Power of Attorney vs Executor: An Ontario Guide

The real difference between a power of attorney vs executor boils down to a single, critical question: are you alive or not?

A Power of Attorney (POA) is your chosen representative while you are still living, but only if you become unable to make decisions for yourself. An Executor, on the other hand, steps in to manage your affairs after you’ve passed away. Think of it like a relay race for your life’s administration: the POA runs the first leg, and the Executor takes the baton for the final lap once you’re gone.

Understanding Your Key Representatives in Ontario

When it comes to estate planning in Ontario, it’s crucial to grasp the very different jobs your representatives will have. Both roles demand immense trust and carry serious legal weight, but their authority kicks in at completely separate times and operates under different provincial laws.

A Power of Attorney is a legal document you sign to name someone to handle your affairs if you become mentally incapable. This isn’t a role that’s active from day one; it’s a contingency plan. In Ontario, we split this responsibility into two distinct documents:

- Power of Attorney for Property: This person steps in to manage your financial world—paying your bills, handling investments, and dealing with real estate. You can explore the full scope of this role in our guide on the Power of Attorney for Property.

- Power of Attorney for Personal Care: This individual is entrusted with decisions about your health, living arrangements, and general well-being.

Now, an Executor—who is officially called an “Estate Trustee” in Ontario—is the person you appoint in your Last Will and Testament. Their job doesn’t even begin until after you’ve died.

A Power of Attorney’s authority ends the very moment of death. There’s no overlap. At that precise instant, the Executor’s role begins, though they usually must have the Will validated by the court before they can take action.

This clear-cut transition is designed to prevent confusion. The Executor’s mandate is to find your assets, clear your final debts and taxes, and then distribute whatever is left to the beneficiaries you’ve named in your Will.

To make this even clearer, let’s break down the core differences in a simple table.

Power of Attorney vs Executor At a Glance

The table below offers a quick summary of the fundamental differences between these two vital roles in Ontario.

| Attribute | Power of Attorney | Executor (Estate Trustee) |

|---|---|---|

| When They Act | During your lifetime, only if you become incapacitated. | Only after your death. |

| Source of Authority | A Power of Attorney document. | Your Last Will and Testament, confirmed by a court. |

| Governing Law (Ontario) | Substitute Decisions Act, 1992 | Estates Administration Act & Succession Law Reform Act |

| Primary Duty | To act in your best interests while you are alive. | To carry out the instructions in your Will for your beneficiaries. |

Understanding these distinctions is the first step in building a solid estate plan that protects you during your lifetime and ensures your wishes are honoured after you’re gone.

Defining Your Key Representatives in Ontario Law

When we talk about a power of attorney versus an executor, the first thing to get straight is that these are two completely different jobs, governed by different Ontario laws. They aren’t interchangeable. Think of them as two separate roles for two distinct chapters of your life—and getting them wrong can leave a serious hole in your estate plan.

A Power of Attorney (POA) is a legal document you sign while you’re alive and well. It gives someone you trust—your “attorney”—the power to make decisions for you if you become mentally incapable of doing so yourself. The critical takeaway here is that a POA is for managing your affairs while you are still living.

The Two Pillars of a Power of Attorney

Here in Ontario, the law smartly splits the Power of Attorney into two distinct documents, because managing money and making health decisions are very different responsibilities. You’ll need to appoint someone for each, although you can certainly choose the same person for both roles.

-

Power of Attorney for Property: This document hands over the reins of your financial world to your attorney. Their authority is broad, covering everything from paying your bills and managing your investments to selling your house. Unless you write specific limits into the document, they can step in and manage all of your assets.

-

Power of Attorney for Personal Care: This person is your advocate for all things related to your health and well-being. They’ll be the one to make crucial decisions about your medical care, where you live, and what you eat if you can’t voice your own wishes. Their job is all about protecting your quality of life.

It’s crucial to remember that a POA’s power has an expiry date: the moment you die. The second you pass away, both POA documents become invalid, and your attorney’s authority is immediately extinguished.

In Ontario, the official legal term for an Executor is “Estate Trustee.” While everyone uses the word “Executor,” your actual Last Will and Testament will name an “Estate Trustee” to follow its instructions. It’s a small but legally important distinction.

Understanding the Role of an Estate Trustee

This is where your Executor, or more formally, your Estate Trustee, steps in. This is the person (or trust company) you appoint in your Will to take charge of your estate after you’re gone. Their job doesn’t even begin until you’ve passed away.

The Estate Trustee’s sole mission is to carry out the wishes you’ve laid out in your Will. It’s a big job with a long list of duties, all heavily regulated by Ontario’s Estates Administration Act. Here’s a glimpse of what’s involved:

- Finding the original Will and making funeral arrangements.

- Tracking down and securing every asset you own, from bank accounts and investments to your home and car.

- Applying to the court for a Certificate of Appointment of Estate Trustee (this is the formal process often called “probate”).

- Settling all your final debts, bills, and income taxes.

- Distributing what’s left to the beneficiaries you’ve named in your Will.

These roles are designed to work in sequence, not at the same time. Your POA looks after you during your lifetime, and your Estate Trustee takes over the moment you’re gone. A truly solid estate plan needs both. To see what a complete plan involves, take a look at our comprehensive Canadian estate planning checklist to make sure you’ve covered all your bases.

Comparing Legal Authority and Fiduciary Duties

While the timing of their roles is a key difference, the real legal substance separating a Power of Attorney (POA) from an Executor is found in their scope of authority and the duties they owe. Both of these roles are held to a strict legal standard called a fiduciary duty. This is the highest duty of loyalty in Canadian law, demanding absolute honesty and requiring them to act strictly in the best interests of the person or entity they represent.

The crucial distinction, however, is who they owe that duty to. An Attorney for property or personal care owes their fiduciary duty to one person and one person only: you, while you are alive but unable to make your own decisions. In stark contrast, an Executor (officially called an Estate Trustee in Ontario) owes their duty to your estate, which really means they must act in the collective best interests of your beneficiaries as laid out in your Will.

This single difference colours every decision they make. Your Attorney might decide to spend a significant amount of your money on high-quality, in-home care to make you more comfortable, even if it eats into the value of your estate. An Executor has no such discretion. Their job is to preserve the estate’s assets for the beneficiaries, not to make choices based on what might have been best for your comfort before you passed away.

The Scope of Decision-Making Authority

The legal boundaries for each role are drawn by completely different documents and legislation. Getting a handle on these limits is essential to understanding the power of attorney vs. executor dynamic.

The power your Attorney holds is defined entirely by the Power of Attorney document you signed, alongside Ontario’s Substitute Decisions Act, 1992. This means you can give them very broad authority or put specific guardrails in place, like prohibiting the sale of the family cottage. Their entire purpose is to step into your shoes and manage your affairs as you would have if you were capable.

On the other hand, an Executor’s authority springs from your Last Will and Testament and is governed by Ontario’s Estates Administration Act. Their power isn’t about managing your life; it’s about winding it up. This involves a formal, legally supervised process of gathering assets, paying off debts, and distributing what’s left. For a deeper dive into this court-overseen process, you can read our guide on how to probate a Will in Ontario.

The most critical distinction is this: an Attorney’s power legally and automatically terminates the moment you die. The misuse of an expired POA is a significant factor in contested estate filings in Ontario’s Superior Court of Justice. These mistakes can cost families tens of thousands of dollars in extra legal fees to undo invalid transactions.

This automatic termination is a bright, uncrossable line in the sand. An Attorney who keeps using a bank account or selling assets after the person has died is acting without any legal authority and can be held personally responsible for those actions and any resulting losses.

Financial Management and Legal Liabilities

Both roles come with immense financial responsibility and, as a result, serious legal liability if things are handled poorly. Anyone in these positions must keep meticulous records of every single transaction—every dollar in and every dollar out.

For an Attorney, this means carefully tracking all income received and every bill paid on your behalf while you are incapacitated. If your family or beneficiaries later suspect mismanagement, they have the right to ask the court for a formal “passing of accounts,” where a judge will scrutinize every financial move.

For an Executor, this duty is even more intense. They are required to provide a complete and formal accounting to all beneficiaries before they can distribute the estate. Any beneficiary who questions the accounting can challenge it in court if they think the Executor mismanaged funds, took excessive compensation, or was otherwise not acting prudently.

The table below offers a more detailed breakdown of their distinct duties and legal boundaries.

In-Depth Comparison of Duties and Legal Boundaries

Here’s a clear look at how the specific legal duties, powers, and liabilities differ between an Attorney and an Executor in Ontario.

| Responsibility Area | Power of Attorney | Executor (Estate Trustee) |

|---|---|---|

| Primary Allegiance | The living (but incapacitated) individual. | The estate and its beneficiaries. |

| Decision-Making Goal | To manage affairs for the person’s current best interests and comfort. | To follow the Will’s instructions and preserve assets for distribution. |

| Financial Protocol | Pay ongoing bills, manage investments, and file the person’s taxes. | Locate all assets, pay final debts and taxes, and distribute the remaining estate. |

| Source of Power | Power of Attorney document & Substitute Decisions Act, 1992. | Last Will and Testament & Estates Administration Act. |

| Legal Accountability | Accountable to the individual; can be required to pass accounts in court. | Accountable to all beneficiaries and the court; must provide a final accounting. |

Ultimately, while both roles are foundational to a solid estate plan, their legal frameworks are built for two entirely separate chapters. Your Attorney is there to protect you during your lifetime’s vulnerable moments, while your Executor steps in to make sure your final wishes are honoured with legal precision after you’re gone.

Real-World Scenarios for Your Estate Plan

It’s one thing to understand the textbook definitions of a Power of Attorney (POA) and an Executor, but it’s another to see how these roles play out in real life. These aren’t just abstract legal terms; they’re essential safeguards for you and your family during life’s most unpredictable moments.

Let’s walk through a few common situations to show you exactly why having both a POA and an Executor is non-negotiable for a solid estate plan in Ontario.

The Sudden Health Crisis

Imagine Sarah, a 55-year-old from Burlington, suffers a major stroke. She’s rushed to the hospital, unable to communicate, and her family is suddenly faced with a flood of urgent decisions. Because Sarah planned ahead, her chosen representatives can step in immediately.

- POA for Personal Care in Action: Sarah’s sister, named as her Attorney for Personal Care, gets to work. She speaks with the doctors, gives consent for medical treatments, and makes critical choices about Sarah’s care, all guided by conversations they had years ago. There’s no guessing, just clear action.

- POA for Property in Action: At the same time, her husband, as Attorney for Property, takes charge of the finances. He pays the mortgage, manages her investments, and uses her bank account to cover any medical expenses not handled by OHIP. This prevents their financial world from spiralling into chaos during an already stressful time.

Without these documents, Sarah’s family would be stuck. They’d have to go through a lengthy and expensive court process to be appointed her guardian, causing critical delays when time is of the essence.

The Gradual Decline With Dignity

Now, think about David, an 82-year-old in the GTA whose memory is starting to fade. His family notices he’s missing bill payments and might be susceptible to scams. This is where a POA for Property is invaluable for protecting his financial security and personal dignity.

His daughter, whom he appointed as his Attorney years ago, can gently step in to help. She can:

- Consolidate his bank accounts to simplify things.

- Set up automatic payments for his utilities and condo fees.

- File his income tax returns for him.

- Speak directly with the bank to safeguard his savings.

This proactive step allows David to stay in his own home for as long as possible, knowing his finances are being managed by someone he trusts. His daughter is simply acting as his financial steward, making decisions in his best interest while he is still alive. Alarmingly, a high percentage of adults in Ontario don’t have a POA, leaving their families exposed to court-appointed guardianship proceedings that can rack up thousands in legal fees every year.

The Power of Attorney is a living document for a living person. It’s all about protecting your well-being and financial stability with a trusted person at the helm if you can no longer manage things yourself.

After a Loved One Passes Away

Let’s circle back to Sarah’s story. Sadly, after a few months, she passes away. The very moment of her death, the legal authority granted to her sister and husband as her Attorneys vanishes. Their job is done. Now, a completely new role takes over.

Sarah had named her adult son, Michael, as the Executor (or Estate Trustee, as it’s formally called in Ontario) in her Will. His duties are entirely different and begin right away:

- He finds Sarah’s original Will and starts making funeral arrangements based on her written wishes.

- He begins notifying banks, credit card companies, and government agencies of her passing.

- He hires an estate lawyer to help him prepare and file an application for a Certificate of Appointment of Estate Trustee with the court—the process most people know as probate.

- Once the court grants him the authority, he starts gathering all of Sarah’s assets, paying her final taxes, and settling her debts. This includes calculating the Estate Administration Tax, which you can estimate using our firm’s probate fees calculator.

- Finally, after every last bill and tax is paid, Michael distributes what’s left of the estate to the beneficiaries Sarah named in her Will.

These scenarios highlight the clear handoff between these two critical roles. A comprehensive guide to end-of-life planning will always include both. One plan protects you during your life; the other ensures your final wishes are honoured after you’re gone. Without both, your estate plan has a major gap, leaving your family exposed when they are most vulnerable.

How to Choose the Right Representatives

Picking the person to act as your Attorney for Property, Attorney for Personal Care, or your Executor is easily one of the most important decisions you’ll make in your estate plan. These aren’t just titles you hand out to make someone feel special; they are demanding jobs that call for a specific skillset, complete integrity, and a steady hand in stressful times. Getting this choice right is fundamental to protecting your well-being while you’re alive and ensuring your wishes are respected after you’re gone.

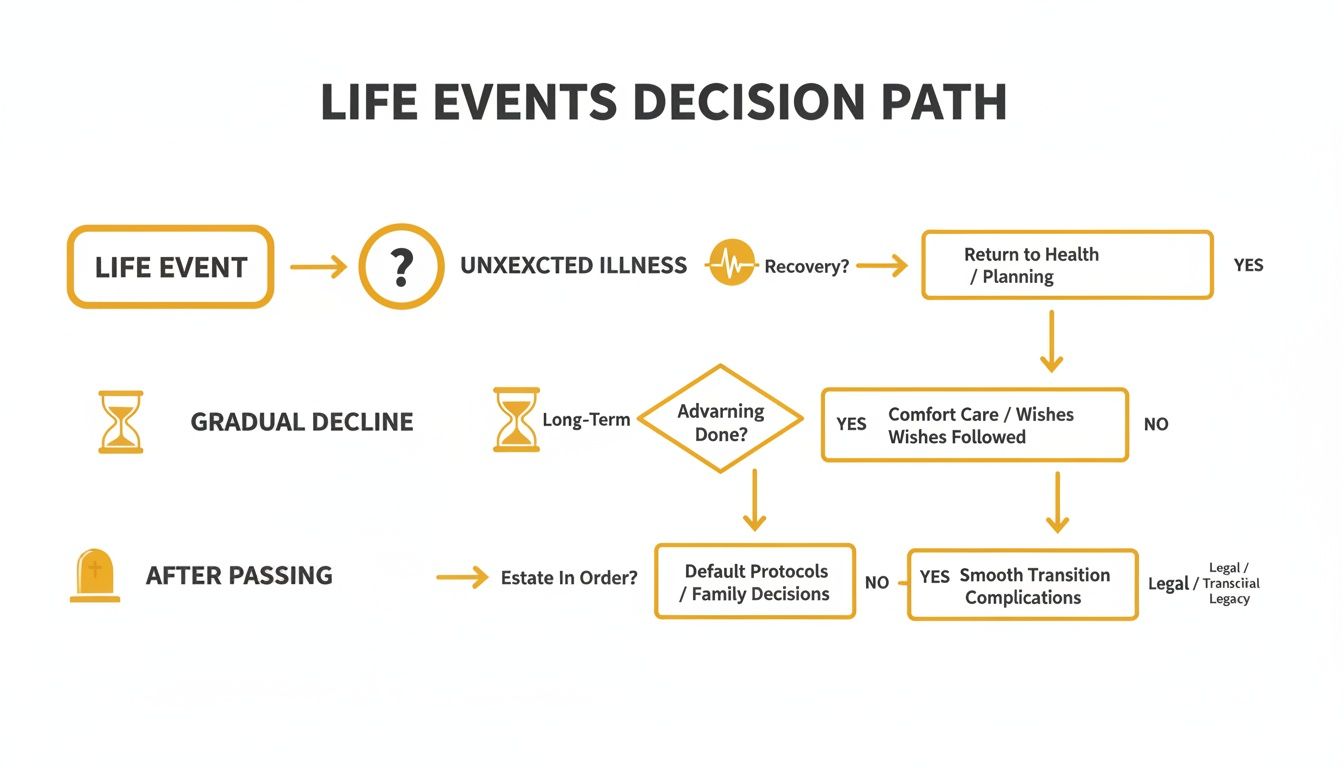

This visual guide helps clarify when each role becomes active.

As the flowchart shows, whether you’re dealing with a sudden illness or a gradual decline in health, your Power of Attorney is the one who steps in. Your Executor’s role only begins after you’ve passed away.

Key Qualities to Look For

When you break it down, the ideal candidate for a Power of Attorney or an Executor shares the same core qualities. Of course, you have to trust them completely, but that’s just the starting point.

Here are the essential traits you should be looking for in anyone you consider:

- Unquestionable Integrity: This person’s moral compass must be locked in. They need to act solely in your best interests (as an Attorney) or for your beneficiaries (as an Executor), without a hint of self-interest.

- Strong Organizational Skills: Both roles are buried in paperwork, strict deadlines, and the need for perfect records. Someone who isn’t organized will drown in the details.

- Financial Competence: They don’t need to be an accountant, but they must be comfortable paying bills, managing bank accounts, and grasping basic financial ideas.

- Emotional Resilience: Can this person make clear-headed, tough decisions under pressure? Think about dealing with grieving relatives or navigating complex medical choices.

- Willingness to Serve: This is a huge ask. You absolutely must have a frank conversation with them to make sure they understand what’s involved and are genuinely prepared to take on the responsibility.

Your choice of representative should be guided by competence and reliability, not just emotion or family obligation. The most loving family member may not be the best person to manage complex financial or legal duties.

Family Member vs. Professional Trustee

Many people get stuck on whether to appoint a family member or hire a professional, like a lawyer or a trust company. Each path has its own distinct advantages and disadvantages.

Appointing a Family Member:

- Pros: They know you, your history, and what you value. Plus, they generally don’t charge for their time (though they are entitled to compensation from the estate).

- Cons: They might not have the financial or legal know-how. Even more critically, appointing one child over another can light a fuse on family conflicts, especially when they’re also a beneficiary.

Appointing a Professional:

- Pros: Professionals bring impartiality, efficiency, and deep expertise. They know how to navigate the legal system and can act as a neutral buffer to prevent family squabbles.

- Cons: Their services come at a cost, which is paid from your assets or estate. They also won’t have the personal history and connection that a family member brings to the table.

A critical first step is to formally name your Executor in your Will. For guidance, many people find it useful to learn how to write a will, as this document is the cornerstone of your entire estate plan.

The Importance of Alternates

So, what happens if your first choice can’t or won’t act when the time comes? Life is unpredictable—they could pass away, become ill themselves, or simply realize the job is too much. This is precisely why naming at least one (and ideally two) alternate representatives isn’t just a smart move; it’s an essential part of a solid plan.

If you don’t have an alternate named in your Power of Attorney documents or Will, your loved ones could be forced to go to an Ontario court to have someone appointed. That process is expensive, drags on for months, and adds a mountain of stress to an already painful time. You can prevent all of that with the simple step of naming a backup.

For professional help in drafting these crucial documents, it’s always wise to connect with an experienced Wills lawyer in the Toronto area.

Common Planning Mistakes and How to Avoid Them

Even the most carefully considered plans can go sideways because of a few common, and entirely avoidable, mistakes. When it comes to the power of attorney vs executor distinction, small errors can unfortunately spiral into major legal headaches and financial losses for your family here in Ontario. Knowing what these pitfalls are is the first step to building a plan that actually works when you need it to.

One of the most common blunders is picking the wrong person for the role. It’s easy to appoint someone based on emotion—like choosing your eldest child simply because they’re the eldest. But this can be a recipe for disaster. If they don’t have a good head for finances or they fall apart under stress, they’re probably not the right fit to manage your affairs, no matter how much they love you.

Using Generic Forms and Vague Instructions

In a bid to save a few dollars, many people reach for DIY kits or generic online templates for their Wills and Powers of Attorney. This is a critical error. These one-size-fits-all documents often miss the specific legal nuances required by Ontario’s Substitute Decisions Act, 1992, which could make them completely invalid.

Vague language is another huge problem. An instruction like “divide my personal belongings as my children see fit” is an open invitation for a family feud. A properly drafted document, on the other hand, is crystal clear. It leaves no room for argument and ensures your wishes are followed exactly as you intended.

The Most Dangerous Post-Mortem Mistake

Perhaps the most legally perilous mistake happens when a person acting as an Attorney continues to make decisions after the individual has passed away. This comes from a fundamental misunderstanding of the power of attorney vs executor timeline.

An Attorney’s authority legally evaporates the instant the person dies. Any action taken after that moment—whether it’s paying a bill from the deceased’s bank account or selling a stock—is not valid. The former Attorney could be held personally liable for any financial loss that results.

This often happens with the best of intentions. The Attorney might just be trying to “tidy up” a few loose ends. But that’s a job strictly for the court-appointed Executor. Confusing these two roles can lead to expensive legal messes to reverse invalid transactions, placing a huge financial burden on someone who was only trying to help.

The solution is simple: make sure both your Attorney and your Executor know exactly when their jobs start and, just as crucially, when they stop.

Forgetting to Name Alternates

Life happens. The person you choose as your Attorney or Executor might not be able to step in when the time comes. They could become ill, pass away themselves, or simply find the responsibility too overwhelming. Not naming at least one backup—an “alternate”—for each role leaves a massive hole in your plan.

If there’s no alternate, your family will have no choice but to go to an Ontario court to get someone appointed. That process is slow, expensive, and adds a tremendous amount of stress to an already painful time. Simply naming a backup in your documents can prevent all of this, ensuring a smooth transition and keeping someone you trust in control.

Your Top Ontario Estate Planning Questions Answered

When you start digging into estate planning, a lot of questions pop up. It’s completely normal. Here, we’ll answer some of the most common ones we hear from our clients across the GTA and Ontario, clearing up the confusion so you can move forward with confidence.

Can My Power of Attorney and My Executor Be the Same Person?

Yes, absolutely. In Ontario, it’s not only allowed but often makes a lot of sense. Many people choose the same trusted person, like a spouse or a responsible child, for both roles.

Think of it this way: the person acting as your Power of Attorney will already be familiar with your finances, property, and personal wishes. This knowledge creates a much smoother transition when they later step into the executor role to handle your estate. It’s a natural handover.

But there’s a flip side to consider. Both jobs are demanding, and asking one person to handle everything can lead to burnout. It’s a huge responsibility. That’s why we always insist that you name at least one backup (an alternate) for each role. If your first choice can’t act for any reason, you’ve got a plan B ready to go.

A key thing to remember is that these are two distinct jobs with a hard stop and start. Your Power of Attorney’s power vanishes the moment you pass away. At that exact same moment, your Executor’s authority begins. They never overlap.

What If I Don’t Have a Power of Attorney and Become Incapable?

This is a scenario you really want to avoid. If you become mentally incapable without a Power of Attorney in place, your family can’t just step in and start making decisions for you. It doesn’t work that way in Ontario.

Instead, they’ll be forced to apply to an Ontario court to be appointed as your legal guardian. It’s a public, expensive, and incredibly slow process. Imagine putting your loved ones through that kind of stress and legal red tape during an already emotional time. A Power of Attorney document prevents all of it.

Does My Executor Have Any Say Over My Affairs While I’m Alive?

Not a single bit. Being named as the executor in your Will gives that person zero authority while you are living. Their role is entirely post-mortem.

Their legal power to act on behalf of your estate only kicks in after your death, and even then, it’s typically only official once they’ve obtained a Certificate of Appointment of Estate Trustee from the court. This is probably the most critical distinction in the power of attorney vs. executor comparison.

Getting your estate plan right is one of the most important things you can do for your family’s future. The team at UL Lawyers, based in Burlington but serving clients all over the GTA and Ontario, has spent years helping families craft clear, solid Wills and Powers of Attorney. To make sure your wishes are properly protected, get in touch with us for a consultation today.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies