What is No Fault Insurance in Ontario? Essential Guide

Let’s clear up one of the biggest misconceptions about car insurance in Ontario right from the start. The term “no-fault insurance” does not mean no one is at fault for an accident. It’s a bit of a misnomer, really.

What it actually means is that if you’re injured or your car is damaged in a collision, you deal directly with your own insurance company for benefits and repairs. This happens no matter who was responsible for the crash.

Demystifying Ontario’s No-Fault Insurance System

Think of it like having your own dedicated medical and financial support team on standby. After an accident, instead of getting caught in a lengthy back-and-forth between insurance companies arguing over who pays, you simply turn to your own provider.

Your insurer is responsible for getting you immediate access to things like medical care, rehabilitation services, and income replacement benefits. The whole system is built to provide fast, direct support when you’re most vulnerable.

How It Benefits You Directly

The two biggest advantages of this model are speed and accessibility. You don’t have to hire a lawyer and sue the at-fault driver just to get your initial physiotherapy bills or lost wages covered. That process can take months, even years.

Instead, the no-fault system ensures everyone has a foundational level of support built right into their own policy. This not only eases the burden on our legal system but, more importantly, lets people focus on their recovery instead of stressing about how they’re going to pay the bills.

The core idea behind no-fault insurance is simple: give people timely and predictable access to benefits after a motor vehicle accident. It’s about minimizing the need for costly, drawn-out legal fights just to get essential care.

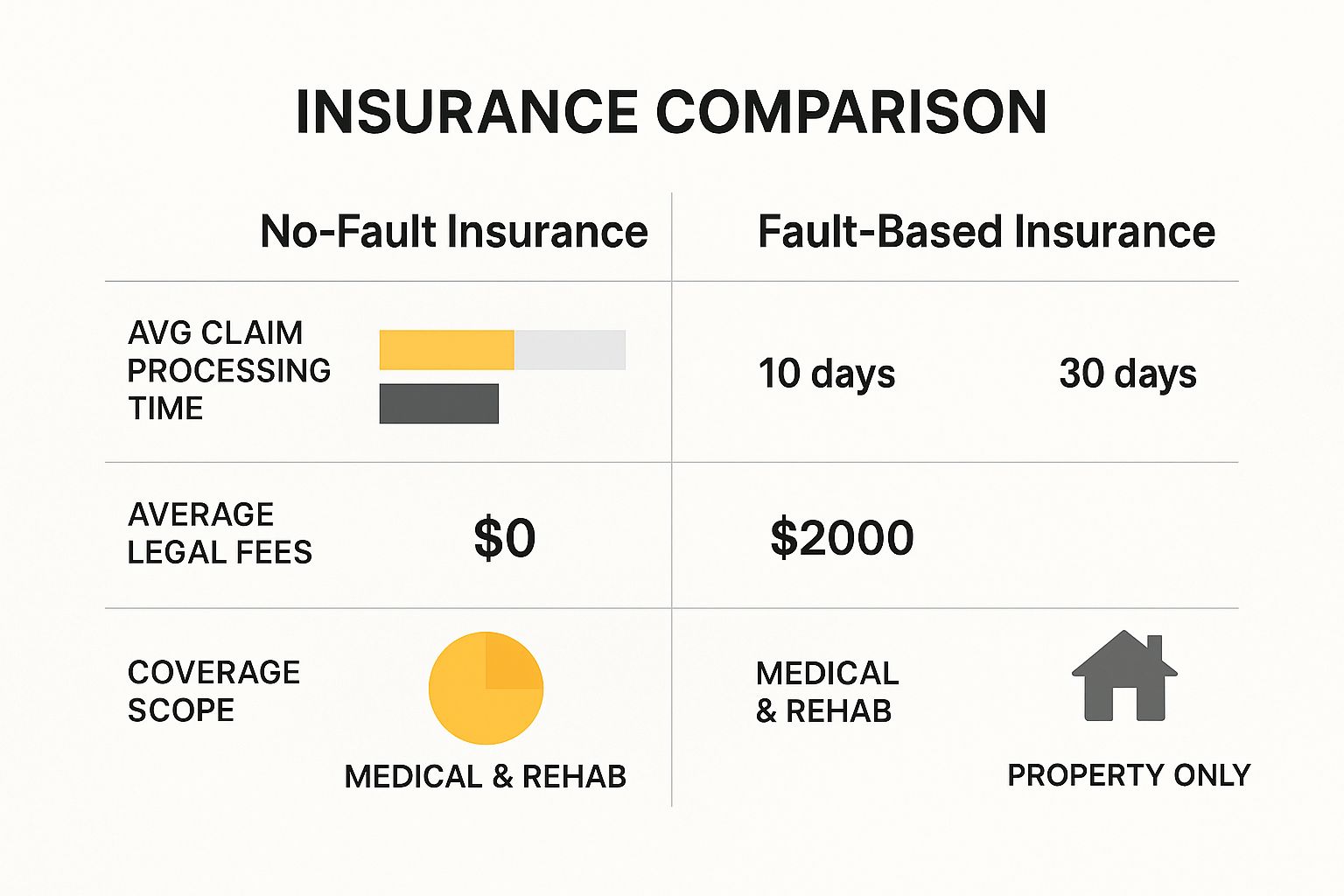

This visual breakdown really highlights the differences between Ontario’s system and a traditional at-fault model.

As you can see, the no-fault approach dramatically speeds up the claims process and cuts down on the initial legal hurdles for accident victims.

To make this even clearer, let’s compare the two systems side-by-side.

No-Fault vs. At-Fault Systems At a Glance

This table breaks down the fundamental differences between Ontario’s no-fault system and the traditional tort-based (at-fault) systems you see in other jurisdictions.

| Feature | Ontario’s No-Fault System | Traditional At-Fault (Tort) System |

|---|---|---|

| Who Pays for Your Injury? | Your own insurance company provides immediate accident benefits. | You must claim from the at-fault driver’s insurance company. |

| Claim Speed | Faster access to benefits for medical care and lost income. | Often delayed until fault is determined, which can take years. |

| Need to Sue? | Less initial need to sue for basic benefits. | Lawsuits are often necessary to get any compensation. |

| Fault Determination | Fault is still determined to set future insurance premiums. | Fault is the central issue that must be resolved before payment. |

| Focus | Recovery and quick access to financial support. | Assigning blame and legal liability. |

The takeaway is that Ontario’s system prioritizes getting you back on your feet quickly, while the at-fault model forces you to prove someone else was to blame before you see a dollar.

A Brief History of No-Fault in Ontario

This isn’t some new-fangled idea; it’s been the law in this province for quite a while. Ontario’s mandatory no-fault insurance system was introduced in 1990 as part of the Ontario Motorist Protection Plan (OMPP).

It was created to compensate drivers for their losses regardless of who was at fault. The plan provided immediate access to accident benefits, allowing nearly everyone to get support quickly while still keeping their right to sue at-fault parties for damages that went beyond what their own policy paid.

Even though your insurer handles your benefits, fault is still determined for every single accident. Insurance companies use a set of provincial regulations called the Fault Determination Rules to figure this out. This decision impacts future insurance premiums and becomes critically important if your injuries are serious enough to warrant a lawsuit for pain, suffering, and other damages.

To get a better handle on what you might be entitled to, have a look at our comprehensive guide on motor vehicle accident compensation.

The Four Mandatory Parts of Your Auto Insurance Policy

Every standard auto insurance policy in Ontario—officially known as an Ontario Automobile Policy or OAP 1—is built around four mandatory types of coverage. You can think of them as the non-negotiable foundation of your protection on the road. For drivers all over the GTA, from Burlington to Brampton, getting a handle on these four parts is the key to understanding what your policy actually does for you.

These coverages are designed to work together, creating a safety net that catches everything from your own medical bills to legal claims filed against you. Let’s break down what each one really means.

Statutory Accident Benefits Coverage (SABS)

This is the absolute core of Ontario’s no-fault system. Statutory Accident Benefits Coverage, or SABS, is what provides you, your passengers, or even a pedestrian with benefits after an injury in a car accident—regardless of who was at fault.

It’s designed to give you immediate access to financial and medical support so you can start recovering right away. Key benefits include:

- Medical and Rehabilitation Benefits: This covers the treatments OHIP won’t, like physiotherapy, chiropractic sessions, or specialized medical equipment.

- Income Replacement Benefits: If you’re hurt and can’t work, this benefit helps bridge the financial gap. It typically covers up to 70% of your gross weekly income, with a standard maximum of $400 per week.

- Attendant Care Benefits: For more serious injuries, this pays for a professional caregiver to help you with daily activities like bathing and getting dressed.

The whole point of SABS is to let you focus on getting better, not on how you’re going to pay your bills while you’re off work.

Third-Party Liability Coverage

While SABS takes care of your injuries, Third-Party Liability Coverage is what protects you if you get sued. If you’re found legally responsible for an accident that injures someone else or wrecks their property, this is the part of your policy that pays for those legal claims.

By law, every Ontario driver must have at least $200,000 in liability coverage. But if you ask any insurance broker or lawyer, they’ll tell you that’s nowhere near enough. Most strongly recommend carrying $1 million to $2 million, because a lawsuit from a serious crash can easily cost far more than the legal minimum.

Think of this coverage as your financial shield. Without enough of it, a major at-fault accident could put your personal assets—like your home or your life savings—on the line to cover a court judgment.

Direct Compensation – Property Damage (DC-PD)

This is where the “no-fault” idea really comes into play for your vehicle’s repairs. Direct Compensation – Property Damage (DC-PD) is a straightforward concept: when you’re not at fault for a collision, you deal directly with your own insurance company to get your car fixed.

For DC-PD to apply, a few conditions have to be met:

- The accident must happen in Ontario.

- At least one other vehicle has to be involved.

- The other driver(s) must also be insured by an Ontario company.

When those boxes are checked, your insurer pays for your repairs. This saves you the massive headache of trying to chase down the at-fault driver’s insurance company and speeds up the entire process of getting back on the road.

Uninsured Automobile Coverage

So, what happens if you’re hit by someone with no insurance or, worse, a driver who flees the scene? That’s exactly what Uninsured Automobile Coverage is for. This mandatory protection steps in to cover you and your family if you’re injured or killed by an uninsured or unidentified hit-and-run driver.

It also covers damage to your vehicle if it’s hit by a driver who can be identified but is confirmed to be uninsured. It’s a crucial piece of the puzzle, ensuring you aren’t left holding the bag financially just because someone else broke the law.

Getting a grip on these four components is a great start, but navigating the claims process can still get complicated. For a deeper dive into the legal side, you can learn more about Ontario’s car accident law and see how these rules apply in real-world scenarios.

Decoding Your Statutory Accident Benefits

When you hear “no-fault insurance,” what it really boils down to is your direct line to a powerful set of protections called Statutory Accident Benefits (SABS). This is the core promise of your policy: if you’re injured in a car accident, your own insurance company steps in with immediate support, no matter who was at fault.

Think of SABS as your pre-approved financial and medical safety net. It’s built to catch you and your family, helping you handle the fallout from an injury without having to wait for a lengthy legal battle to decide who was to blame. It’s a system designed to make sure every person in Ontario has a foundational level of care right when they need it.

This system completely changed how accident recovery works in the province. When the Ontario Motorist Protection Plan (OMPP) first rolled out these major no-fault reforms, the goal was simple: get more help to more injured people, faster. In fact, early projections showed that medical expense costs would jump by an estimated 240.6% compared to the old system. Why? Because the new rules gave people much broader access to the medical and rehab services they desperately needed. If you’re curious about the numbers behind this shift, you can dig into the original actuarial analysis of the OMPP.

Your SABS benefits are neatly organized into different categories, with each one tackling a specific part of your recovery. Let’s break down the main pillars of support you’re entitled to.

Medical and Rehabilitation Benefits

Your OHIP card is great, but it has its limits. That’s precisely where your Medical and Rehabilitation Benefits come in. This coverage is there to pay for reasonable and necessary health care costs that aren’t covered by the provincial plan or any private insurance you might have.

Here are some of the things it typically pays for:

- Physiotherapy and Chiropractic Care: To help you get your strength and mobility back on track.

- Massage Therapy: A key tool for managing pain and helping muscles recover.

- Psychological Services: To help you work through the mental and emotional trauma that often follows an accident.

- Ambulance Bills: For getting you to the hospital safely.

- Medical Equipment: Things like crutches, wheelchairs, or even necessary modifications to your home.

- Prescription Drugs: For medications related to your accident injuries.

This benefit is absolutely critical. It ensures you can get the specialized treatments you need for a full recovery without having to stress about paying for it all out of pocket.

Income Replacement Benefits

One of the first things people worry about after a crash is how they’ll pay their bills if they can’t work. The Income Replacement Benefit (IRB) is designed for exactly this problem. If your injuries stop you from doing the essential tasks of your job, this benefit provides a safety net by covering a portion of your lost income.

Under a standard policy, the IRB replaces 70% of your gross weekly income, but it’s capped at $400 per week. For many families, especially in the GTA, that’s simply not enough. This is why buying optional coverage to increase this amount is one of the most important choices you can make when you buy your policy.

To be eligible, you need to have been working when the accident happened or have worked for at least 26 of the 52 weeks before it. There’s a one-week waiting period before the payments start, but they can continue for up to 104 weeks (two years) as long as you remain unable to do your old job.

Attendant Care Benefits

For those who suffer more severe or even catastrophic injuries, everyday tasks can suddenly feel impossible. The Attendant Care Benefit is there to provide funding for a personal aide to help with essential daily activities like personal grooming, bathing, getting dressed, and moving around.

This benefit isn’t automatic; it’s reserved for those who have sustained a truly significant injury. An occupational therapist or registered nurse must conduct an assessment (using a Form 1) to figure out your specific needs and the level of care required. The funds can be used to hire a professional or even to pay a family member or friend for providing this vital support.

Navigating the Minor Injury Guideline

It’s crucial to understand that SABS doesn’t treat all injuries equally. The government created the Minor Injury Guideline (MIG) to standardize treatment for common, less severe injuries like sprains, strains, and whiplash.

If your injury is classified under the MIG, your medical and rehabilitation benefits are capped at $3,500. The idea behind the MIG is to streamline claims and create a clear, evidence-based treatment plan. However, if your recovery isn’t going as planned or if a pre-existing condition complicates things, it is possible to be removed from the MIG to access more funding. This can get complicated, which is why our guide on accident benefits in Ontario provides more in-depth advice on how to manage your claim.

Why Being At Fault Still Matters in Ontario

One of the most persistent myths about Ontario’s no-fault system is that “fault” suddenly doesn’t matter after a crash. That couldn’t be further from the truth.

The term “no-fault” simply means you deal directly with your own insurance company for your own benefits and repairs, regardless of who caused the accident. It streamlines the immediate aftermath. But behind the scenes, determining who was responsible is a critical part of the process, and it comes with very real consequences.

How Fault is Determined in Ontario

Your insurance adjuster doesn’t just make an educated guess. Ontario has a standardized, legally mandated system called the Fault Determination Rules. These rules are a regulation under the province’s Insurance Act.

Think of it as a detailed playbook for car accidents. The rules lay out dozens of common collision scenarios—everything from a simple rear-ender to complex intersection T-bones—and assign a clear percentage of fault (0% to 100%) to each driver. Every single insurance company in Ontario must follow these exact same rules, ensuring a consistent approach across the board.

Picture a common fender-bender on a busy Toronto street. A driver making a left turn gets hit by a car coming straight through the intersection. While the turning driver gets their initial benefits from their own insurer, the Fault Determination Rules will almost always assign them 100% fault for failing to yield.

This official fault decision is what triggers the long-term consequences that can follow you for years.

The Financial Impact of an At-Fault Accident

When you’re found at-fault, the financial fallout hits you in two major ways.

First, your insurance premiums are almost guaranteed to go up. A lot. To an insurer, an at-fault claim on your record flags you as a higher risk. When your policy comes up for renewal, you’ll likely face a steep rate hike that can stick around for several years. You can learn more about exactly how much insurance can increase after an accident to see how significant the impact can be.

Second, and even more serious, is the risk of being sued. While your no-fault benefits cover your own immediate needs, the other driver can still sue you for losses that go beyond what their own policy covers. These lawsuits often claim damages for:

- Pain and Suffering: Compensation for serious and permanent injuries.

- Future Economic Losses: If their injuries prevent them from working or advancing in their career.

- Additional Healthcare Costs: For long-term medical care that standard benefits don’t cover.

This is where your Third-Party Liability coverage kicks in to protect you. But if a court awards a settlement that’s higher than your liability limit, you are personally on the hook for the rest. It’s a sobering thought that highlights just how crucial having adequate liability coverage truly is.

Your Step-By-Step Guide to Filing a Claim

The minutes, hours, and days after a car accident are often a blur of stress and confusion. Knowing what to do and when to do it can feel overwhelming, especially when you’re shaken up.

Think of this as your clear, practical roadmap for handling an insurance claim in Ontario. Following these steps will help you navigate the process with confidence and avoid common pitfalls.

What you do immediately after a collision is critical. Your first thought should always be safety, but once the dust settles, the information you gather will form the very foundation of your claim.

First Moves at the Scene

Try to stay calm and methodical. This is your best strategy for gathering the essentials.

- Safety First: Check on everyone involved. If anyone is injured, call 911 immediately. Move your vehicles out of live traffic lanes, but only if it’s safe to do so.

- Exchange the Essentials: You are required to swap information with the other driver(s). Get their name, address, driver’s licence number, and, crucially, their insurance company and policy number.

- Document Everything: Your phone is your best tool here. Take pictures of the damage to all vehicles, their positions on the road, and the wider scene. Make a quick note of the date, time, and specific location.

- Get a Police Report: You must report the accident to the police if there are any injuries or if the combined vehicle damage looks to be over $2,000. That official police report is a vital piece of evidence for your insurer.

For a more detailed checklist of what to do right after a crash, check out our guide on what to do after a car accident.

Contacting Your Insurer and Kicking Things Off

Once you’re safe and away from the scene, the clock officially starts on your claim. You can’t afford to wait.

You need to notify your own insurance company about the accident within seven days. This initial call gets the ball rolling. Your insurer will assign an adjuster to your case, and this person will be your main point of contact throughout the process.

From there, they will send you an Application for Accident Benefits (OCF-1). This is the key that unlocks your access to Statutory Accident Benefits (SABS).

Pay close attention to this deadline: you must complete and return your OCF-1 form within 30 days of receiving it. Missing this window can seriously delay—or even jeopardize—your access to benefits for medical treatments and lost income.

Handling the Paperwork Trail

After you’ve submitted the OCF-1, your adjuster will need more details, especially if you’ve been injured. You can expect a few more forms to come your way.

- OCF-3 Disability Certificate: Your doctor, physiotherapist, or another healthcare practitioner will need to fill this out to officially document the nature and extent of your injuries.

- OCF-2 Employer’s Confirmation Form: If you’re unable to work and need to claim income replacement benefits, this form is sent to your employer to verify your job and earnings.

- OCF-5 Permission to Disclose Health Information: This gives your insurance company the necessary permission to access medical records directly related to your accident injuries.

It’s a smart move to keep organized copies of everything—every form, every receipt for medical costs, and every email. The claims process isn’t simple. Just look at the numbers from the General Insurance Statistical Agency (GISA): in 2023, Ontario’s collision claims ratio soared to 82%, with the average cost per claim hitting $10,955. These figures show just how important it is to submit a well-documented claim on time.

Answering Your Top Questions About No-Fault Insurance

Even with a solid grasp of the basics, it’s totally normal to have questions about how no-fault insurance plays out in the real world. Let’s face it, the concepts can feel a bit tangled, especially when you’re trying to figure out your rights after a collision.

Think of this section as a quick Q&A with an expert. We’re going to tackle the most common questions Ontario drivers have, breaking them down into clear, simple answers to help everything click into place.

Can I Still Sue the At-Fault Driver in Ontario?

Yes, you absolutely can. This is probably one of the biggest misconceptions about the “no-fault” system. While your own insurance company steps in to provide immediate medical care and benefits (SABS), that doesn’t close the door on holding the at-fault driver accountable.

You still have the right to file a lawsuit, known as a tort claim, against the driver who caused the accident. This is for damages that go beyond what your standard accident benefits can cover, such as:

- Pain and Suffering: Compensation for the physical pain and emotional distress caused by a major injury.

- Future Economic Losses: This covers income you stand to lose down the line if your injuries stop you from working or building your career.

- Extra Healthcare Costs: For long-term medical needs that might exhaust your standard benefit limits.

There’s a catch, though. Ontario law puts some important limits on these lawsuits. To sue for pain and suffering, your injury has to meet a legal threshold—it must be considered both “permanent” and “serious.” This two-part system is designed to give you immediate support through your own policy, while still preserving your right to seek justice for life-altering injuries.

Will My Insurance Premiums Go Up After a No-Fault Claim?

This one boils down to a single word: fault.

Simply using your own no-fault Accident Benefits to cover physio or medical bills will not, on its own, jack up your rates. That’s the whole point of having these benefits in the first place—to get you help without penalty.

Where it gets tricky is when fault is assigned for the collision itself. Your premiums will almost certainly increase if you’re found to be partially or fully at-fault. As we discussed earlier, every insurer in the province uses the Fault Determination Rules to figure out who was responsible.

If you’re deemed 0% at-fault for the crash, your rates shouldn’t change because of the claim. But if you’re found to be 50% or 100% at-fault, you should brace for a significant hike at renewal time. It’s a crucial reminder that while benefits are “no-fault,” fault itself always matters for your driving record and your wallet.

What if My Insurer Denies My Accident Benefits Claim?

It’s a frustrating situation, but it happens. An insurer might deny a specific benefit, perhaps arguing your injury is minor and falls under the Minor Injury Guideline (MIG), or they might decide you’re ready to go back to work before you truly feel capable. If you find yourself in this spot, know that you have the right to challenge their decision.

The first step is always to have a frank conversation with your adjuster to understand their reasoning. If that doesn’t lead to a resolution, the next formal step is filing an application with the Licence Appeal Tribunal (LAT). The LAT is an independent body that acts as a referee for disputes between people and their insurance companies over accident benefits.

Be aware that there are very strict deadlines for filing with the LAT, so it’s critical to act fast after getting a denial notice. This process can get complicated, so getting advice from a legal professional who specializes in personal injury and insurance law is often a wise move to protect your rights.

Can I Buy More Coverage to Increase My No-Fault Benefits?

Yes, and honestly, you probably should. The standard benefit limits that come with a basic auto policy are often not nearly enough to cover the true costs of a serious injury, especially in a high cost-of-living province like Ontario.

Insurers offer a menu of optional benefits you can purchase to boost your coverage, and these upgrades can provide incredible peace of mind for your family. Some of the most common options include:

- Increased Medical, Rehabilitation, and Attendant Care: You can raise your coverage from the standard $65,000 for non-catastrophic injuries to $130,000 or even $1,000,000.

- Higher Income Replacement: The standard weekly benefit can be increased from $400 to $600, $800, or $1,000.

- Adding Caregiver and Housekeeping Benefits: For non-catastrophic injuries, these benefits aren’t included in a standard policy, but you can add them for a relatively small premium.

Make it a point to have a detailed chat with your insurance broker or agent about these optional coverages. Taking a little extra time to tailor your policy to your family’s needs is one of the smartest financial decisions you can make.

Navigating the aftermath of a car accident can be challenging, especially when dealing with insurance claims and disputes. At UL Lawyers, we believe that everyone deserves clear guidance and strong advocacy. If you’ve been injured and are struggling to get the benefits you are entitled to, our experienced team is here to help you understand your rights and fight for the compensation you deserve.

For a free, no-obligation consultation to discuss your case, visit us at https://ullaw.ca.

Related Resources

A Plain-Language Guide to Motor Vehicle Accidents Law in Ontario

Continue reading A Plain-Language Guide to Motor Vehicle Accidents Law in OntarioFind a Car Accident Lawyer in Mississauga Fast

Continue reading Find a Car Accident Lawyer in Mississauga FastNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies