A Guide to Long Term Disability Insurance in Ontario

Think of long-term disability insurance as your financial lifeline. It’s a plan designed to step in and replace a significant chunk of your income if a serious illness or injury keeps you from working for a long time. It’s all about providing income stability when your paycheque suddenly stops.

Your Financial Backup Generator

Here’s a simple way to look at it. Your income is the main power supply to your household, keeping the lights on and everything running. A serious health issue is like an unexpected, long-lasting power outage. Without a backup plan, everything stops.

This is where long-term disability (LTD) insurance comes in. It acts like your personal backup generator, kicking on to restore financial power. It ensures you can still cover the mortgage, pay the bills, and buy groceries.

This isn’t just a quick fix. LTD is built to provide support for years—sometimes even until you reach retirement age, depending on the policy. It’s the tool that prevents a health crisis from turning into a financial catastrophe for your family.

How You Get LTD Coverage in Ontario

In Ontario, there are really only two main ways to get long-term disability coverage:

- Group Insurance Plans: This is the most common route. Most employers offer LTD as part of their employee benefits package. Often, the cost of the premiums is shared between you and your employer, and sometimes the company covers it all.

- Private or Individual Policies: If you’re self-employed, run a small business, or work for a company that doesn’t offer benefits, you can buy a policy directly from an insurance provider. These plans offer more flexibility and can be customized, but the premiums are usually higher.

No matter which path you take, the first step is always the same: you have to understand the specific terms of your insurance contract. That’s where your financial security begins.

How LTD Differs From Government Programs

It’s easy to get LTD mixed up with government benefits, but they play very different roles. LTD is a private insurance product, completely separate from programs run by the government.

The real difference comes down to the amount and duration of support. Government programs provide a basic safety net, but private LTD insurance is designed to deliver more substantial, longer-lasting income replacement that’s actually based on your earnings.

Let’s look at the key distinctions:

- Employment Insurance (EI) Sickness Benefits: This is a federal program that offers temporary help for up to 26 weeks if a medical reason stops you from working. Think of it as a short-term bridge.

- Canada Pension Plan (CPP) Disability Benefits: This is a federal long-term plan, but it’s only available if you’ve contributed enough to the CPP. The real hurdle is its strict definition of disability—your condition must be “severe and prolonged” and prevent you from performing any kind of gainful work. Many people who are sick or injured enough to qualify for LTD benefits simply don’t meet the high bar for CPP Disability.

LTD insurance fills the massive gap these programs leave behind. Benefits often begin right after EI ends and pay out a much higher monthly amount than CPP Disability, typically covering 60-85% of your usual income.

While our focus here is on LTD, it’s helpful to see how all these pieces fit together. To get a better handle on the first steps after a work absence, check out our detailed guide on short-term disability in Ontario. Understanding the whole picture is key to navigating your disability coverage.

Understanding How Your Policy Defines Disability

When you look at your long-term disability policy, one clause stands out as the most important: the definition of “total disability.” This isn’t just fine print; it’s the specific measuring stick the insurance company uses to approve or deny your claim. How that term is worded can be the deciding factor between getting the financial support you need and facing a denial.

Here in Canada, insurance policies almost always lean on one of two key definitions. Getting a firm grip on what they mean is the first, most critical step in navigating your claim.

The Strongest Protection: Own Occupation

The “own occupation” definition is, without a doubt, the best coverage you can have. Under this standard, you are considered totally disabled if your illness or injury stops you from performing the main duties of your specific job.

It’s that simple. What matters is the job you had when you became disabled, not whether you could do something else. Your ability to work in a different field is completely irrelevant.

Imagine a construction worker in Hamilton who suffers a severe back injury. They can no longer handle the physical demands of their job. Even if they could theoretically take on a desk job, under an “own occupation” policy, they would qualify for benefits because they can no longer perform their job. It’s powerful protection tailored to your actual profession.

The Stricter Standard: Any Occupation

On the other hand, the “any occupation” definition is a much tougher hurdle to clear. To qualify under this test, you must prove that you are unable to perform the duties of any job for which you are reasonably suited based on your education, training, and experience.

This gives the insurance company a lot of room to argue. They can look past your old job and suggest other roles you could fill. For instance, an office administrator from Mississauga develops chronic migraines that make looking at a screen all day impossible. They’d likely qualify under an “own occupation” definition. But with an “any occupation” policy, the insurer might argue they could work in a different role that doesn’t involve computers, even if that job pays far less.

The core difference lies in focus. “Own occupation” zeroes in on the specific job you lost. “Any occupation” broadens the view to any job in the entire workforce you could possibly do.

The nuances of these definitions become even more complex when dealing with mental health conditions. For a deeper dive into this, you can learn more by reading our detailed article on whether depression is considered a disability.

To make this distinction clearer, let’s break down the key differences.

Own Occupation vs Any Occupation Definition of Disability

| Feature | Own Occupation | Any Occupation |

|---|---|---|

| Focus | Your specific job at the time of disability. | Any job you are reasonably suited for. |

| Eligibility | Easier to qualify. | Much harder to qualify. |

| Example | A surgeon with a hand tremor can’t operate. | A surgeon with a hand tremor could teach or consult. |

| Protection | Protects your specific career and income level. | Provides a basic safety net if you can’t work at all. |

Ultimately, the “own occupation” definition offers far more security, but it’s crucial to know which one—or which combination—is in your policy.

The Critical Change of Definition Date

Many group policies in Ontario don’t just stick to one definition. Instead, they combine both, hinged on a crucial deadline known as the “change of definition” date. This is one of the most common and difficult challenges people face when on long-term disability.

Here’s how it usually plays out:

- First 24 Months: For the first two years of your claim, you’re assessed under the more forgiving “own occupation” definition.

- After 24 Months: Once that two-year mark passes, the rules of the game change. Your policy “flips” to the much stricter “any occupation” standard.

This switch is a major reason why claims get terminated. An insurer who has been paying your benefits might suddenly cut you off, claiming that while you still can’t do your old job, you are capable of doing some other kind of work. If you’re on a long-term claim, preparing for this date is absolutely essential.

Navigating the LTD Claim and Application Process

When you’re already trying to manage a serious health problem, the thought of filing a long-term disability claim can feel like a mountain to climb. The process is loaded with detailed paperwork and unforgiving deadlines, but if you know what to expect, it becomes much less intimidating. Knowing the ropes from the get-go is the best way to build a strong, well-documented application right from the start.

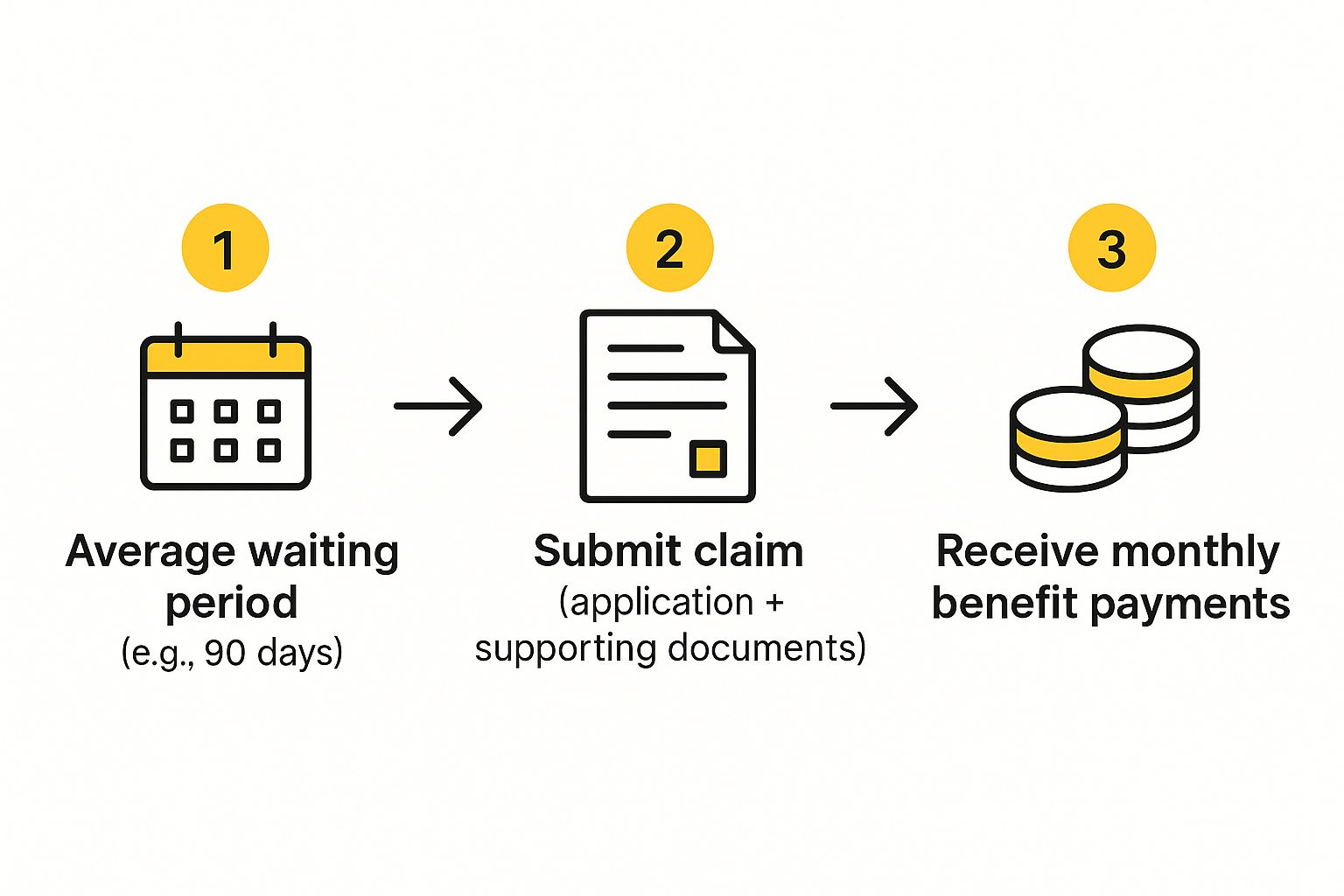

Your journey toward getting benefits usually begins with a waiting period, which you might also hear called an “elimination period.” This is simply the amount of time you have to be off work before you’re even allowed to apply for LTD. For most policies, this period is around 90 to 120 days and is often designed to kick in just as your short-term disability or EI Sickness benefits are running out. After that waiting period is over, the real application process can begin.

This image gives a bird’s-eye view of the typical claim process, from that initial waiting period right through to (hopefully) receiving your first payment.

As you can see, the core of the process is about submitting a complete application package that bridges the gap between your last paycheque and the financial support you need.

The Three Core Parts of Your Application

Your LTD application isn’t just one form—it’s more like a puzzle with pieces coming from three different places. Getting it right means gathering information from you, your employer, and your doctor, and making sure every single detail lines up. Trust me, insurers are trained to spot any inconsistencies and will use them as a reason to deny a claim.

The complete application package has these three key parts:

- Claimant’s Statement: This is your part. You’ll fill out your personal information, give a detailed description of your job duties, and explain your medical condition and how its symptoms stop you from being able to work.

- Employer’s Statement: Your employer handles this form. They will confirm your job title, salary, employment dates, and—critically—the physical and mental demands of your position.

- Attending Physician’s Statement (APS): This is arguably the most important piece of the puzzle. Your family doctor or specialist provides a detailed medical report covering your diagnosis, prognosis, symptoms, and the objective medical evidence that proves you can’t work.

Key Takeaway: Consistency across these three documents is everything. If the way you describe your job doesn’t match what your employer says, or if your doctor’s report doesn’t clearly connect your medical limitations to those specific job duties, the insurer will immediately flag your claim for a much closer look.

The Insurance Company’s Review Process

Once you’ve sent in your application, the insurance company will assign it to a case manager or claims adjudicator. This person’s job is to go through every document with a fine-toothed comb and decide if your situation fits the policy’s definition of “disability.” It’s important to understand that they aren’t on your side; their primary role is to protect the insurer’s bottom line.

Here’s what you can expect during their review:

- Requests for More Information: The case manager will almost certainly ask for your complete medical file from all your doctors. They’re looking for anything that might contradict what you’ve said in your application.

- Phone Interviews: It’s very common to get a call from them. They’ll ask pointed questions about your daily activities, your symptoms, and exactly what you can and can’t do.

- A Potential Independent Medical Examination (IME): If the insurer is skeptical about what your doctor has said, they have the right to send you to a doctor of their choosing for another assessment. Keep in mind, this “independent” doctor is being paid by the insurance company.

Don’t forget that you can also apply for government benefits at the same time. Many people are also eligible for support from the Canada Pension Plan, for example. You can learn more about that in our guide on how to apply for CPP disability, which can offer another layer of financial help.

Ultimately, being prepared for the insurance company’s tactics is half the battle. If you provide them with clear, consistent, and thorough information from day one, you give your claim the best possible chance of being approved without a fight.

Why Insurance Companies Deny LTD Claims in Canada

Getting that denial letter for your long-term disability claim can feel like a punch to the gut. You’re already dealing with a major health issue, and now the safety net you thought you had has been pulled away. But here’s something you need to know: a denial is rarely the final word. It’s simply the insurance company’s opening move, and understanding their playbook is your best defence.

Insurers have a whole host of reasons for denying claims, ranging from simple paperwork issues to complex disagreements over your medical condition. Getting familiar with these common tactics is the first step in building a powerful appeal and securing the benefits you rightfully deserve.

Not Enough Medical Evidence (Or So They Say)

One of the most common reasons an insurer will give for a denial is “insufficient medical evidence.” This is a tricky one. It doesn’t mean you aren’t disabled; it means the paperwork you sent them doesn’t tell a compelling enough story for them.

Remember, the responsibility is on you to prove you can’t work. If your doctor’s notes are too brief, if you’re missing objective test results like an MRI, or if the connection between your symptoms and your job duties isn’t spelled out crystal clear, the insurer has an opening. They’re looking for a detailed, rock-solid case, and they will use any gap or missing piece of information as a reason to say no.

They Don’t Agree with Your Doctor

It’s incredibly frustrating, but insurance companies often push back against the opinions of your own family doctor or specialists. They might suggest your doctor is just acting as your advocate, not as an objective medical expert.

To get around your doctor’s assessment, the insurer will usually hire their own medical consultant to review your file or send you for an Independent Medical Examination (IME). It’s crucial to understand that the doctor performing the IME is paid by the insurance company. If that doctor’s opinion differs from your own physician’s, the insurer will almost always use their expert’s report as justification to deny or cut off your benefits.

A classic tactic is having an insurer’s doctor, who has never even met you, review your file and decide you’re fit to work. This “paper review” can be enough for the company to issue a denial, completely ignoring years of medical history with the doctors who actually treat you.

The 24-Month “Change of Definition” Cliff

A huge number of LTD denials in Ontario happen right around the two-year mark. Why then? As we covered earlier, most group policies have a critical switch in the definition of disability after 24 months—from “own occupation” to the much tougher “any occupation” standard.

This isn’t an accident; it’s a planned reassessment point for the insurance company. They’ll start to argue that even if you can’t go back to your old job, you’re perfectly capable of doing some other job, based on your education, training, and experience.

Here’s a real-world example from the GTA: Imagine a 50-year-old marketing manager from Burlington on LTD for severe anxiety and burnout. For the first two years, her benefits are paid because she can’t do her high-pressure marketing job. But right at the 24-month mark, her claim is terminated. The insurer’s logic? A vocational report they ordered suggests she could handle a part-time administrative assistant role. In their eyes, she no longer meets the “any occupation” definition of being totally disabled.

They’re Watching You: Surveillance and Social Media

Yes, it really happens. Insurers frequently hire private investigators to conduct surveillance. They might follow you, take pictures, or shoot video of you doing everyday things like carrying groceries, mowing the lawn, or playing with your kids at a park.

They are also digging through your social media. That photo of you smiling at a family barbecue or a post about going for a short walk can be twisted and used against you. They present these isolated moments as “proof” that your condition isn’t as bad as you say, conveniently ignoring the fact that you might have been in pain for days afterward. This misleading snapshot is often all they need to build their case and deny your long term disability insurance claim.

What to Do When Your LTD Claim Is Denied

There are few things as gut-wrenching as getting a denial letter for your long-term disability claim. After all the doctor’s visits, the endless forms, and the emotional toll of being unable to work, a “no” from the insurance company can feel like a final, devastating blow.

But here’s something the insurance company won’t tell you: that denial letter isn’t the end of the road. In fact, it’s just their opening move.

In Ontario, you have options to fight back. What you do in the moments after receiving that denial is critical, and a strategic, swift response can be the difference between giving up and getting the financial support you’re owed.

Your Two Paths Forward After a Denial

When your claim is denied, you’re standing at a fork in the road with two very different paths ahead. Understanding the destination of each path is crucial, because one is a much clearer route to success.

- The Internal Appeal: This is the path the insurance company wants you to take. They’ll invite you to “appeal” their decision, which means you send them more information and ask the very same people who just denied you to please change their minds.

- Taking Legal Action: This path involves hiring a disability lawyer and filing a lawsuit against the insurer for breach of contract. You take the decision out of their hands and move the fight to neutral ground: the legal system.

The internal appeal might sound reasonable, but it’s often a dead end. Insurance companies can use this process to drag things out, making you wait, and hoping you’ll get tired and just go away. The odds are stacked against you because you’re asking an organization to admit it was wrong.

Why Legal Action Is Almost Always the Better Choice

Starting a lawsuit is, in most cases, a far more powerful strategy. When your lawyer files a Statement of Claim, you’re no longer playing their game by their rules. You’re forcing the insurer to defend their decision in a formal legal setting where they’re held accountable.

This one step sends a clear signal: you are serious about fighting for your rights. It gives you immediate leverage that an internal appeal simply can’t. A skilled disability lawyer will start building a proper case, gathering medical evidence, and preparing to negotiate from a position of strength.

It’s a fact that the vast majority of disability lawsuits in Ontario never see the inside of a courtroom. Once a strong legal case is put forward, most insurers would rather negotiate a fair settlement than face the cost and uncertainty of a trial they might lose.

Filing a lawsuit is the most direct way to force a fair re-evaluation of your claim. You can get a much deeper look into this process in our guide on what to do if your long-term disability claim is denied.

The Critical Importance of Ontario’s Limitation Period

If you choose to take legal action, you have to move quickly. Ontario’s Limitations Act puts a strict timer on your right to sue. For most disability claims, you have exactly two years from the date your benefits were first denied or cut off to file a lawsuit.

Miss that two-year deadline, and your right to sue the insurance company is likely gone forever, no matter how solid your case is.

This is precisely why getting bogged down in a long internal appeal is so risky. The insurer might let the process drag on for months—or even a year—all while that two-year clock is relentlessly ticking down. It’s a primary reason why getting legal advice right after a denial is so vital.

A disability lawyer will make sure your claim is filed well within the limitation period, protecting your legal rights. From our offices in Burlington, we help clients across Ontario, from Toronto to the far corners of the GTA, stay on the right side of these deadlines. Your lawyer handles the legal battle, so you can focus on what truly matters: your health.

Answering Your Ontario LTD Insurance Questions

Trying to understand long-term disability insurance can feel overwhelming. The policies are often packed with confusing language and strict deadlines. To help you make sense of it all, we’ve put together plain-language answers to the questions we hear most often from our clients.

Are My LTD Benefits Taxable?

This is a big one, and the answer comes down to a simple question: who paid the insurance premiums?

- If your employer paid 100% of the premiums, then yes, your LTD benefits are considered taxable income.

- If you paid 100% of the premiums yourself using after-tax money (which is typical for private plans), your benefits are completely tax-free.

- If you and your employer split the cost, things get a bit more complicated. Generally, the portion of the benefit that corresponds to your employer’s contribution will be taxed.

When in doubt, it’s always a good idea to confirm with your plan administrator or a financial advisor to be sure.

Can I Work Part-Time While Receiving LTD?

Many Canadian policies actually encourage a gradual return to work and include provisions for what they call “residual” or “partial” disability benefits. This means you can often work in a limited capacity without immediately losing your support.

However, there’s a catch. Any money you earn will almost certainly be subtracted from your monthly LTD payment. This is called an “offset.” It is absolutely crucial that you report all work and earnings to your insurance provider. Hiding this information can be viewed as fraud and could get your entire claim terminated.

How Long Do LTD Benefits Last?

The answer is written right into your policy document, usually under a section called the “benefit period.”

The most common benefit period for LTD policies in Ontario is until you turn 65. That said, some plans are designed to last for a shorter, fixed term, like two, five, or ten years. You have to read your specific contract to know for sure.

Keep in mind, your benefits can also be cut off if the insurance company decides you no longer fit their definition of disability. This often happens around the two-year mark when the definition of “disability” itself often changes. If the application process feels like too much, our guide on how to apply for disability benefits can help walk you through the first steps.

Going through a disability claim is tough, but you don’t have to face it by yourself. The team at UL Lawyers is here to offer the expert guidance and strong representation you deserve. If your claim was denied or you’re hitting roadblocks with the application, contact us for a free consultation. Visit https://ullaw.ca to see how we can help.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies