects the inheritance from affecting the child’s eligibility for government support, ensuring their financial security.

Trusts provide a sophisticated layer of planning, allowing for nuanced solutions tailored to specific family and financial situations.

Actionable Tips for Your Trust

Key Insight: A trust is not just a document; it’s an active legal relationship. The choice of trustee and the clarity of the trust deed are paramount to its long-term success.

- Clearly Define Purpose and Beneficiaries: Be explicit in the trust document about its goals (e.g., education, lifetime support) and who qualifies as a beneficiary. Ambiguity can lead to disputes and administrative challenges.

- Choose Trustees Carefully: Your trustee will have significant legal and financial responsibilities. Consider naming a professional corporate trustee, especially for complex or long-term trusts, to ensure impartial and expert management.

- Understand the 21-Year Rule: In Canada, most trusts are subject to a “deemed disposition” rule every 21 years, which can trigger capital gains tax. This rule must be a central part of your planning to avoid unexpected tax liabilities. You can find out more by exploring our practice areas in wills and estates.

- Ensure Proper Documentation: A trust must be meticulously documented and administered. Maintain clear records of all transactions, decisions, and distributions to comply with legal requirements and provide transparency for beneficiaries.

7. Life Insurance Assessment

A strategic life insurance assessment is a fundamental part of any robust estate planning checklist in Canada. Far more than a simple safety net, life insurance is a powerful financial tool that provides immediate, tax-free liquidity to your beneficiaries upon your death. This liquidity can be used to cover final expenses, pay off debts, replace lost income for dependents, and, critically, settle estate taxes and other liabilities without forcing the sale of valuable assets like a family home or business.

In Canada, the proceeds of a life insurance policy are paid directly to the named beneficiary and do not form part of the estate for probate purposes. This means the funds bypass the often lengthy and costly probate process, providing your loved ones with swift access to cash when they need it most. Properly structured, life insurance ensures your estate plan’s objectives are met efficiently, preserving the value of your legacy for the next generation.

Real-World Scenarios in Ontario

- For a Cottage Owner: A family in Peterborough owns a cherished cottage that has appreciated significantly, creating a large capital gains tax liability for their estate. They purchase a permanent life insurance policy with a death benefit calculated to cover the anticipated tax bill. This ensures their children can inherit the cottage without being forced to sell it to pay the taxes.

- For Small Business Owners: Two partners in a Cambridge-based manufacturing firm have a buy-sell agreement funded by life insurance. If one partner dies, the insurance proceeds are paid to the surviving partner, providing the exact funds needed to purchase the deceased’s shares from their estate. This guarantees a smooth business succession, provides fair market value to the deceased’s family, and ensures business continuity.

- For an Income Earner: A parent in Brampton is the primary income earner for their family. They secure a term life insurance policy to cover their mortgage and provide income replacement for their spouse and children until the children are financially independent. This ensures their family’s standard of living is protected in the event of their premature death.

A well-planned life insurance strategy offers a solution for predictable and unpredictable estate costs alike.

Actionable Tips for Your Life Insurance

Key Insight: View life insurance not just as income replacement, but as a strategic tool for estate preservation, tax planning, and legacy creation. The type and amount of coverage should directly align with the specific goals of your estate plan.

- Review Beneficiary Designations: Life events like marriage, divorce, or the birth of a child should trigger an immediate review of your policy’s beneficiaries. An outdated designation can lead to unintended and irreversible consequences.

- Match Policy Type to Your Needs: Use term insurance for temporary needs, such as covering a mortgage or providing for children until they are financially independent. Use permanent insurance (like whole or universal life) for permanent needs, such as funding final tax liabilities or creating a legacy gift.

- Regularly Reassess Coverage: Your insurance needs will change over time. Review your coverage every 3-5 years or after a significant financial change to ensure it still aligns with the liquidity requirements of your estate plan.

- Explore Advanced Strategies: For complex situations, such as those involving business succession or significant charitable giving, consult with a financial advisor and an estate planning lawyer. They can help structure insurance to maximize its benefits and integrate it seamlessly with your will and trusts. For certain policies, it is also important to understand the distinctions between different claim types, such as those covered under accidental death and dismemberment policies.

Estate Planning Checklist: 7 Key Components Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Creating a Will | Moderate – requires legal formalities | Moderate – lawyer recommended | Clear asset distribution, guardianship | Planning estate distribution and guardianship | Ensures wishes documented, reduces disputes |

| Establishing Power of Attorney | Moderate – legal document, provincial variations | Low to moderate – choice of attorney needed | Authority to manage finances if incapacitated | Incapacity planning, financial decision continuity | Prevents guardianship, tailored authority |

| Creating Power of Attorney for Personal Care | Moderate – healthcare-specific legal form | Low – requires discussions with lawyers | Healthcare wishes respected during incapacity | Medical decisions, end-of-life care planning | Reduces family burden, prevents unwanted care |

| Beneficiary Designations Review | Low – mainly paperwork updates | Low – personal review, occasional legal advice | Fast asset transfer, bypasses probate | Registered accounts, insurance policies | Speedy transfer, privacy, tax advantages |

| Tax Planning and RRSP/RRIF Strategies | High – complex tax rules and strategies | High – professional tax and legal advice | Minimized tax burden, optimized inheritance | Managing taxes on registered accounts and estates | Reduces taxes, maximizes estate value |

| Trust Structures and Considerations | High – complex setup, ongoing management | High – professional trustees, legal fees | Asset protection, controlled distributions | Protecting vulnerable beneficiaries, multi-generation planning | Asset protection, privacy, tax planning |

| Life Insurance Assessment | Moderate – selecting and managing policy | Moderate to high – premium payments ongoing | Financial security, liquidity for estate | Income replacement, estate liquidity, business succession | Tax-free benefits, financial security |

Bringing It All Together: Your Next Steps

Navigating the intricacies of estate planning can feel like assembling a complex puzzle. Each piece, from your Last Will and Testament to your beneficiary designations, represents a critical component of a larger picture: your legacy and your family’s future security. This comprehensive estate planning checklist for Canada has provided a detailed roadmap, guiding you through the essential pillars of a robust plan tailored for Ontarians. We’ve demystified the core documents, explored strategic financial decisions, and highlighted the importance of clear communication.

The journey doesn’t end with simply understanding these concepts. The true value lies in transforming this knowledge into decisive action. Your goal is to build a plan that is not only legally sound but also a genuine reflection of your values and wishes, ensuring your assets are distributed efficiently and your loved ones are protected from unnecessary stress and financial hardship.

Recapping Your Estate Planning Pillars

Let’s briefly revisit the foundational elements we’ve covered. Each one plays a unique and indispensable role in your overall strategy:

- Your Will: This is the cornerstone document, dictating the distribution of your assets and appointing the executor who will manage your estate. Without it, the province of Ontario decides for you, often leading to outcomes you never intended.

- Powers of Attorney: These documents are your voice when you cannot speak for yourself. The Power of Attorney for Property manages your finances, while the Power of Attorney for Personal Care makes crucial health and welfare decisions on your behalf.

- Beneficiary Designations: A simple yet powerful tool, correctly assigned beneficiaries on accounts like RRSPs, RRIFs, and life insurance policies allow these assets to bypass your estate, avoiding probate fees and delays.

- Tax Minimisation Strategies: Proactive tax planning, including understanding capital gains, probate fees, and the strategic use of trusts or insurance, can preserve a significant portion of your estate for your heirs rather than the Canada Revenue Agency.

- Trusts and Insurance: These are more than just financial products; they are strategic instruments. Trusts can provide asset protection and controlled distributions for beneficiaries, while life insurance can create immediate liquidity to cover taxes and other final expenses.

From Checklist to Action Plan

Reading a checklist is the first step; implementation is what truly matters. Procrastination is the greatest risk to any estate plan. The most meticulously crafted intentions are meaningless if they are not legally documented and finalised. Your next steps are clear and manageable.

- Gather Your Information: Start by compiling a comprehensive list of your assets and liabilities. Collect all relevant documents, including property deeds, investment account statements, insurance policies, and loan agreements.

- Have the Difficult Conversations: Talk to your chosen executor and powers of attorney. Discuss your wishes with your family to manage expectations and prevent future conflicts. These conversations, while sometimes uncomfortable, are an invaluable gift to your loved ones.

- Seek Professional Guidance: The legal landscape of estate planning in Ontario is nuanced. A generic, do-it-yourself template simply cannot account for the complexities of your unique family situation, business interests, or financial portfolio.

Key Insight: A successful estate plan is not a static document but a living strategy. It must be reviewed and updated every few years, or whenever a major life event occurs, such as a marriage, divorce, birth of a child, or significant change in financial status.

By moving from passive learning to active planning, you are taking control of your legacy. You are ensuring that your life’s work is protected and that your family is cared for according to your precise wishes. This proactive approach provides more than just financial security; it offers profound peace of mind, knowing that you have organised your affairs with diligence and care. Completing your estate planning checklist for Canada is one of the most meaningful and impactful actions you can take for your family’s future.

Navigating the complexities of wills, trusts, and powers of attorney requires expert guidance. The team at UL Lawyers specializes in creating comprehensive, personalized estate plans for individuals and families across Burlington, the GTA, and all of Ontario. We can help you translate your wishes into a legally sound strategy that protects your assets and your loved ones. Contact UL Lawyers today to schedule a consultation and take the definitive next step in securing your legacy.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies